TX Comptroller 50-246 2014 free printable template

Show details

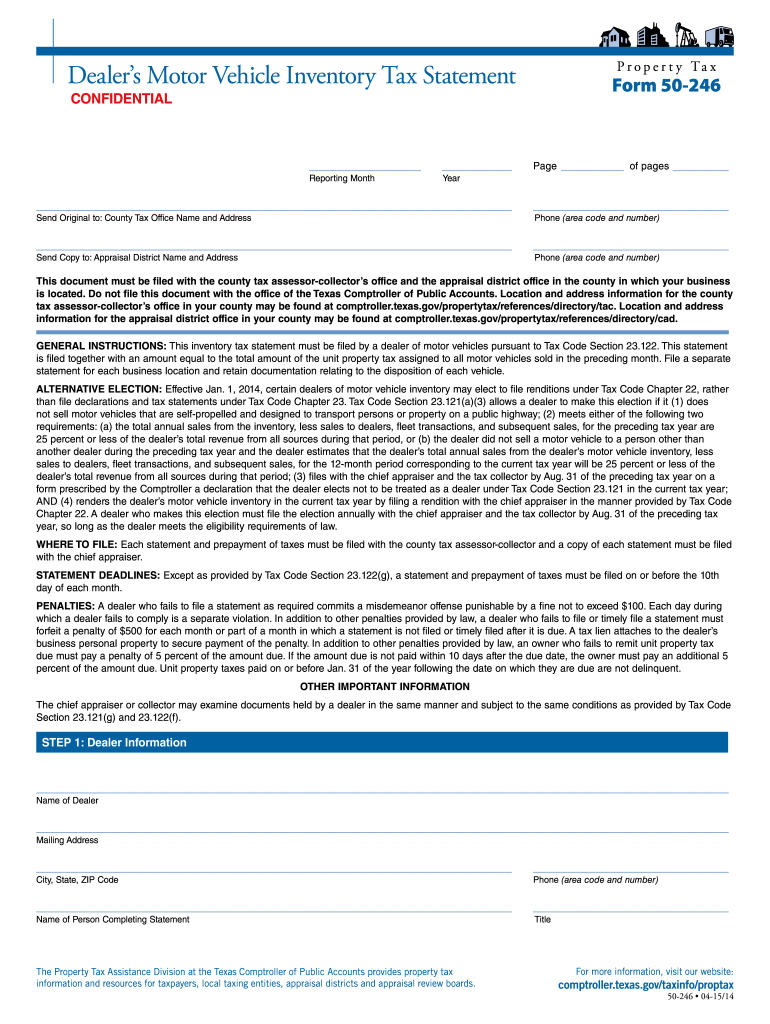

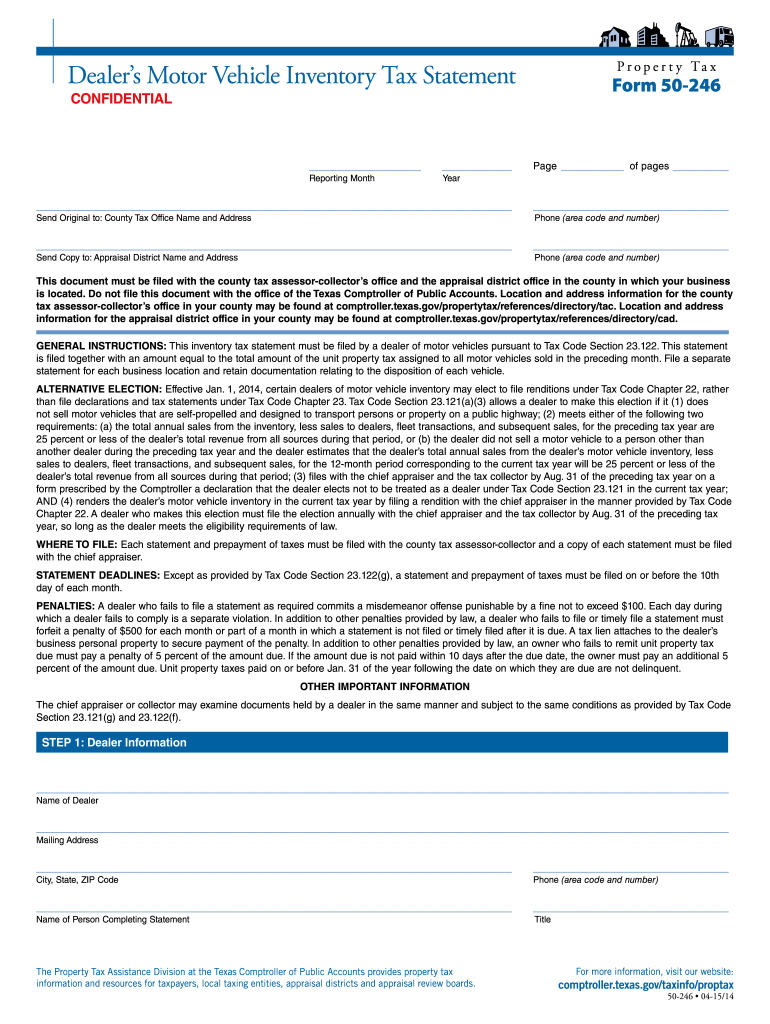

P r o p e r t y Ta x Dealer s Motor Vehicle Inventory Tax Statement Form 50-246 CONFIDENTIAL Page Reporting Month of pages Year Send Original to County Tax Office Name and Address Phone area code and number Send Copy to Appraisal District Name and Address This document must be filed with the county tax assessor-collector s office and the appraisal district office in the county in which your business is located. Do not file this document with the office of the Texas Comptroller of Public...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign form 50 246 2014

Edit your form 50 246 2014 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 50 246 2014 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 50 246 2014 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form 50 246 2014. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX Comptroller 50-246 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out form 50 246 2014

How to fill out TX Comptroller 50-246

01

Begin by downloading the TX Comptroller 50-246 form from the official website.

02

Fill in the entity name in the appropriate section at the top of the form.

03

Provide the entity's mailing address in the designated space.

04

Enter the federal Employer Identification Number (EIN) or Social Security Number (SSN).

05

Indicate the type of entity (e.g., corporation, partnership, sole proprietorship).

06

Complete the section regarding the type of exemption you are applying for.

07

Provide any additional information or documentation required to support your application.

08

Review the form for accuracy and completeness.

09

Sign and date the form as required in the designated area.

10

Submit the completed form by mail or in person to the appropriate office.

Who needs TX Comptroller 50-246?

01

Any businesses or organizations seeking a tax exemption in Texas may need to fill out TX Comptroller 50-246.

02

Nonprofit organizations applying for an exemption from sales and use tax must complete this form.

03

Entities that meet the criteria for specific exemptions as outlined in Texas tax laws will require this form.

Fill

form

: Try Risk Free

People Also Ask about

Who is exempt from motor vehicle sales tax in Texas?

A motor vehicle purchased in Texas for use exclusively outside Texas is exempt from motor vehicle sales tax. To claim the exemption, a purchaser must not use the motor vehicle in Texas, except for transportation directly out of state, and must not register the motor vehicle in Texas.

Does Texas charge property tax on vehicle registration?

Texas does not base property tax on the Registration State or the License Plate State. It is based solely on the reported and documented physical address that is in the system as of Jan 1st of any year. It cannot be changed after the fact or refunds cannot be requested.

