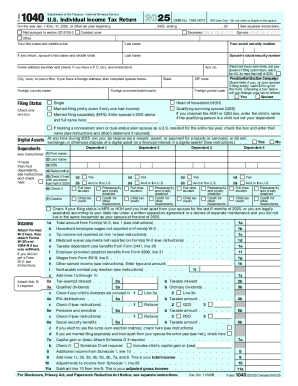

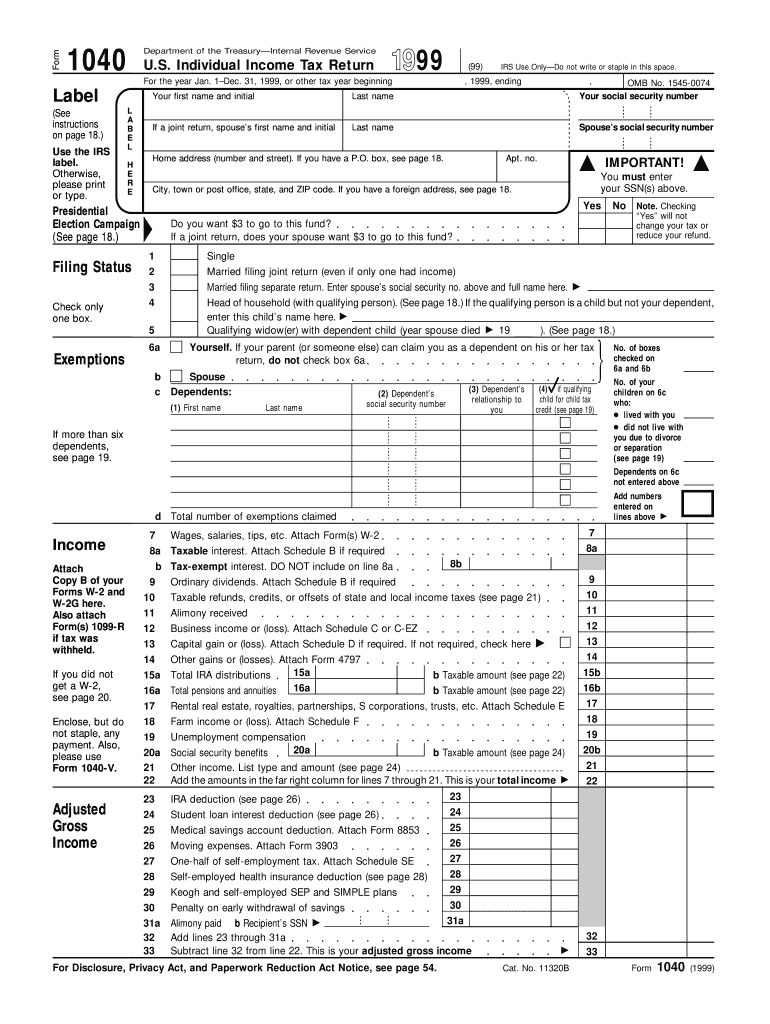

IRS 1040 1999 free printable template

Instructions and Help about IRS 1040

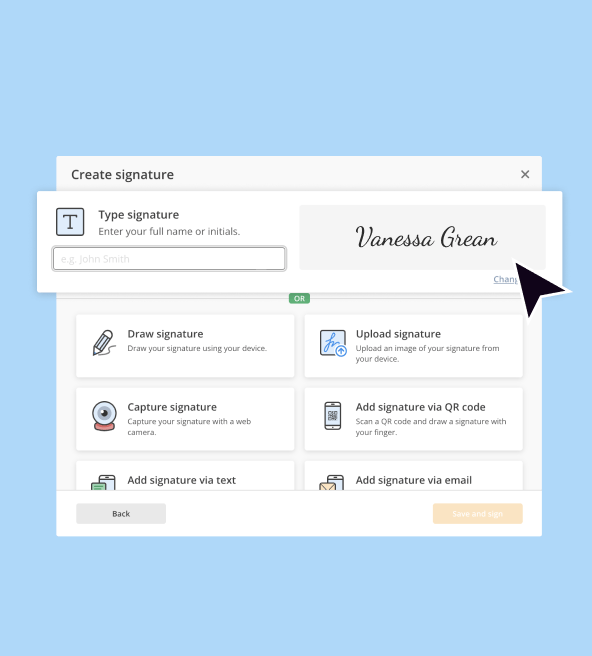

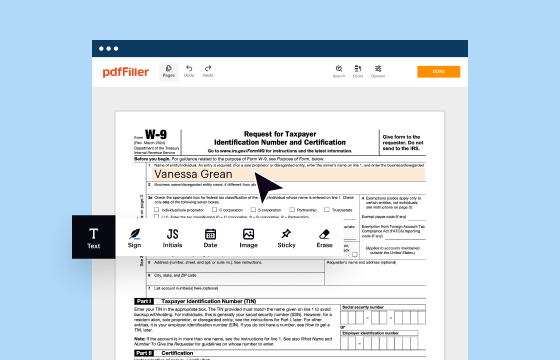

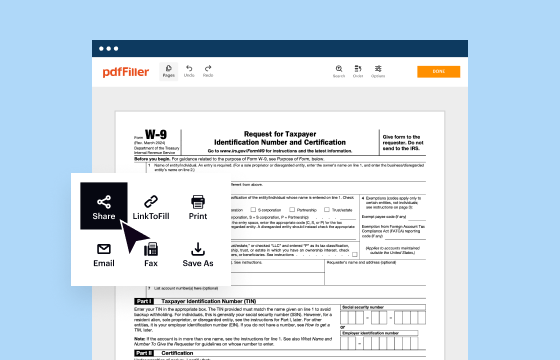

How to edit IRS 1040

How to fill out IRS 1040

About IRS previous version

What is IRS 1040?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1040

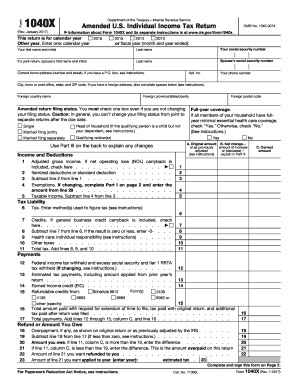

How can I correct errors on my filed IRS 1040?

To correct errors on your filed IRS 1040, you need to submit an amended return using Form 1040-X. Ensure you provide the necessary information regarding the changes and attach any supporting documents. Submitting an amended return is essential to rectify discrepancies before any potential audits or penalties arise.

What should I do if my IRS 1040 e-filing gets rejected?

If your IRS 1040 e-filing is rejected, review the email notification for specific rejection codes. Common issues include incorrect Social Security Numbers or mismatches with prior returns. Once you fix the identified errors, you can re-submit your e-filing to the IRS.

How long should I retain records related to my IRS 1040?

You should keep records related to your IRS 1040 for at least three years after the due date of the return or the date it was filed, whichever is later. These records may be useful if the IRS audits your return or if there's a need to amend it in the future.

Can I file my IRS 1040 on behalf of someone else?

Yes, you may file an IRS 1040 on behalf of someone else if you have proper authorization, often facilitated through a Power of Attorney (POA) document. Ensure you comply with the IRS regulations related to signatures and submission when acting for another individual.

What happens if I receive an IRS notice after filing my 1040?

If you receive an IRS notice after filing your 1040, carefully read the notice to understand the IRS's concerns. Responding promptly with the required documentation or information is crucial to resolve issues effectively. Keeping records of your correspondence can also be beneficial.

See what our users say