IRS 13615 2021 free printable template

Show details

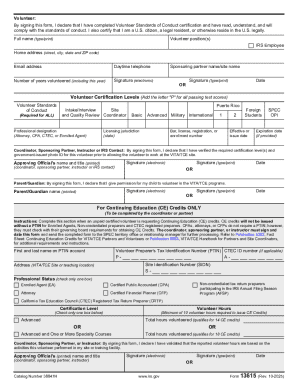

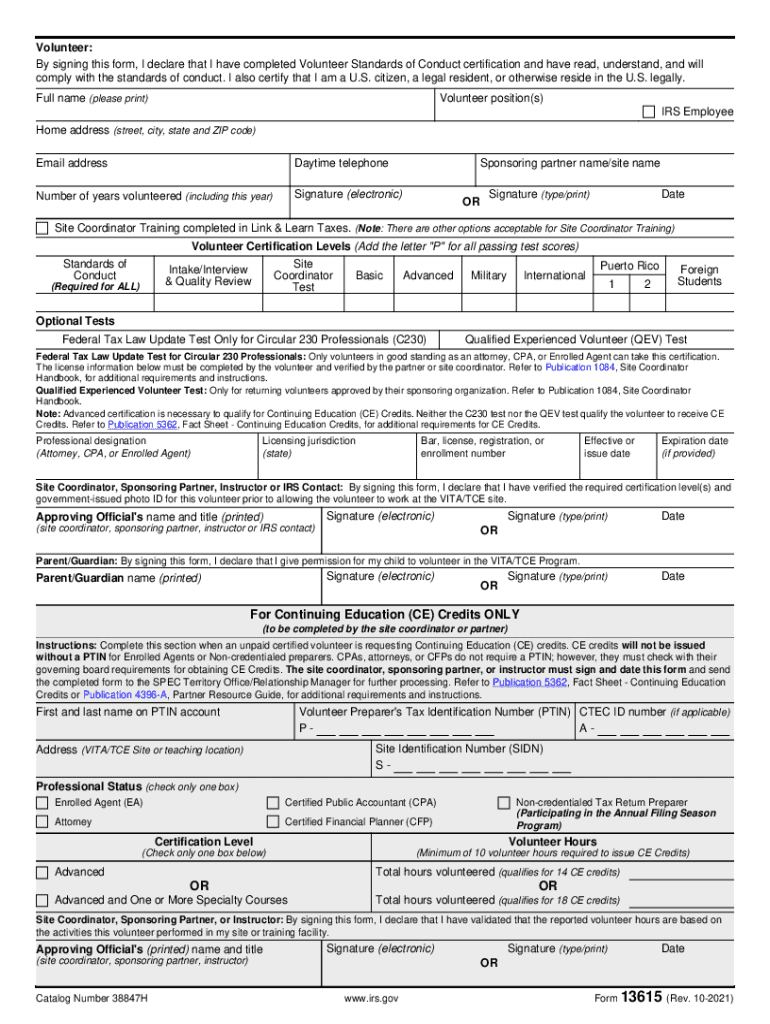

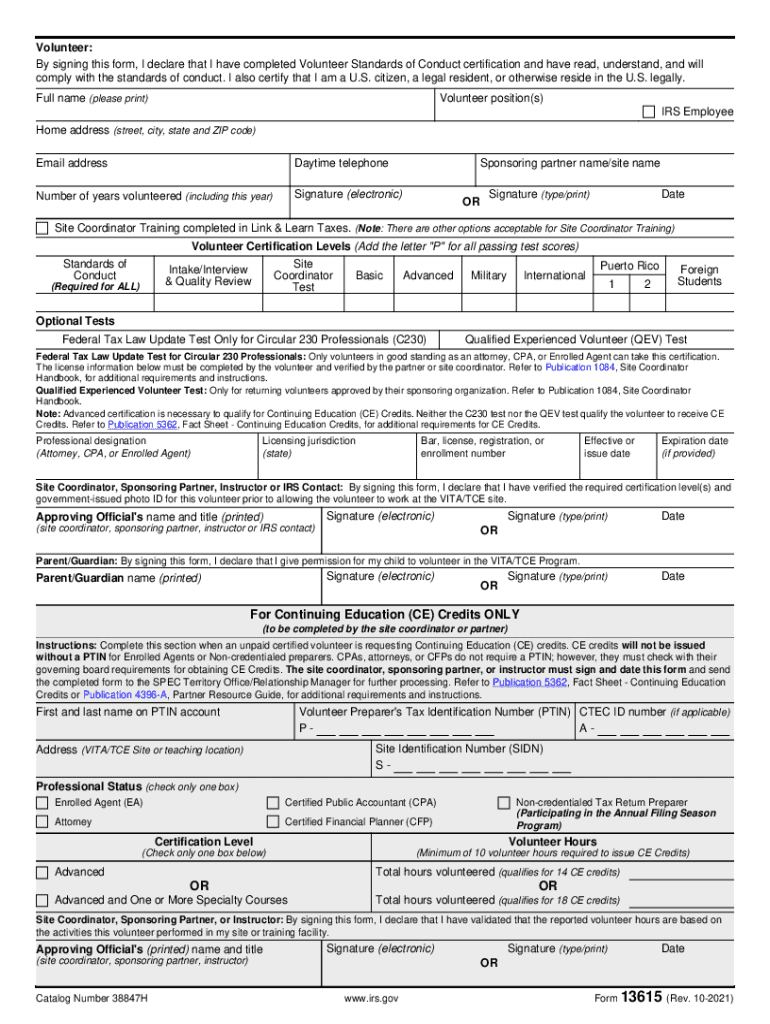

Form 13615 (October 2021) Department of the Treasury — Internal Revenue Service Volunteer Standards of Conduct Agreement VITA/THE Programs The mission of the VITA/THE return preparation programs

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 13615

Edit your IRS 13615 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 13615 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IRS 13615 online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit IRS 13615. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 13615 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 13615

How to fill out IRS 13615

01

Gather your personal information, including your name, Social Security number, and contact information.

02

Complete the top section with your name, address, and the date.

03

Provide details regarding your income sources, including any self-employment income or wage income.

04

Fill in the section regarding tax preparation assistance, indicating whether you need help with filing your taxes.

05

Sign and date the form to verify that all information provided is accurate.

Who needs IRS 13615?

01

Individuals seeking assistance with filing their tax returns.

02

Taxpayers who want to ensure they are complying with IRS requirements.

03

Clients of Volunteer Income Tax Assistance (VITA) or Tax Counseling for the Elderly (TCE) programs.

Fill

form

: Try Risk Free

People Also Ask about

What is the percent of federal income tax withheld?

