IRS Publication 1281 2003 free printable template

Show details

No. irs. gov Publication 1281 Rev. 8-2003 Catalog Number 63327A TABLE OF CONTENTS Page Part 1 Introduction What s New Backup Withholding Rate Table Part 2 Frequently Asked Questions Part 3 Where to Call for Help Part 4 Actions for Missing TINs and Incorrect Name/TIN Combinations CP2100 Notice Missing TIN s Incorrect Name/TIN Combinations First B Notice Second B Notice Third and Subsequent Notices Part 5 The IRS Matching Process Name Controls Part 6 Flow Charts Part 7 Notices and Forms...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign publication 1281 2003 form

Edit your publication 1281 2003 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your publication 1281 2003 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit publication 1281 2003 form online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit publication 1281 2003 form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS Publication 1281 Form Versions

Version

Form Popularity

Fillable & printabley

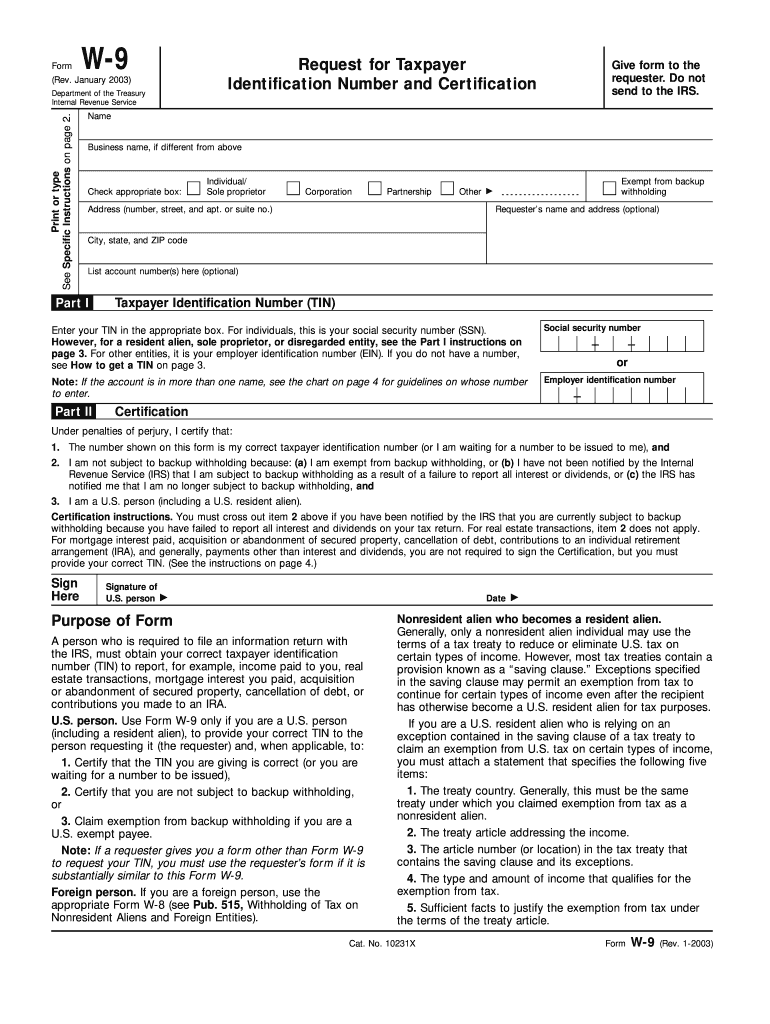

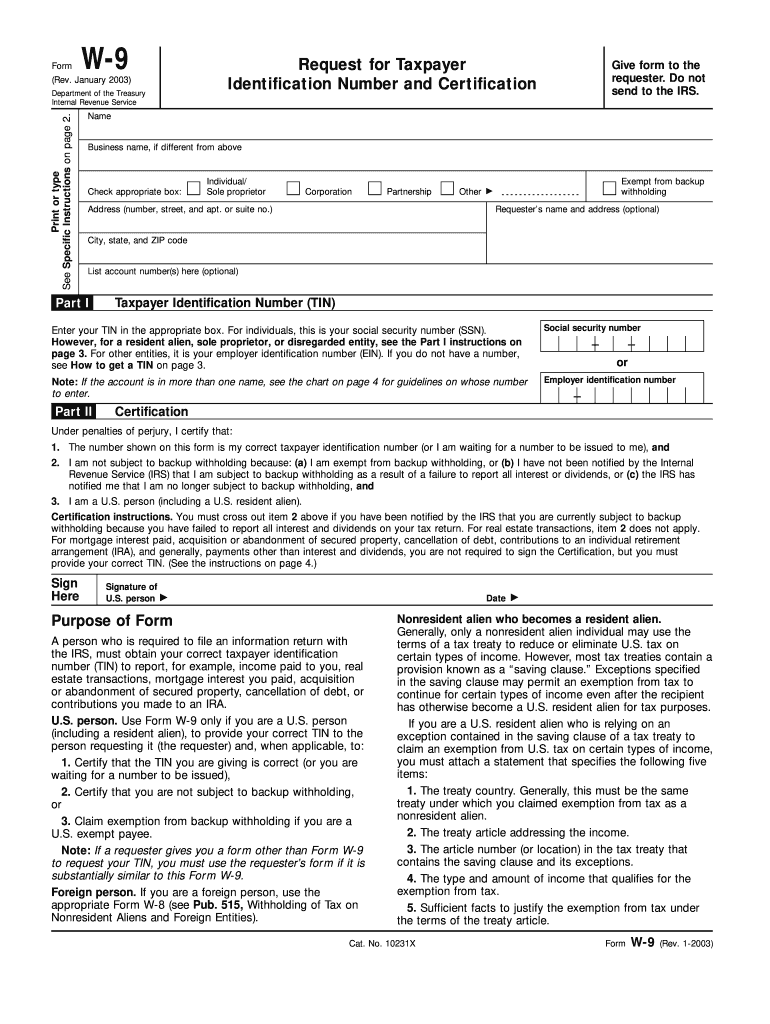

How to fill out publication 1281 2003 form

How to fill out IRS Publication 1281

01

Obtain IRS Publication 1281 from the IRS website or a local office.

02

Read the instructions carefully to understand the purpose of the form.

03

Fill in your name, address, and taxpayer identification number in the appropriate fields.

04

Provide details about the income subject to backup withholding.

05

Indicate the reason for filing the form, such as not providing a taxpayer identification number.

06

Sign and date the form at the bottom to certify that the information provided is accurate.

07

Submit the completed form to the IRS by the specified deadline.

Who needs IRS Publication 1281?

01

Individuals or businesses that are required to report payments subject to backup withholding.

02

Payors who are required to notify the IRS of certain payments made to payees without a valid taxpayer identification number.

03

Any entity that has withheld taxes from a payment and needs to report that to the IRS.

Fill

form

: Try Risk Free

People Also Ask about

How do I remove a C notice from the IRS?

What to do if you receive a “C” notice to start backup withholding? Start backup withholding at the current backup withholding rate of 24 percent. Stop backup withholding when the IRS notifies you that the taxpayer is no longer liable.

How do I know if I am exempt from backup withholding?

Who Is Exempt from Backup Withholding? Most American citizens are exempted from backup withholding so long as their tax identification number (TIN) or social security number is on file with their broker, and corresponds with their legal name. Retirement accounts and unemployment income are also exempted.

How do I get my IRS backup withholding back?

