IRS 13615 2020 free printable template

Show details

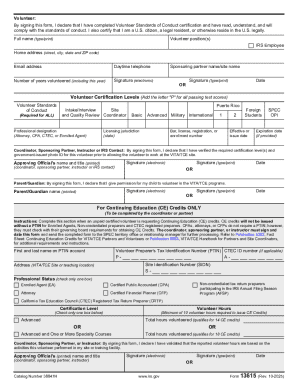

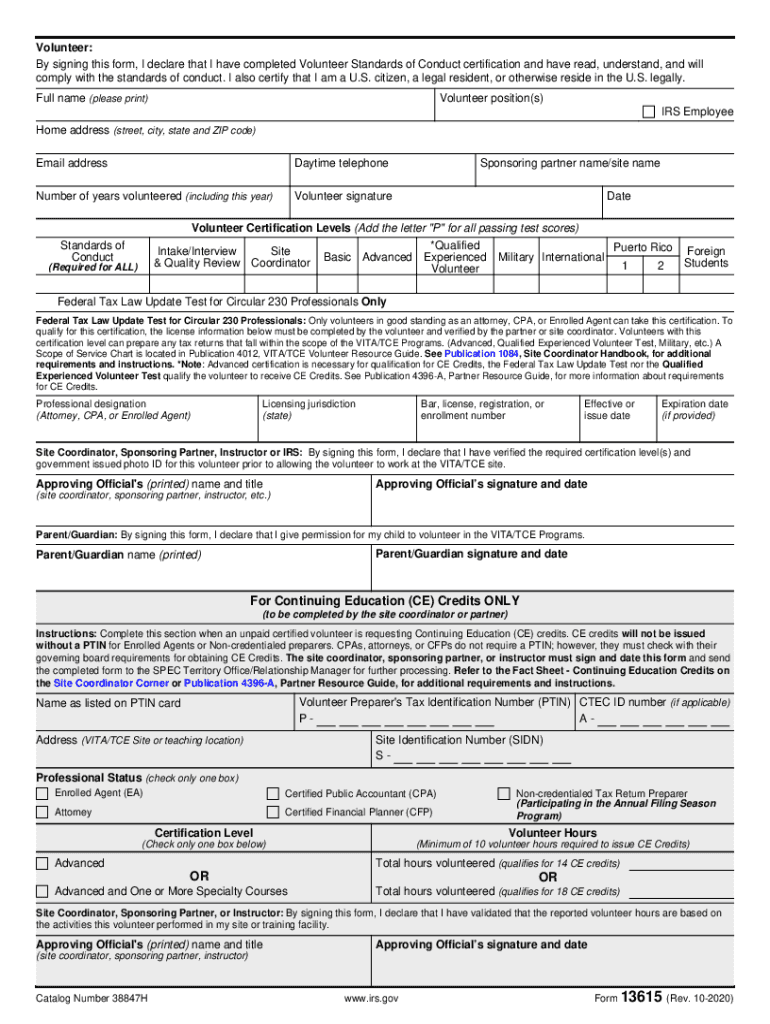

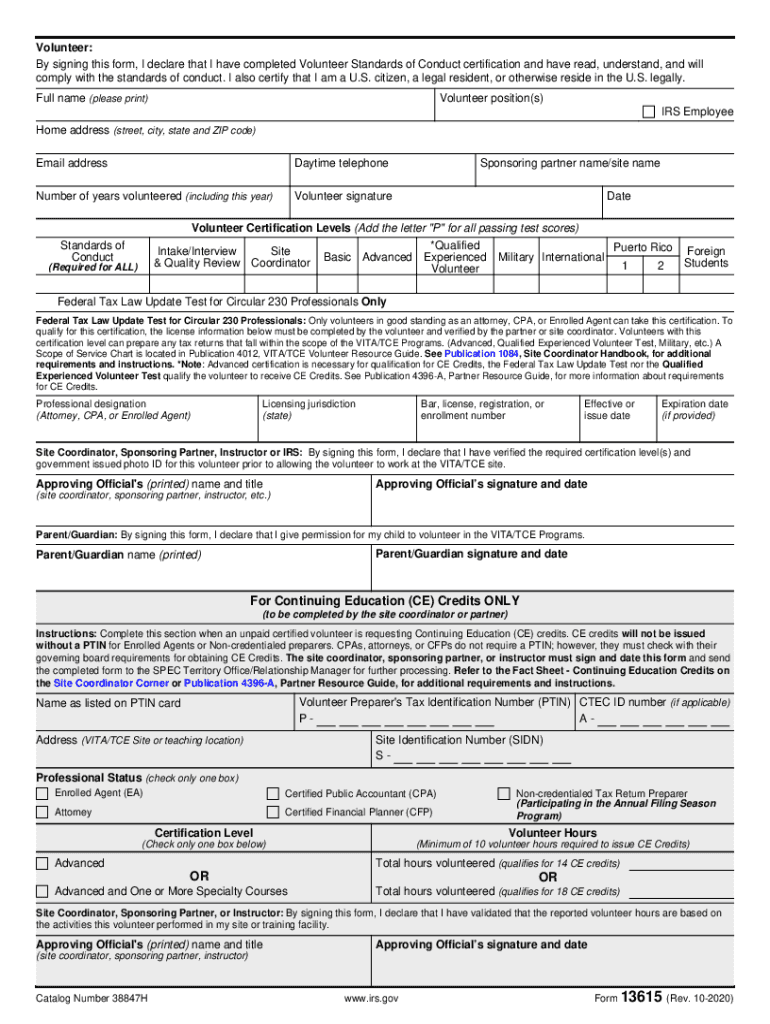

Department of the Treasury Internal Revenue ServiceFormVolunteer13615(October 2020)Standards of Conduct Agreement VITA/THE Programs' mission of the VITA/THE return preparation programs is to assist

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 13615

Edit your IRS 13615 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 13615 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IRS 13615 online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit IRS 13615. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 13615 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 13615

How to fill out IRS 13615

01

Obtain IRS Form 13615 from the IRS website or through a tax professional.

02

Fill in your personal information, including your name, address, and contact details.

03

Indicate if you are a volunteer tax preparer and your corresponding organization.

04

Provide information regarding your qualifications, such as any tax preparation training or certifications.

05

Confirm that you understand the ethics and responsibilities associated with preparing taxes by signing and dating the form.

Who needs IRS 13615?

01

IRS Form 13615 is required for individuals volunteering as tax preparers, particularly for those participating in the Volunteer Income Tax Assistance (VITA) program or the Tax Counseling for the Elderly (TCE) program.

Fill

form

: Try Risk Free

People Also Ask about

What will the standard deduction be for 2023?

Standard Deduction Amounts for 2023 Taxes (Returns Due April 2024) Filing StatusStandard Deduction 2023Single; Married Filing Separately$13,850Married Filing Jointly & Surviving Spouses$27,700Head of Household$20,800 Apr 20, 2023

What is a standard 1040?

Form 1040 is the standard U.S. individual tax return form that taxpayers use to file their annual income tax returns with the IRS.

What is the most popular IRS form?

IRS Form 1040 is the standard federal income tax form people use to report their income, claim tax deductions and credits, and calculate the amount of their tax refund or tax bill for the year.

What are the IRS standards for 2023?

For single taxpayers and married individuals filing separately, the standard deduction rises to $13,850 for 2023, up $900, and for heads of households, the standard deduction will be $20,800 for tax year 2023, up $1,400 from the amount for tax year 2022.

