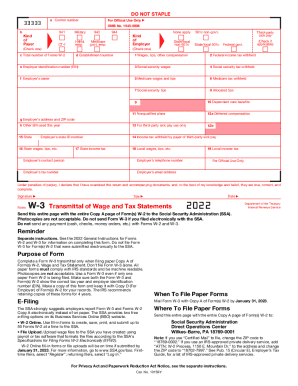

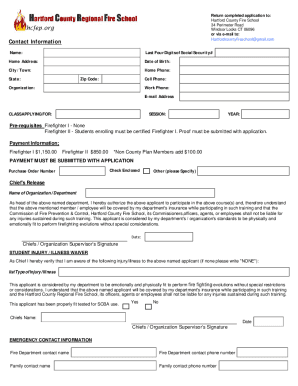

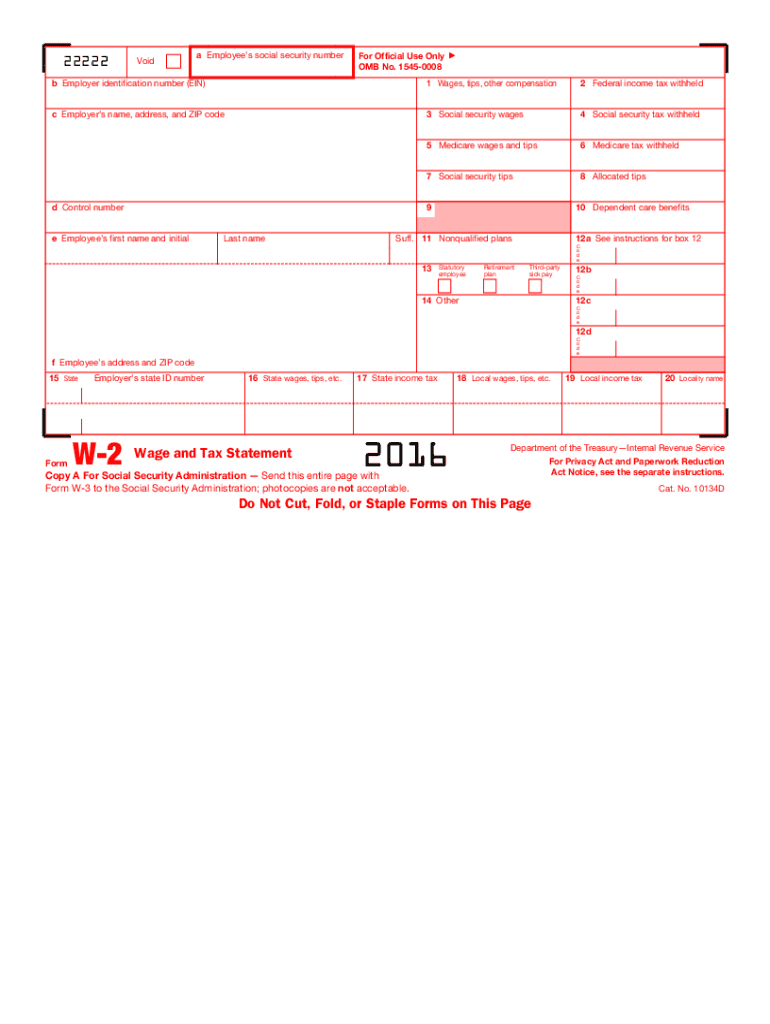

IRS W-2 2016 free printable template

Instructions and Help about IRS W-2

How to edit IRS W-2

How to fill out IRS W-2

About IRS W-2 2016 previous version

What is IRS W-2?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS W-2

What should I do if I realize I've made a mistake on my submitted IRS W-2?

If you discover an error on your submitted IRS W-2, you need to file a corrected form known as the IRS W-2c. This should be done as soon as the mistake is identified to rectify the information with the IRS and inform your employees accordingly. Ensure that you check for any penalties that might apply in case of late corrections.

How can I track the status of my filed IRS W-2?

To track the status of your filed IRS W-2, you can use the IRS's e-file tracking tools if you submitted electronically. It's also advisable to confirm with the recipient that they've received their form as expected. Monitor any IRS notices regarding your submission for updates or potential rejections, where applicable.

What are some common errors to avoid when filing an IRS W-2?

Common errors when filing an IRS W-2 include incorrect Social Security numbers, mismatched names, and failing to report all income accurately. To avoid these issues, double-check all entered information and use validation tools offered by e-filing software to ensure your data is correct before submission.

What should I know about privacy and data security when filing IRS W-2 forms?

When filing IRS W-2 forms, it's crucial to understand the importance of data security. Utilize secure e-filing methods and ensure that sensitive information, such as Social Security numbers, is protected during transmission. Maintain records securely for the required retention period to comply with legal obligations and safeguard against unauthorized access.

Can someone else file the IRS W-2 on my behalf?

Yes, an authorized representative or Power of Attorney (POA) can file the IRS W-2 on your behalf. Ensure that proper authorization documentation is provided to avoid issues. This is often helpful for businesses or individuals who may not be able to file the form directly due to various circumstances.

See what our users say