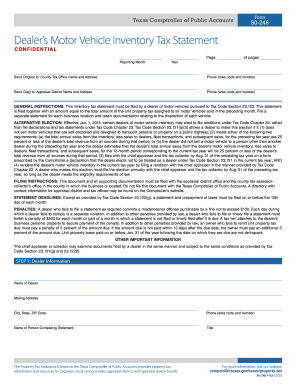

TX Comptroller 50-246 2012 free printable template

Show details

CONFIDENTIAL P r o p e r t y Ta x Dealer s Motor Vehicle Inventory Tax Statement Form 50-246 See Page 3 for Instructions Page of pages Month and Year (817) 884-1100 Tarrant County Tax Assessor Collector,

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign texas property tax form

Edit your texas property tax form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your texas property tax form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing texas property tax form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit texas property tax form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX Comptroller 50-246 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out texas property tax form

How to fill out TX Comptroller 50-246

01

Obtain form 50-246 from the Texas Comptroller of Public Accounts website or through your local tax office.

02

Read the instructions provided with the form carefully to ensure you understand the requirements.

03

Fill in the property owner's name and address in the designated fields.

04

Provide the property identification number or a detailed description of the property.

05

Specify the type of exemption you are applying for under the relevant section of the form.

06

Complete any additional sections as required by the form, including providing income information or supporting documentation if applicable.

07

Review all entered information for accuracy before final submission.

08

Sign and date the form at the bottom.

09

Submit the completed form to your local appraisal district office.

Who needs TX Comptroller 50-246?

01

Property owners in Texas who wish to apply for a property tax exemption.

02

Individuals or organizations claiming exemptions for charitable, religious, or educational purposes.

03

Homeowners seeking to realize tax benefits on their primary residence.

Fill

form

: Try Risk Free

People Also Ask about

Who is exempt from motor vehicle sales tax in Texas?

A motor vehicle purchased in Texas for use exclusively outside Texas is exempt from motor vehicle sales tax. To claim the exemption, a purchaser must not use the motor vehicle in Texas, except for transportation directly out of state, and must not register the motor vehicle in Texas.

Does Texas charge property tax on vehicle registration?

Texas does not base property tax on the Registration State or the License Plate State. It is based solely on the reported and documented physical address that is in the system as of Jan 1st of any year. It cannot be changed after the fact or refunds cannot be requested.

What is the personal property tax on vehicles in Texas?

The rate is 6.25 percent and is calculated on the purchase price of the vehicle. The taxable value of private-party purchases of used motor vehicles may be based on the standard presumptive value.

Do you have to pay tax on a private car sale in Texas?

Sales: 6.25 percent of sales price, minus any trade-in allowance. The taxable value of private-party purchases of used motor vehicles may be based on the standard presumptive value.

Who pays the vehicle inventory tax in Texas?

The VIT is a property tax assessed on the dealer, not the purchaser, and is a negotiable item on the sales agreement. Moreover, the VIT is not, by statute, a part of "total consideration." Dealers may, however, separately list a reimbursement of the VIT on the sales agreement.

Who is exempt for collecting sales tax in Texas?

Common Texas sales tax exemptions include those for necessities of life, including most food and health-related items. In addition, goods for resale, such as wholesale items, are exempt from sales tax, as well as newspapers, containers, previously taxed items, and certain goods used for manufacturing.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify texas property tax form without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your texas property tax form into a dynamic fillable form that can be managed and signed using any internet-connected device.

How can I send texas property tax form for eSignature?

Once your texas property tax form is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I edit texas property tax form online?

With pdfFiller, it's easy to make changes. Open your texas property tax form in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

What is TX Comptroller 50-246?

TX Comptroller 50-246 is a form used for reporting information regarding property taxes in Texas.

Who is required to file TX Comptroller 50-246?

Entities that receive local property tax exemptions or those required to report information to the Texas Comptroller must file TX Comptroller 50-246.

How to fill out TX Comptroller 50-246?

To fill out TX Comptroller 50-246, provide the required identification information, report property details, and include any relevant financial information as outlined in the form instructions.

What is the purpose of TX Comptroller 50-246?

The purpose of TX Comptroller 50-246 is to ensure compliance with property tax exemption qualification criteria and to gather necessary data for tax assessment purposes.

What information must be reported on TX Comptroller 50-246?

The information that must be reported includes property identification, ownership details, exemption type, and other relevant financial data related to the property.

Fill out your texas property tax form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Texas Property Tax Form is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.