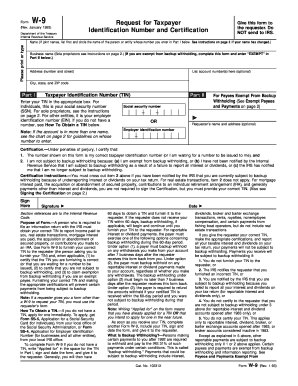

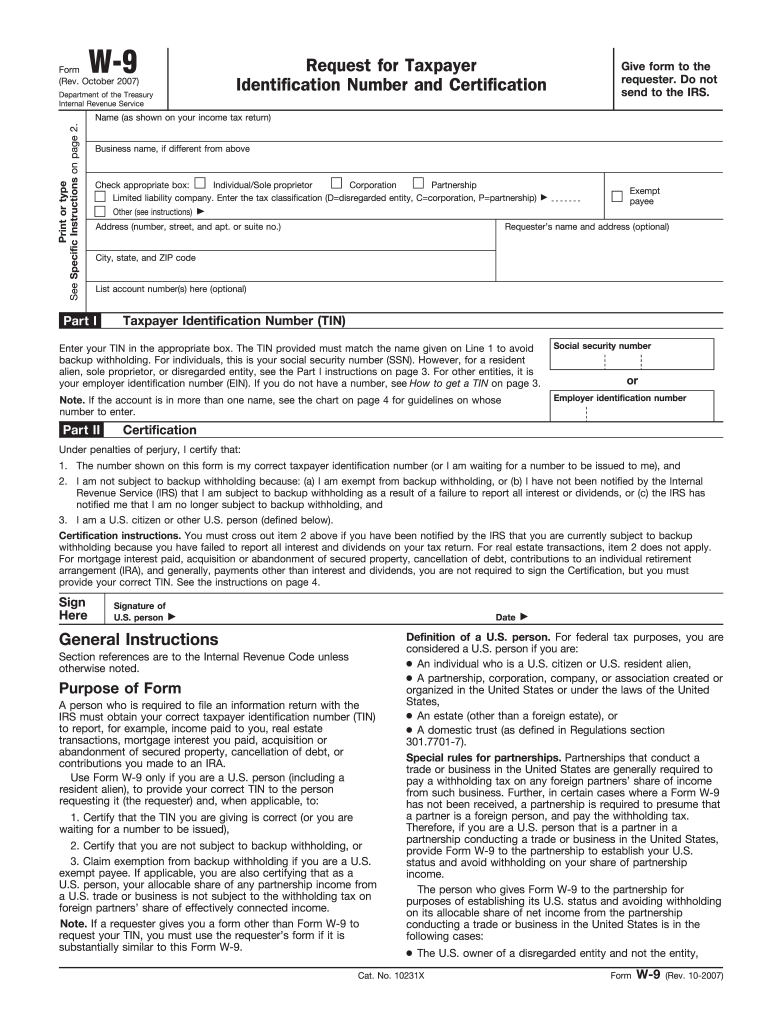

IRS W-9 2007 free printable template

Instructions and Help about IRS W-9

How to edit IRS W-9

How to fill out IRS W-9

About IRS W-9 2007 previous version

What is IRS W-9?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS W-9

What should I do if I make a mistake on my IRS W-9 form after submitting it?

If you discover an error on your submitted IRS W-9, you need to submit a new form with the correct information. Clearly indicate that it is an updated version and ensure it is sent to the same recipient who received the original. Remember to keep records of both submissions for your reference.

How can I track the status of my submitted IRS W-9?

Tracking the status of an IRS W-9 is typically handled by the recipient, as the IRS does not provide a direct way to track the form. You should follow up with the recipient to confirm if they received it and if there are any issues. If you filed electronically, check for any emails or notifications regarding submission confirmation.

Are electronic signatures acceptable for an IRS W-9 form?

Yes, electronic signatures can be used for submitting an IRS W-9, provided the recipient accepts them. Ensure that your e-signature complies with any applicable regulations for electronic agreements in your jurisdiction to maintain document integrity.

What common errors should I watch for when completing my IRS W-9?

Common errors on the IRS W-9 include providing incorrect taxpayer identification numbers or omitting important details such as your name or business name. To avoid these mistakes, double-check all entries, ensuring they match IRS records and are legible.

What should I do if I receive an IRS notice related to my W-9 submission?

If you receive an IRS notice concerning your IRS W-9, carefully read the letter to understand the issue. Gather the relevant documentation and respond promptly while following the instructions in the notice. If needed, consult a tax professional for guidance on how to address the specific concern.

See what our users say