IRS Publication 1281 2011 free printable template

Show details

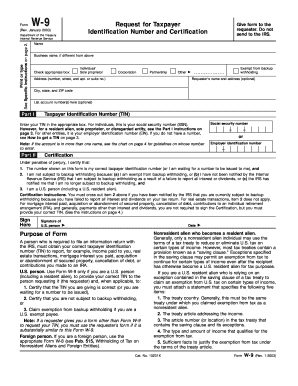

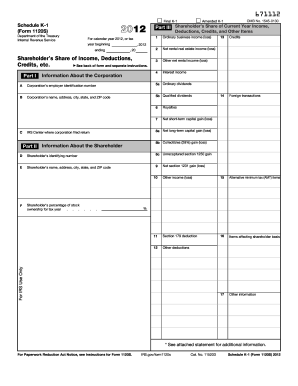

UAnnnn is the Payer A-Record file. 114 Characters. A Copy of Publication 1281. nnnn is the CD/DVD transmittal number. Backup Withholding for Missing and Incorrect Name/TIN s Including instructions for reading tape cartridges and CD/DVD Formats Publication 1281 Rev. 2-2011 Catalog Number 63327A Department of the Treasury Internal Revenue Service www.irs.gov TABLE OF CONTENTS Page Part 1- Introduction Part 2 - Frequently Asked Questions Part 3 - Where to Call for Help Part 4 - Actions for...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign publication 1281 2011 form

Edit your publication 1281 2011 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your publication 1281 2011 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit publication 1281 2011 form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit publication 1281 2011 form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS Publication 1281 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out publication 1281 2011 form

How to fill out IRS Publication 1281

01

Obtain IRS Publication 1281 from the IRS website or through a tax professional.

02

Read the instructions carefully to understand the purpose of the form.

03

Gather all required information regarding payments made to foreign entities.

04

Fill in the section detailing the withholding agent's information, ensuring accuracy.

05

Provide the necessary information about the foreign entities receiving payments.

06

Complete any additional sections relevant to your situation as outlined in the publication.

07

Review all entered information for completeness and correctness.

08

Submit the completed form according to the guidelines provided in the publication.

Who needs IRS Publication 1281?

01

Withholding agents who make payments to foreign entities.

02

Organizations required to report withholding on certain payments.

03

Tax professionals assisting clients with international transactions.

Fill

form

: Try Risk Free

People Also Ask about

How do I know if I am exempt from backup withholding?

Who Is Exempt from Backup Withholding? Most American citizens are exempted from backup withholding so long as their tax identification number (TIN) or social security number is on file with their broker, and corresponds with their legal name. Retirement accounts and unemployment income are also exempted.

How do I remove a C notice from the IRS?

What to do if you receive a “C” notice to start backup withholding? Start backup withholding at the current backup withholding rate of 24 percent. Stop backup withholding when the IRS notifies you that the taxpayer is no longer liable.

What do I put for backup withholding?

Backup withholding at a rate of 24% may be applied to taxpayers who provide an incorrect taxpayer identification number (TIN) or do not report certain types of income. Some payments subject to backup withholding are interest payments, dividends, and rents.

What does it mean if you are subject to backup withholding?

When it applies, backup withholding requires a payer to withhold tax from payments not otherwise subject to withholding. You may be subject to backup withholding if you fail to provide a correct taxpayer identification number (TIN) when required or if you fail to report interest, dividend, or patronage dividend income.

How do I fix my backup withholding?

To stop backup withholding, you'll need to correct the reason you became subject to backup withholding. This can include providing the correct TIN to the payer, resolving the underreported income and paying the amount owed, or filing the missing return(s), as appropriate.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the publication 1281 2011 form in Gmail?

Create your eSignature using pdfFiller and then eSign your publication 1281 2011 form immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I fill out publication 1281 2011 form using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign publication 1281 2011 form and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

Can I edit publication 1281 2011 form on an iOS device?

Create, edit, and share publication 1281 2011 form from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

What is IRS Publication 1281?

IRS Publication 1281 provides guidance on reporting backup withholding and the requirements related to Form 1099.

Who is required to file IRS Publication 1281?

Entities that are required to report backup withholding to the IRS must file IRS Publication 1281.

How to fill out IRS Publication 1281?

To fill out IRS Publication 1281, follow the instructions provided in the publication, which detail how to compute the amount to be withheld and reported, as well as where to send the information.

What is the purpose of IRS Publication 1281?

The purpose of IRS Publication 1281 is to provide taxpayers with the necessary information on backup withholding requirements and reporting.

What information must be reported on IRS Publication 1281?

Information that must be reported on IRS Publication 1281 includes the amount of payment subject to backup withholding, the reason for withholding, and the total amount withheld and reported on Form 1099.

Fill out your publication 1281 2011 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Publication 1281 2011 Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.