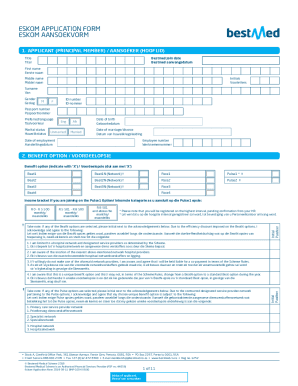

IRS Publication 1281 2017 free printable template

Show details

BACKUP WITHHOLDING FOR MISSING AND INCORRECT NAME/TIN(S) (Including instructions for reading tape cartridges and CD/DVD Formats)Publication 1281 (Rev. 32017) Catalog Number 63327A Department of the

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign 1281 irs pub 2017

Edit your 1281 irs pub 2017 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 1281 irs pub 2017 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 1281 irs pub 2017 online

Follow the guidelines below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 1281 irs pub 2017. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

The use of pdfFiller makes dealing with documents straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS Publication 1281 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out 1281 irs pub 2017

How to fill out IRS Publication 1281

01

Obtain a copy of IRS Publication 1281 from the IRS website.

02

Read the publication to understand the purpose and requirements.

03

Fill in your personal information including name, address, and Taxpayer Identification Number (TIN).

04

Identify the type of payments you're reporting and appropriate codes.

05

List the recipients of the payments, including their names and TINs.

06

Indicate the amounts paid to each recipient.

07

Complete any additional sections relevant to your reporting situation.

08

Review the completed document for accuracy.

09

Submit the form as instructed, either electronically or via mail.

Who needs IRS Publication 1281?

01

Business owners who make payments to certain U.S. residents.

02

Payors who must report backup withholding.

03

Any entities that issue forms such as 1099-MISC, 1099-DIV, or 1099-INT.

Instructions and Help about 1281 irs pub 2017

Fill

form

: Try Risk Free

People Also Ask about

What are B notices from the IRS?

B Notices are sent to IRS Form 1099 filers who've submitted a name and taxpayer identification number (TIN) combination that doesn't match the IRS database. Filers have a 15-day window to take action on the notices, and send updated TIN solicitations.

How do I remit withholding tax?

The person making the payment deducts tax prior to paying the amount due. The tax withheld/deducted is then remitted to the KRA. The payer is required to generate a withholding tax certificate on iTax which is automatically sent to the payee once the payer remits the withholding tax to KRA.

How do you submit backup withholding?

Employers that withhold taxes from certain payments must file a Form 945. For example, you'd have to file Form 945 if the IRS required you to make backup withholdings on an independent contractor's pay.

What happens with backup withholding?

What is backup withholding? There are situations when the payer is required to withhold at the current rate of 24 percent. This 24 percent tax is taken from any future payments to ensure the IRS receives the tax due on this income.

What accounts are subject to backup withholding?

Payments subject to backup withholding Attorney's fees (Form 1099-NEC) and gross proceeds such as settlements paid to an attorney (Form 1099-MISC) Interest payments (Form 1099-INT) Dividends (Form 1099-DIV) Payment Card and Third Party Network Transactions (Form 1099-K)

Who qualifies for exemption from withholding?

Exemption From Withholding To qualify for this exempt status, the employee must have had no tax liability for the previous year and must expect to have no tax liability for the current year. A Form W-4 claiming exemption from withholding is valid for only the calendar year in which it's furnished to the employer.

How do I know if Im backup withholding?

Am I subject to federal backup withholding? You received specific notification from the IRS stating that you are subject to backup withholding. You fail to furnish your taxpayer identification number on Form W9. You provide the wrong taxpayer identification number.

Under which circumstance would a payer not be subject to backup withholding?

Upon opening a new investment account or making an investment at a bank for the first time, it's important that you provide them with your name and TIN or SSN. As long as you provide an accurate W-9 to the institution you're investing through, you don't have to worry about backup withholding tax.

What is a TIN notice?

The TIN Notice is sent by the IRS when the taxpayer identification number (TIN) is not correct. The 2nd TIN Notice is the second notice sent by the IRS in three calendar years. When the 2nd TIN Notice checkbox is selected, the IRS will stop sending you TIN notices on the current account.

How do I know if I'm exempt from backup withholding?

Who Is Exempt from Backup Withholding? Most American citizens are exempted from backup withholding so long as their tax identification number (TIN) or social security number is on file with their broker, and corresponds with their legal name. Retirement accounts and unemployment income are also exempted.

How do I know if I have backup withholding?

Most people are not subject to federal backup withholding. The IRS notifies taxpayers if they are subject to backup withholding. Any of the following reasons may cause your account to be subject to backup withholding: You received specific notification from the IRS stating that you are subject to backup withholding.

Why is my bank asking about backup withholding?

This is known as Backup Withholding (BWH) and may be required: Under the BWH-B program because you failed to provide a correct taxpayer identification number (TIN) to the payer for reporting on the required information return.

How does the IRS notify you of backup withholding?

The IRS notifies the payer to start withholding on interest or dividends because you have underreported interest or dividends on your income tax return. The IRS will do this only after it has mailed you four notices over at least a 120-day period.

How do I submit a backup withholding to the IRS?

If you withhold or are required to withhold federal income tax (including backup withholding) from nonpayroll payments, you must file Form 945. See Purpose of Form 945, earlier. You don't have to file Form 945 for those years in which you don't have a nonpayroll tax liability.

What is a notice CP2100A?

CP2100 and CP2100A notices are sent twice a year; an initial mailing in September and October and a second mailing in April of the following year. The notices inform payers that the information return is missing a Taxpayer Identification Number (TIN), has an incorrect name or a combination of both.

How do you know if you're exempt from backup withholding?

Who Is Exempt from Backup Withholding? Most American citizens are exempted from backup withholding so long as their tax identification number (TIN) or social security number is on file with their broker, and corresponds with their legal name. Retirement accounts and unemployment income are also exempted.

What is a CP2100 b notice?

Payer information The IRS will issue a CP2100 or CP2100A Notice if the payee's TIN is missing or obviously incorrect (not 9 digits or contains something other than a number) or their name and TIN on the information return filed does not match the IRS's records.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 1281 irs pub 2017 to be eSigned by others?

When you're ready to share your 1281 irs pub 2017, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I make edits in 1281 irs pub 2017 without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your 1281 irs pub 2017, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How do I complete 1281 irs pub 2017 on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your 1281 irs pub 2017 from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is IRS Publication 1281?

IRS Publication 1281 provides guidelines for payers on how to file information returns reporting backup withholding or discuss the penalty for failure to provide a correct name and taxpayer identification number (TIN).

Who is required to file IRS Publication 1281?

Payers who are required to report and withhold taxes due to incorrect TINs or backup withholding rules must file IRS Publication 1281.

How to fill out IRS Publication 1281?

To fill out IRS Publication 1281, gather the necessary payer and payee information, including names, addresses, and TINs, and provide details on the amounts subject to backup withholding. Follow the instructions provided for correct formatting and submission.

What is the purpose of IRS Publication 1281?

The purpose of IRS Publication 1281 is to inform taxpayers about their responsibilities regarding backup withholding and to ensure compliance in reporting payments made that are subject to such withholding.

What information must be reported on IRS Publication 1281?

IRS Publication 1281 requires reporting of the payer's information, the payee's information including their TIN, the amounts subject to backup withholding, and any penalties related to incorrect information.

Fill out your 1281 irs pub 2017 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

1281 Irs Pub 2017 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.