What is the standard IRS form?

Form 1040 is used by U.S. taxpayers to file an annual income tax return.

What are the different IRS forms?

The others are IRS forms that you might need to fill out as part of preparing your tax return. Form 1040 and Form 1040-SR. Schedule A: For itemizing. Schedule B: Reporting interest and dividends. Schedule C: For freelancers or small business. Schedule D: Capital gains. The W-2: Income from a job.

What are the guidelines of a 1040 form?

What do I need to fill out Form 1040? Social Security numbers for you, your spouse and any dependents. Dates of birth for you, your spouse and any dependents. Statements of wages earned (for example, your W-2 and 1099s). Statements of interest or 1099-DIV forms for dividends from banks or brokerages.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get IRS 13615?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific IRS 13615 and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I fill out the IRS 13615 form on my smartphone?

Use the pdfFiller mobile app to fill out and sign IRS 13615. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

Can I edit IRS 13615 on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign IRS 13615 on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is IRS 13615?

IRS 13615 is a form used by tax preparers to conduct a due diligence check on taxpayers claiming the Earned Income Tax Credit (EITC) or the Child Tax Credit (CTC).

Who is required to file IRS 13615?

Tax preparers who assist clients in claiming the Earned Income Tax Credit (EITC) or the Child Tax Credit (CTC) are required to file IRS 13615.

How to fill out IRS 13615?

To fill out IRS 13615, tax preparers must complete sections that gather necessary information about the taxpayer’s eligibility for credits, including income, number of dependents, and any relevant documentation.

What is the purpose of IRS 13615?

The purpose of IRS 13615 is to ensure that tax preparers perform due diligence in checking the eligibility of taxpayers for claiming certain tax credits, thereby reducing fraudulent claims.

What information must be reported on IRS 13615?

Information that must be reported on IRS 13615 includes the taxpayer's name, Social Security number, information regarding dependents, income details, and the preparer's signature and identification.

Fill out your IRS 13615 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 13615 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.