IRS 13615 2012 free printable template

Get, Create, Make and Sign form 13615 2012

How to edit form 13615 2012 online

Uncompromising security for your PDF editing and eSignature needs

IRS 13615 Form Versions

How to fill out form 13615 2012

How to fill out IRS 13615

Who needs IRS 13615?

Instructions and Help about form 13615 2012

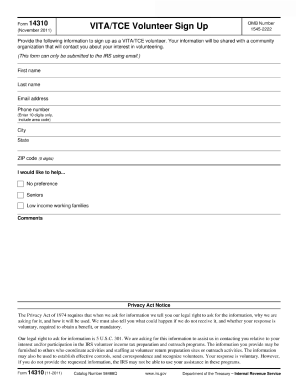

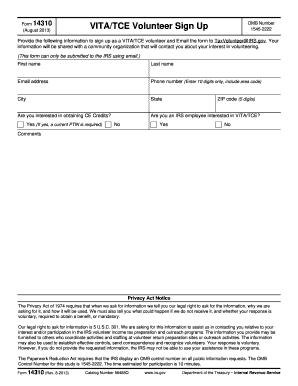

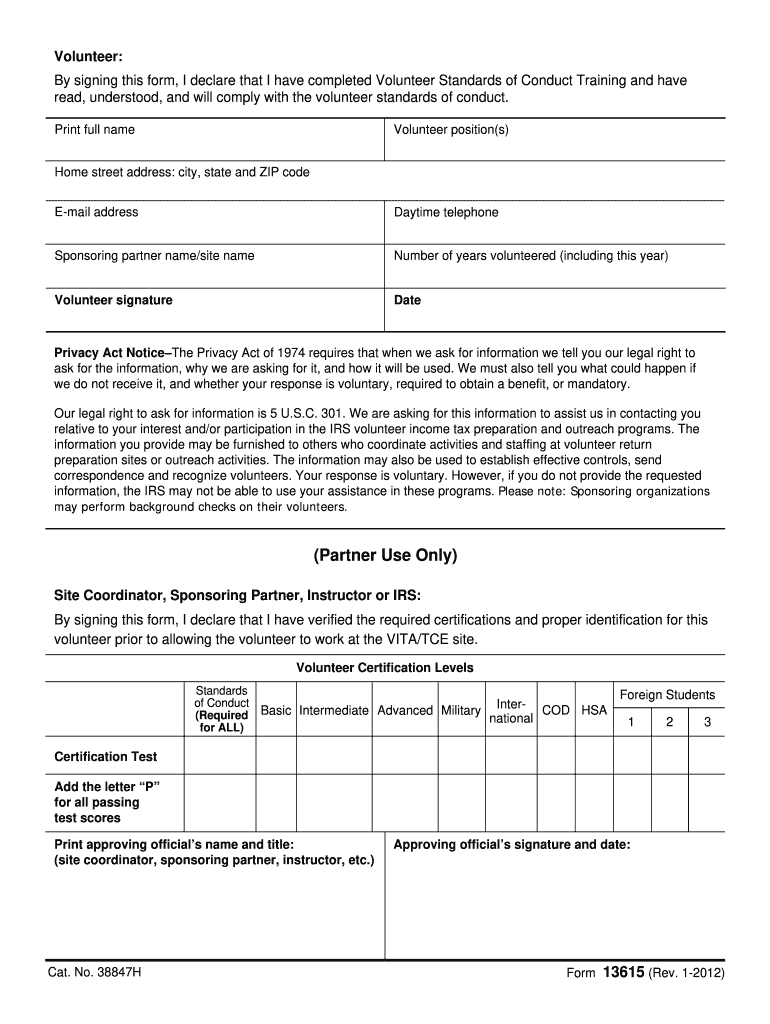

Hi this is Sarah hub bell a community impact coordinator with united way of Stanton Augusta county and Waynesboro and the valley vita program manager, and today we are on the vita the central site we're going to create an IRS account, so we can look at the ways to take your IRS certifications so the URL is link learncertification.com on the right-hand side you have a link to the volunteer standards of conduct training divided the training guides and Lincoln learn taxes and over here on the left-hand side you can enter in your username and password you can sign in with an IRS account if you already have one if you forgot your username or password you can click down here in the bottom left-hand screen, but we're going to create a new account so under the self registration you are going to choose one for vita volunteer you're going to choose no for site coordinator certification unless you'd like to be an alternate site coordinator you can choose yes no for instructor no for spec territory manager and do you plan to volunteer in the vita the program you're going to click yes under training...