What is the personal property tax on vehicles in Texas?

The rate is 6.25 percent and is calculated on the purchase price of the vehicle. The taxable value of private-party purchases of used motor vehicles may be based on the standard presumptive value.

Do you have to pay tax on a private car sale in Texas?

Sales: 6.25 percent of sales price, minus any trade-in allowance. The taxable value of private-party purchases of used motor vehicles may be based on the standard presumptive value.

Who pays the vehicle inventory tax in Texas?

The VIT is a property tax assessed on the dealer, not the purchaser, and is a negotiable item on the sales agreement. Moreover, the VIT is not, by statute, a part of "total consideration." Dealers may, however, separately list a reimbursement of the VIT on the sales agreement.

Who is exempt for collecting sales tax in Texas?

Common Texas sales tax exemptions include those for necessities of life, including most food and health-related items. In addition, goods for resale, such as wholesale items, are exempt from sales tax, as well as newspapers, containers, previously taxed items, and certain goods used for manufacturing.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit form 50 246 2014 from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your form 50 246 2014 into a dynamic fillable form that you can manage and eSign from anywhere.

How can I send form 50 246 2014 to be eSigned by others?

Once your form 50 246 2014 is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I make edits in form 50 246 2014 without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing form 50 246 2014 and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

What is TX Comptroller 50-246?

TX Comptroller 50-246 is a form used in Texas for reporting information about property tax exemptions.

Who is required to file TX Comptroller 50-246?

Property owners who are claiming certain property tax exemptions are required to file TX Comptroller 50-246.

How to fill out TX Comptroller 50-246?

To fill out TX Comptroller 50-246, individuals need to provide specific details about the property, the type of exemption being claimed, and ensure all necessary signatures are included.

What is the purpose of TX Comptroller 50-246?

The purpose of TX Comptroller 50-246 is to document and verify the eligibility for property tax exemptions in Texas.

What information must be reported on TX Comptroller 50-246?

TX Comptroller 50-246 requires information such as the property address, owner details, type of exemption sought, and any supporting documentation.

Fill out your form 50 246 2014 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 50 246 2014 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.