For the 2022 tax year, there are seven federal tax brackets: 10%, 12%, 22%, 24%, 32%, 35% and 37%.

How do I prove a dependent to the IRS?

The dependent's birth certificate, and if needed, the birth and marriage certificates of any individuals, including yourself, that prove the dependent is related to you. For an adopted dependent, send an adoption decree or proof the child was lawfully placed with you or someone related to you for legal adoption.

What are NZ tax brackets 2022?

There are five PAYE tax brackets for the 2021-2022 tax year: 10.50%, 17.50%, 30%, 33% and 39%. Your tax bracket depends on your total taxable income.

Does the IRS investigate dependents?

If one of you doesn't file an amended return that removes the child-related benefits, then the IRS will audit you and/or the other person to determine who can claim the dependent. You'll get a letter in a few months to begin the audit.

What certifications do I need to file taxes?

To become a preparer, you don't need a specific license. With the IRS, however, if you want representation rights, you need to be an enrolled agent, CPA, or attorney. However, seven states require a license if you want to prepare in those geographical areas.

What does the IRS consider support for a dependent?

For the purpose of determining if someone is your dependent, total support includes the amounts spent to provide food, lodging, clothing, education, medical and dental care, recreation, transportation, and similar necessities.

What is a VITA form?

The Volunteer Income Tax Assistance (VITA) Program provides free income tax return preparation to hard working taxpayers earning up to $60,000 annually.

What is the tax table for 2022?