People Also Ask about

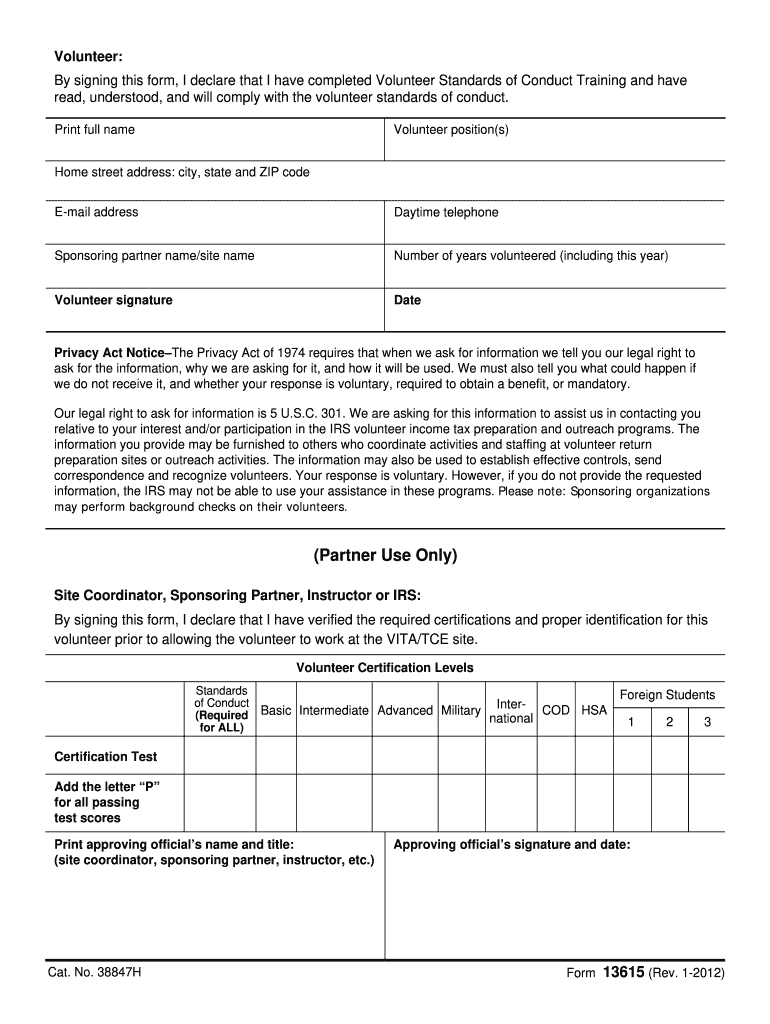

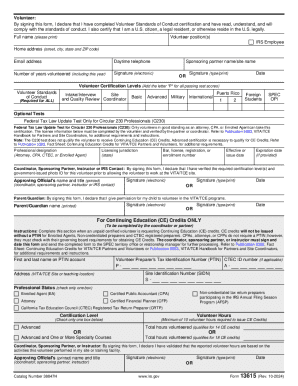

What prior to signing and dating the form 13615?

What is IRS form 15272?

What is the form used for the intake interview?

What is a 13615 form?

Does form 15272 need to be approved?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in form 13615 2012 without leaving Chrome?

How do I fill out the form 13615 2012 form on my smartphone?

Can I edit form 13615 2012 on an Android device?

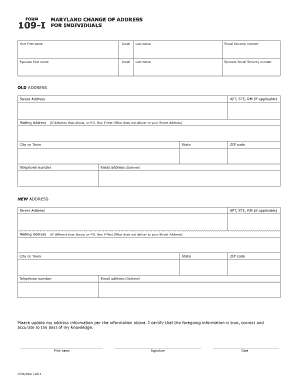

What is IRS 13615?

Who is required to file IRS 13615?

How to fill out IRS 13615?

What is the purpose of IRS 13615?

What information must be reported on IRS 13615?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.