TX Comptroller 50-246 2009 free printable template

Show details

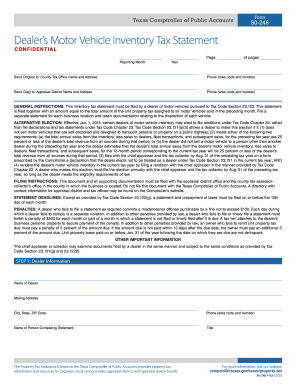

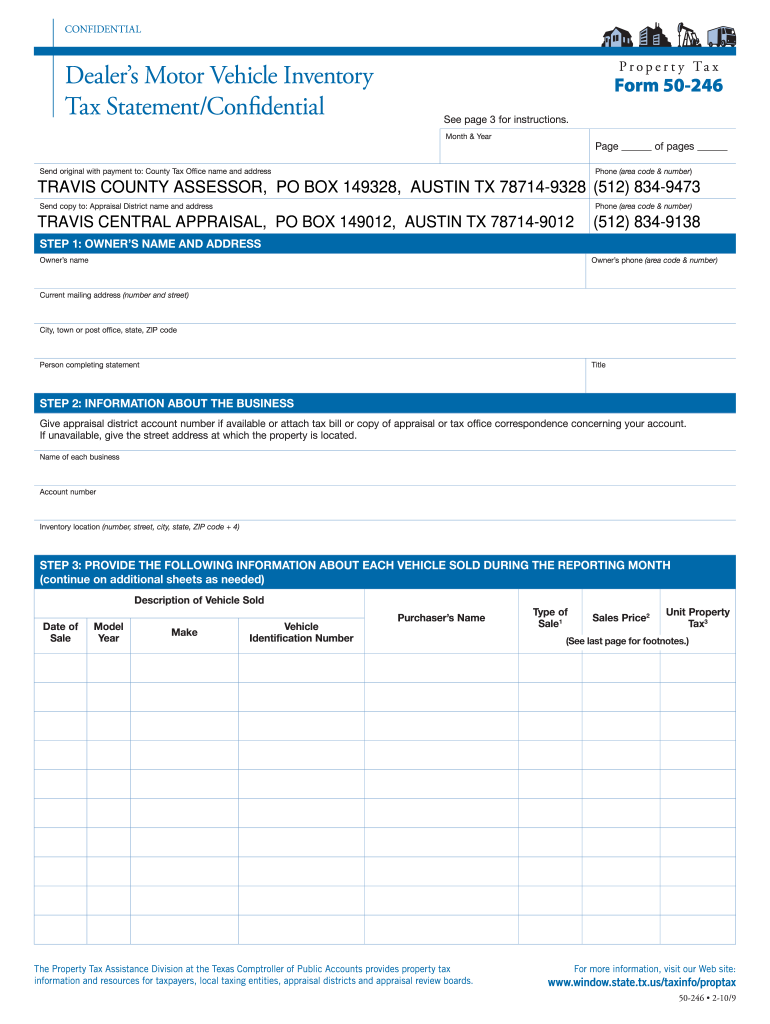

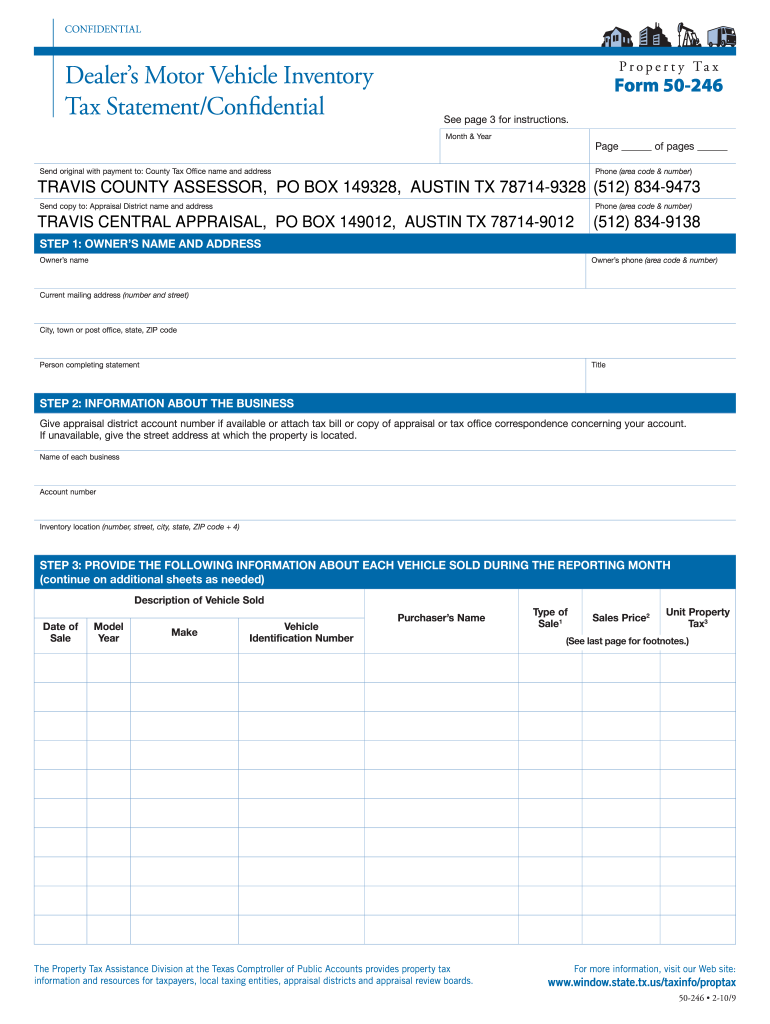

CONFIDENTIAL Dealer s Motor Vehicle Inventory Tax Statement/Confidential P r o p e r t y Ta x Form 50-246 See page 3 for instructions. 10. Instructions If you are an owner of an inventory subject to Sec. 23. 121 Tax Code you must file this dealer s motor vehicle inventory tax statement as required by Sec. 23. Window. state. tx. us/taxinfo/proptax 50-246 2-10/9 STEP 3 continued Total Unit Property Tax this month4 Your general distinguishing number s GDN STEP 4 TOTAL SALES Breakdown of sales...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign dealers motor vehicle inventory

Edit your dealers motor vehicle inventory form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your dealers motor vehicle inventory form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing dealers motor vehicle inventory online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit dealers motor vehicle inventory. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX Comptroller 50-246 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out dealers motor vehicle inventory

How to fill out TX Comptroller 50-246

01

Download the TX Comptroller 50-246 form from the official website.

02

Read the instructions carefully to understand the purpose of the form.

03

Fill out the top section with your contact information, including name, address, and phone number.

04

Provide details about the property for which you are claiming exemption, including address and property identification number.

05

Indicate the type of exemption you are applying for by checking the appropriate box.

06

Complete the required supporting information fields as mandated by the specific exemption type.

07

Confirm that the information provided is accurate by signing and dating the form.

08

Submit the completed form to the local appraisal district by the deadline.

Who needs TX Comptroller 50-246?

01

Individuals and organizations applying for property tax exemptions in Texas.

02

Property owners seeking state-approved exemptions for specific property types.

03

Non-profit organizations that qualify for property tax exemption.

04

Businesses exempt from certain property taxes under Texas law.

Fill

form

: Try Risk Free

People Also Ask about

Do you have to pay inventory tax in Texas?

For local property tax purposes, Texas law requires a motor vehicle dealer's inventory to be appraised based on the total sales of motor vehicles in the prior year. A dealer must file an annual declaration of total sales from the prior year with their county appraisal district.

Do I have to pay vehicle inventory tax in Texas?

For local property tax purposes, Texas law requires a motor vehicle dealer's inventory to be appraised based on the total sales of motor vehicles in the prior year. A dealer must file an annual declaration of total sales from the prior year with their county appraisal district.