2022 Tax Rates and Brackets Tax RateTaxable Income (Single)Taxable Income (Married Filing Jointly)12%$10,276 to $41,775$20,551 to $83,55022%$41,776 to $89,075$83,551 to $178,15024%$89,076 to $170,050$178,151 to $340,10032%$170,051 to $215,950$340,101 to $431,9003 more rows • 05-Dec-2022

Which volunteers must pass the VSC certification test?

All volunteers (coordinators, certified volunteer preparers, quality reviewers, greeters, screeners, client facilitators, etc.) are required to complete the VSC certification, annually.

What is Publication 15 with the IRS?

Employers use Publication 15-T to figure the amount of federal income tax to withhold from their employees' wages.

What is the tax bracket for 2022 in South Africa?

2022 tax year (1 March 2021 – 28 February 2022) Taxable income (R)Rates of tax (R)1 – 216 20018% of taxable income216 201 – 337 80038 916 + 26% of taxable income above 216 200337 801 – 467 50070 532 + 31% of taxable income above 337 800467 501 – 613 600110 739 + 36% of taxable income above 467 5003 more rows

Does the IRS train tax preparers?

The IRS provides free tax law training and materials. The training also covers tax topics, such as deductions and credits.

What are the 6 requirements for claiming a child as a dependent?

Who qualifies as a tax dependent? The child has to be part of your family. The child has to be under a certain age. The child has to live with you. The child can't provide more than half of his or her own financial support. The child can't file a joint tax return with someone.

What constitutes practice before the IRS ing to Circular 230?

Q3. What does “practice before the IRS” entail? “Practice before the IRS” comprehends all matters connected with a presentation to the IRS, or any of its officers or employees, relating to a taxpayer's rights, privileges, or liabilities under laws or regulations administered by the IRS.

How do I get certified by the IRS?

How to become a registered tax preparer Take a 60-hour qualifying education course from a CTEC approved provider within the past 18 months. Purchase a $5,000 tax preparer bond from an insurance/surety agent. Get a Preparer Tax Identification Number (PTIN) from the IRS. Approved Lives Scan.

How can I prove my dependents?

Proof of Relationship Birth certificates or other official documents that show you are related to the child you claim. Paternity test results if the child's father isn't on the birth certificate. Marriage certificate showing how you are related to the child.

What is a 13615 form?

Use of Form 13615: This form provides information on a volunteer's certification. All VITA/TCE volunteers (whether paid or unpaid) must pass the Volunteer Standards of Conduct certification, and sign and date Form 13615, Volunteer Standards of Conduct Agreement - VITA/TCE Programs, prior to working at a VITA/TCE site.

What is the wage bracket method?

The wage bracket method is the most straightforward approach, as it tells you the exact amount to withhold based on the employee's taxable wages, marital status, number of allowances, and payroll period. No calculations are needed.

What is the tax rate for income 2022?

There are seven tax brackets for most ordinary income for the 2022 tax year: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent and 37 percent.”

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find IRS 13615?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the IRS 13615. Open it immediately and start altering it with sophisticated capabilities.

How do I edit IRS 13615 on an iOS device?

Create, modify, and share IRS 13615 using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

How do I edit IRS 13615 on an Android device?

You can make any changes to PDF files, like IRS 13615, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is IRS 13615?

IRS Form 13615 is a form used for the Volunteer Income Tax Assistance (VITA) program, designed to help taxpayers who need assistance in filing their tax returns.

Who is required to file IRS 13615?

Individuals who participate as volunteers in the VITA program and assist taxpayers in preparing their tax returns are required to file IRS Form 13615.

How to fill out IRS 13615?

To fill out IRS Form 13615, volunteers must provide personal information such as name, address, social security number, and check boxes to certify their eligibility and understand the rules and responsibilities of volunteers at the VITA program.

What is the purpose of IRS 13615?

The purpose of IRS Form 13615 is to certify that volunteers have received training and understand the responsibilities involved in assisting taxpayers through the VITA program.

What information must be reported on IRS 13615?

IRS Form 13615 requires reporting of personal information from the volunteer, including name, social security number, address, and confirmation of completing training and understanding of the program's guidelines.

Fill out your IRS 13615 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 13615 is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.