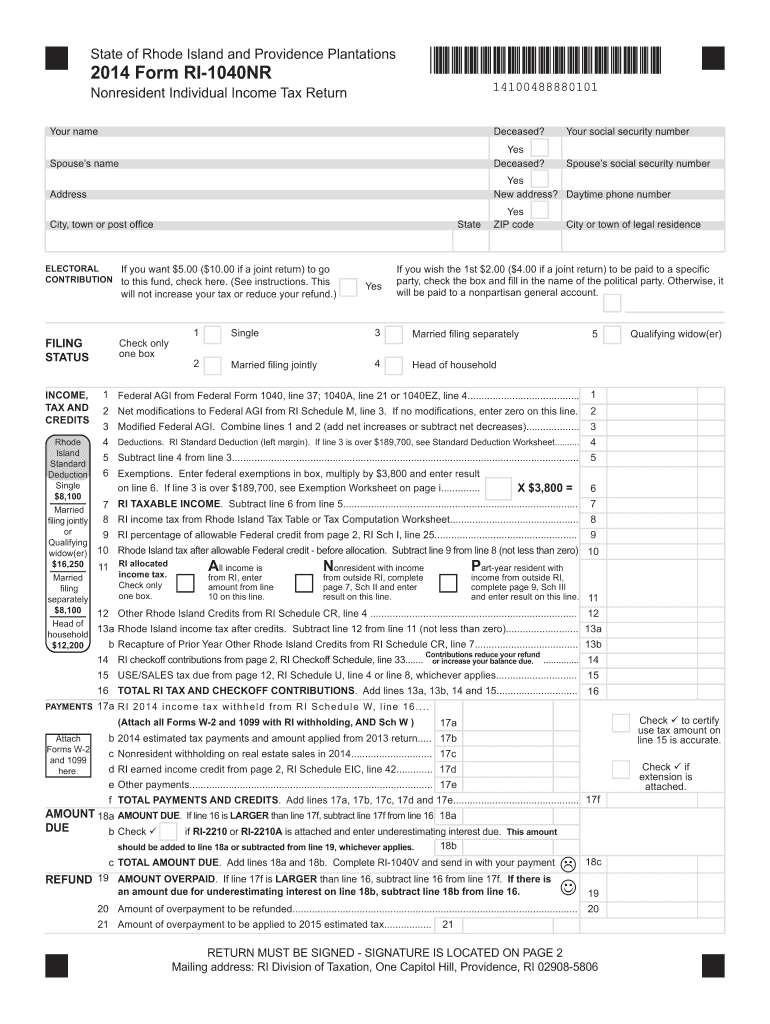

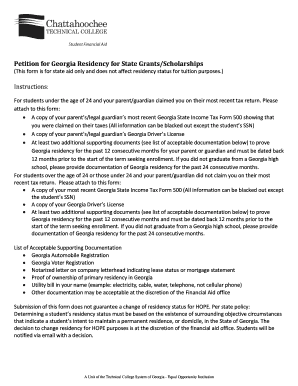

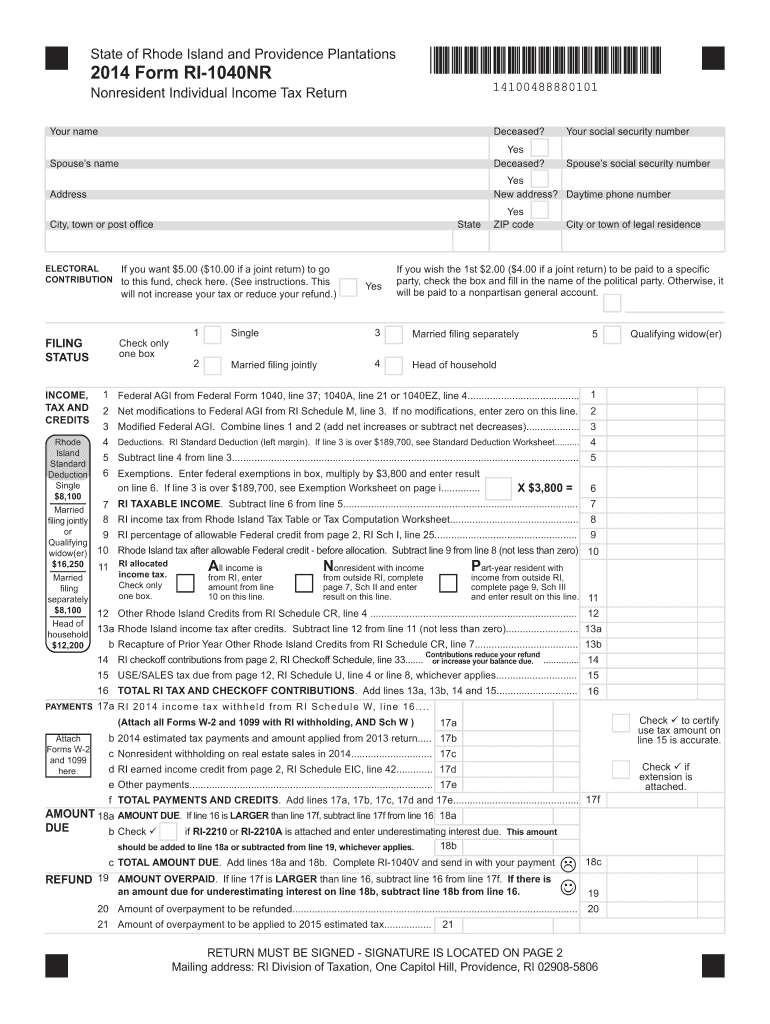

RI DoT RI-1040NR 2014 free printable template

Get, Create, Make and Sign rhode island tax after

How to edit rhode island tax after online

Uncompromising security for your PDF editing and eSignature needs

RI DoT RI-1040NR Form Versions

How to fill out rhode island tax after

How to fill out RI DoT RI-1040NR

Who needs RI DoT RI-1040NR?

Instructions and Help about rhode island tax after

We do a little Boston Red Sox long any Red Sox fans in the house will it listen I mean they're off to an okay start, but I think we need to show a little a lot week we had a few minutes here to play some look at that beautiful bird down there on the left side we have 220 to make this way GEICO skaters you can come it out there with a few more minutes and take back what's going on there we're doing watch the Raptor from its perch the Texas it was affection women though saw service both right here in the United States but also over in Canada also South Africa sir venerable trainer known as the pilot make through the airplane is truly a favorite among folks who flew, but they'll tell you this airplane reach up is slightly of a very, very difficult airplane to fly the GEICO skaters doing a great job let's watch now as they start their takeoff roll here up on the left-hand side they're going to climb to altitude we're going to bring the f-22 in for its demonstration in the fuel oil these guys are going to go get warmed up and ready to go please welcome for their to follow me the GEICO skaters yeah we're just kidding about that sorry nothing all right they have told me now that want to watch another p-51, so we're gonna we're going to hold the f-22 we're now we're going to launch a p-51 this p-51 going to launch right out here on the left side just listen to minutes folks this time please look Tech sergeant Jonathan Billy and the f-22 Raptors I'm in States Air Force the commander of Air Combat Command general like hostage and all the men and women of Air Combat Command we welcome you once again to