What is the unit property tax factor in Texas?

The unit property tax factor is calculated by dividing the prior year's aggregate tax rate by 12. If the aggregate tax rate is expressed in dollars per $100 of valuation, divide by $100 and then divide by 12. It represents one-twelfth of the preceding year's aggregate tax rate at the location.

What is considered inventory for tax?

Inventory is made up of all the items that a business has on hand to sell, as well as all of the goods that the company will use to manufacture income-producing goods. While inventory is not directly taxable, it is used to calculate a business's cost of goods sold, or COGS.

What is inventory tax?

Inventory tax is a property tax that is determined by the value of inventory and usually falls under a Business Tangible Personal Property tax. Other types of property that often fall under this same classification are machinery, office equipment, and furniture.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my dealers motor vehicle inventory directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign dealers motor vehicle inventory and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I modify dealers motor vehicle inventory without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your dealers motor vehicle inventory into a dynamic fillable form that you can manage and eSign from anywhere.

Can I sign the dealers motor vehicle inventory electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

What is TX Comptroller 50-246?

TX Comptroller 50-246 is a form used for reporting information related to the distribution of proceeds from property tax collections, specifically concerning local governments and their funding.

Who is required to file TX Comptroller 50-246?

Organizations or local governments that receive property tax revenues or distributions are required to file TX Comptroller 50-246.

How to fill out TX Comptroller 50-246?

To fill out TX Comptroller 50-246, one must provide details such as the local government entity's identification, the relevant time period for the reporting, and the amounts collected, including any deductions or distributions.

What is the purpose of TX Comptroller 50-246?

The purpose of TX Comptroller 50-246 is to ensure transparency and accountability in the reporting of property tax revenue allocations and to facilitate the oversight of these funds by the Texas Comptroller's office.

What information must be reported on TX Comptroller 50-246?

Information that must be reported on TX Comptroller 50-246 includes the entity’s name, address, tax identification number, amounts of property tax collected, any necessary adjustments, and the specific funding programs supported by these revenues.

Fill out your dealers motor vehicle inventory online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Dealers Motor Vehicle Inventory is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.