TX Comptroller 50-246 2013 free printable template

Show details

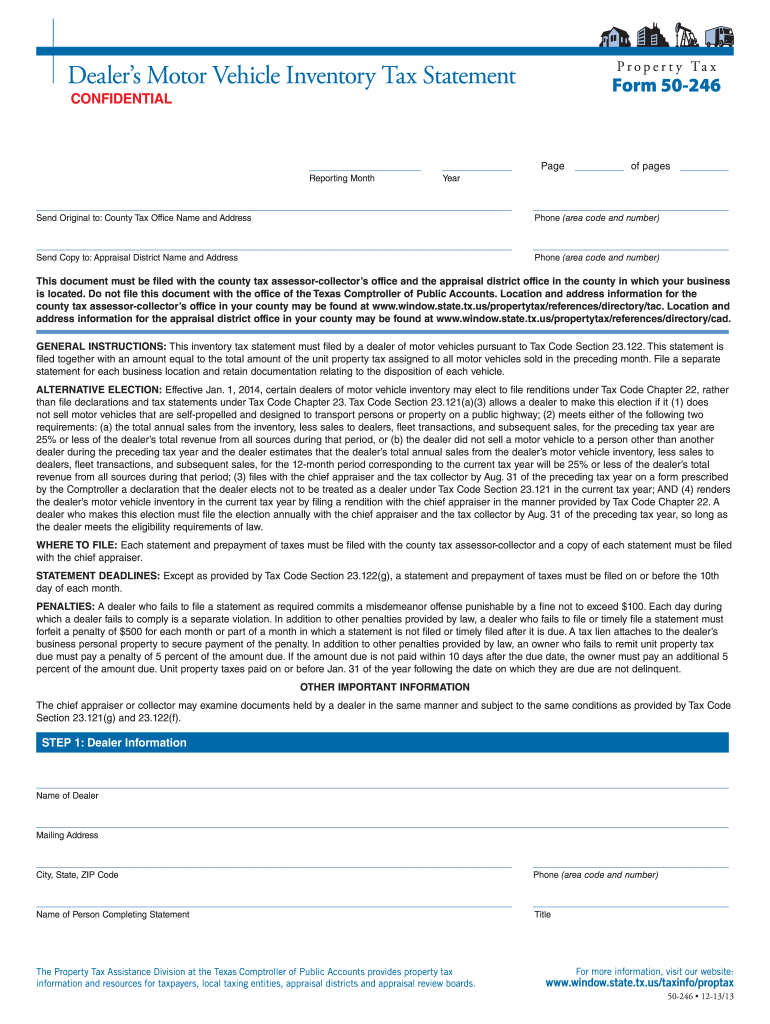

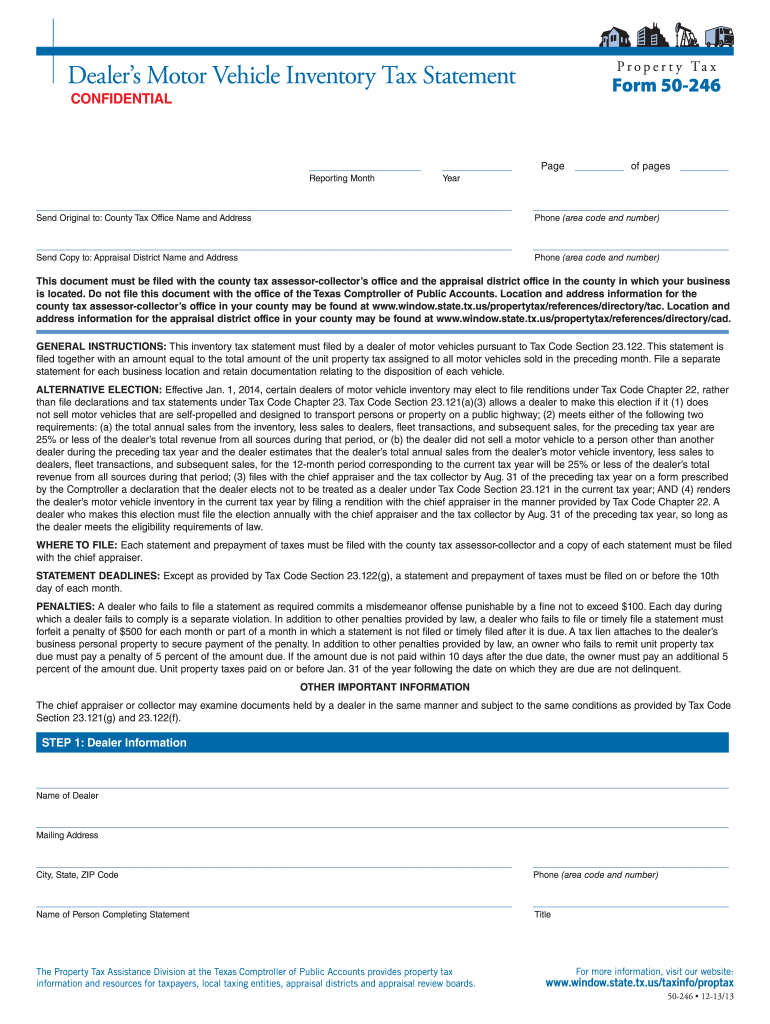

P r o p e r t y Ta x

Dealer’s Motor Vehicle Inventory Tax Statement

Form 50-246

CONFIDENTIAL

___ ___

Reporting Month

Page

___

of pages

___

Year

___ ___

Send Original to: County

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign manufactured housing 2013 form

Edit your manufactured housing 2013 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your manufactured housing 2013 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing manufactured housing 2013 form online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit manufactured housing 2013 form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX Comptroller 50-246 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out manufactured housing 2013 form

How to fill out TX Comptroller 50-246

01

Obtain Form 50-246 from the Texas Comptroller's website.

02

Begin by filling in your name and contact information at the top of the form.

03

Provide the tax ID number related to the property for which the exemption is being requested.

04

Fill in the details of the property, including its address and size.

05

Indicate the type of exemption being requested by checking the appropriate box.

06

Provide a detailed description of the purpose of the exemption and how it meets the criteria.

07

If applicable, include any supporting documentation that verifies your claims.

08

Review the completed form for accuracy and completeness.

09

Sign and date the form at the bottom.

10

Submit the form to the relevant taxing authority by the deadline.

Who needs TX Comptroller 50-246?

01

Property owners seeking a property tax exemption in Texas.

02

Non-profit organizations applying for exemptions based on their charitable status.

03

Individuals or entities owning properties that meet specific criteria for exemptions.

Fill

form

: Try Risk Free

People Also Ask about

Who is exempt from motor vehicle sales tax in Texas?

A motor vehicle purchased in Texas for use exclusively outside Texas is exempt from motor vehicle sales tax. To claim the exemption, a purchaser must not use the motor vehicle in Texas, except for transportation directly out of state, and must not register the motor vehicle in Texas.

Does Texas charge property tax on vehicle registration?

Texas does not base property tax on the Registration State or the License Plate State. It is based solely on the reported and documented physical address that is in the system as of Jan 1st of any year. It cannot be changed after the fact or refunds cannot be requested.

What is the personal property tax on vehicles in Texas?

The rate is 6.25 percent and is calculated on the purchase price of the vehicle. The taxable value of private-party purchases of used motor vehicles may be based on the standard presumptive value.