the 2014 Rhode Island Air Show and open house I'm not 22 raptor maintenance team chief technical sergeant Jonathan Billy from Silver Spring Maryland here with our safety observer and combat ready fighter pilot Captain James Tate from Kansas City Missouri as a member of air combat commands first fighter we located at Joint Base langley-eustis in Hampton Virginia it is my distinct pleasure to describe for you today a capability demonstration by the most technologically advanced fifth-generation fighter aircraft in the world the f-22 Raptors mission is air dominance it supports our Army Navy Marines Coast Guard Air Force and allies to freely operate in today's joint fight anywhere anytime the pilot for today's demonstration is Captain John Cummings from Appleton Wisconsin captain Cummings's a veteran fighter pilot with more than 1100 hours in jet aircraft launching captain Cummings was our expert maintenance team dedicated crew chiefs Staff Sergeant Justin number for Well City Alabama and senior to Matthew Vaughn from Stockbridge Michigan our avionics technician senior Airman Gabriel Brooks from Dover Delaware and senior Airman Abraham Vasquez from El Paso Texas 22 you will see today is an unmodified and fully combat capable aircraft while we can't show you everything that makes the Air Force f-22 Raptor the most lethal fighter aircraft in the world we will...

People Also Ask about

Who won the election in Rhode Island 2018?

Did Rhode Island lose a house seat?

Who won the Congress seat in Rhode Island?

Who won the midterm election in 2018?

Who was the former governor of RI?

Is Rhode Island a swing state?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the rhode island tax after in Chrome?

How can I edit rhode island tax after on a smartphone?

How can I fill out rhode island tax after on an iOS device?

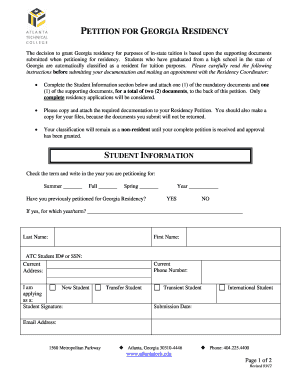

What is RI DoT RI-1040NR?

Who is required to file RI DoT RI-1040NR?

How to fill out RI DoT RI-1040NR?

What is the purpose of RI DoT RI-1040NR?

What information must be reported on RI DoT RI-1040NR?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.