To stop backup withholding, you'll need to correct the reason you became subject to backup withholding. This can include providing the correct TIN to the payer, resolving the underreported income and paying the amount owed, or filing the missing return(s), as appropriate.

Should I select exempt from backup withholding?

Do I need to pay backup withholding? Most taxpayers are exempt from backup withholding. U.S. citizens and resident aliens are exempt as long as they properly report their names and Social Security numbers or tax ID numbers (TINs) to the payer and that information matches IRS records.

What is the penalty for TIN mismatch?

IRC Section 6721 provides a payer may be subject to a penalty for failure to file a complete and accurate information return, including a failure to include the correct payee TIN. The penalty is $50 per return, with a maximum penalty of $250,000 per year ($100,000 for small businesses).

How do I find out if I am subject to backup withholding?

When it applies, backup withholding requires a payer to withhold tax from payments not otherwise subject to withholding. You may be subject to backup withholding if you fail to provide a correct taxpayer identification number (TIN) when required or if you fail to report interest, dividend, or patronage dividend income.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in publication 1281 2003 form without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing publication 1281 2003 form and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How do I edit publication 1281 2003 form straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing publication 1281 2003 form, you need to install and log in to the app.

How do I fill out publication 1281 2003 form using my mobile device?

Use the pdfFiller mobile app to complete and sign publication 1281 2003 form on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

What is IRS Publication 1281?

IRS Publication 1281 provides guidelines for the reporting and withholding of taxes for payments made to certain foreign entities.

Who is required to file IRS Publication 1281?

Entities making certain payments to foreign persons or entities that are subject to withholding under U.S. tax law are required to file IRS Publication 1281.

How to fill out IRS Publication 1281?

To fill out IRS Publication 1281, you need to complete the form with the required identification information, type of payment being reported, and details related to the withholding tax.

What is the purpose of IRS Publication 1281?

The purpose of IRS Publication 1281 is to ensure proper reporting and compliance with U.S. tax withholding requirements on payments made to foreign entities.

What information must be reported on IRS Publication 1281?

Information that must be reported on IRS Publication 1281 includes the name and address of the payee, the type of income, amount of payment, and any withholding tax amounts.

Fill out your publication 1281 2003 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Publication 1281 2003 Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.