Do you have to pay tax on a private car sale in Texas?

Sales: 6.25 percent of sales price, minus any trade-in allowance. The taxable value of private-party purchases of used motor vehicles may be based on the standard presumptive value.

Who pays the vehicle inventory tax in Texas?

The VIT is a property tax assessed on the dealer, not the purchaser, and is a negotiable item on the sales agreement. Moreover, the VIT is not, by statute, a part of "total consideration." Dealers may, however, separately list a reimbursement of the VIT on the sales agreement.

Who is exempt for collecting sales tax in Texas?

Common Texas sales tax exemptions include those for necessities of life, including most food and health-related items. In addition, goods for resale, such as wholesale items, are exempt from sales tax, as well as newspapers, containers, previously taxed items, and certain goods used for manufacturing.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute manufactured housing 2013 form online?

With pdfFiller, you may easily complete and sign manufactured housing 2013 form online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

Can I sign the manufactured housing 2013 form electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your manufactured housing 2013 form in minutes.

Can I create an eSignature for the manufactured housing 2013 form in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your manufactured housing 2013 form and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

What is TX Comptroller 50-246?

TX Comptroller 50-246 is a form used in Texas that requires certain entities to report their property tax information to the state comptroller.

Who is required to file TX Comptroller 50-246?

Entities that own property in Texas and are subject to property taxes, including local governments, nonprofit organizations, and other exempt entities, are required to file TX Comptroller 50-246.

How to fill out TX Comptroller 50-246?

To fill out TX Comptroller 50-246, entities must provide detailed information about their property, including its value, location, and any applicable exemptions that may apply.

What is the purpose of TX Comptroller 50-246?

The purpose of TX Comptroller 50-246 is to ensure proper reporting of property values and exemptions to maintain transparency and compliance with state property tax laws.

What information must be reported on TX Comptroller 50-246?

The information that must be reported on TX Comptroller 50-246 includes the property owner's details, property description, appraised value, and specific exemptions claimed.

Fill out your manufactured housing 2013 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Manufactured Housing 2013 Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.