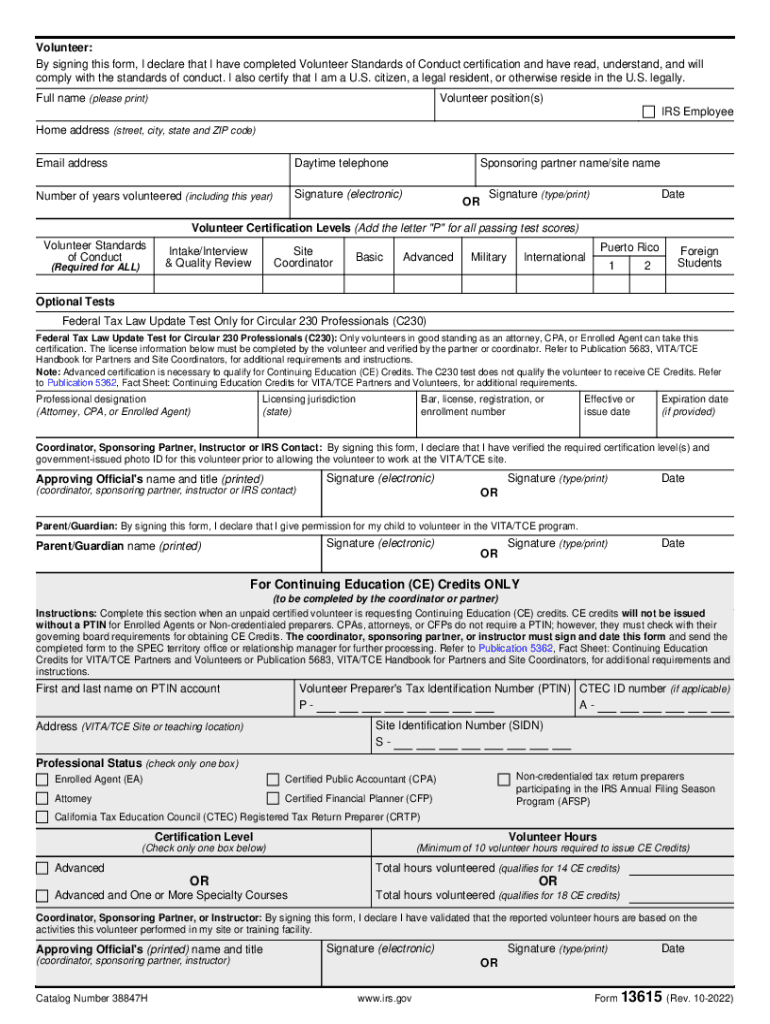

IRS 13615 2022 free printable template

Get, Create, Make and Sign form 13615

Editing form 13615 online

Uncompromising security for your PDF editing and eSignature needs

IRS 13615 Form Versions

How to fill out form 13615

How to fill out IRS 13615

Who needs IRS 13615?

Instructions and Help about form 13615

Hi this is Sarah hub bell a community impact coordinator with united way of Stanton Augusta county and Waynesboro and the valley vita program manager, and today we are on the vita the central site we're going to create an IRS account, so we can look at the ways to take your IRS certifications so the URL is link learncertification.com on the right-hand side you have a link to the volunteer standards of conduct training divided the training guides and Lincoln learn taxes and over here on the left-hand side you can enter in your username and password you can sign in with an IRS account if you already have one if you forgot your username or password you can click down here in the bottom left-hand screen, but we're going to create a new account so under the self registration you are going to choose one for vita volunteer you're going to choose no for site coordinator certification unless you'd like to be an alternate site coordinator you can choose yes no for instructor no for spec territory manager and do you plan to volunteer in the vita the program you're going to click yes under training...

People Also Ask about

What is the percent of federal income tax withheld?

How do I prove a dependent to the IRS?

What are NZ tax brackets 2022?

Does the IRS investigate dependents?

What certifications do I need to file taxes?

What does the IRS consider support for a dependent?

What is a VITA form?

What is the tax table for 2022?

Which volunteers must pass the VSC certification test?

What is Publication 15 with the IRS?

What is the tax bracket for 2022 in South Africa?

Does the IRS train tax preparers?

What are the 6 requirements for claiming a child as a dependent?

What constitutes practice before the IRS ing to Circular 230?

How do I get certified by the IRS?

How can I prove my dependents?

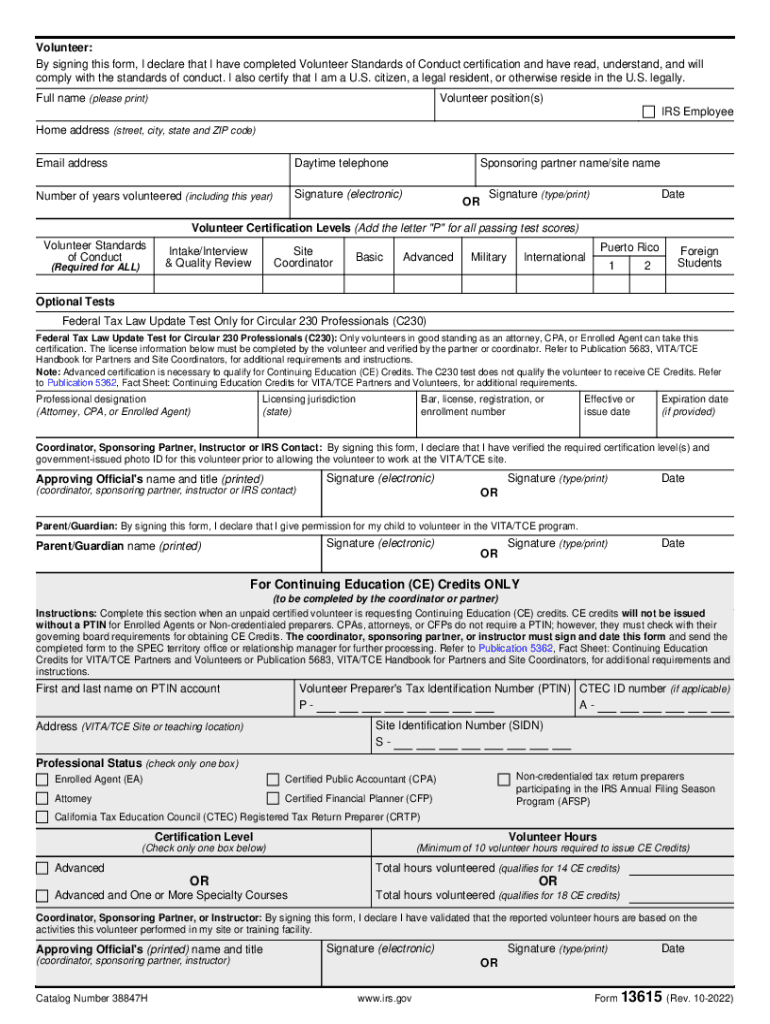

What is a 13615 form?

What is the wage bracket method?

What is the tax rate for income 2022?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit form 13615 from Google Drive?

How do I execute form 13615 online?

How do I fill out the form 13615 form on my smartphone?

What is IRS 13615?

Who is required to file IRS 13615?

How to fill out IRS 13615?

What is the purpose of IRS 13615?

What information must be reported on IRS 13615?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.