IRS 1040 2012 free printable template

Show details

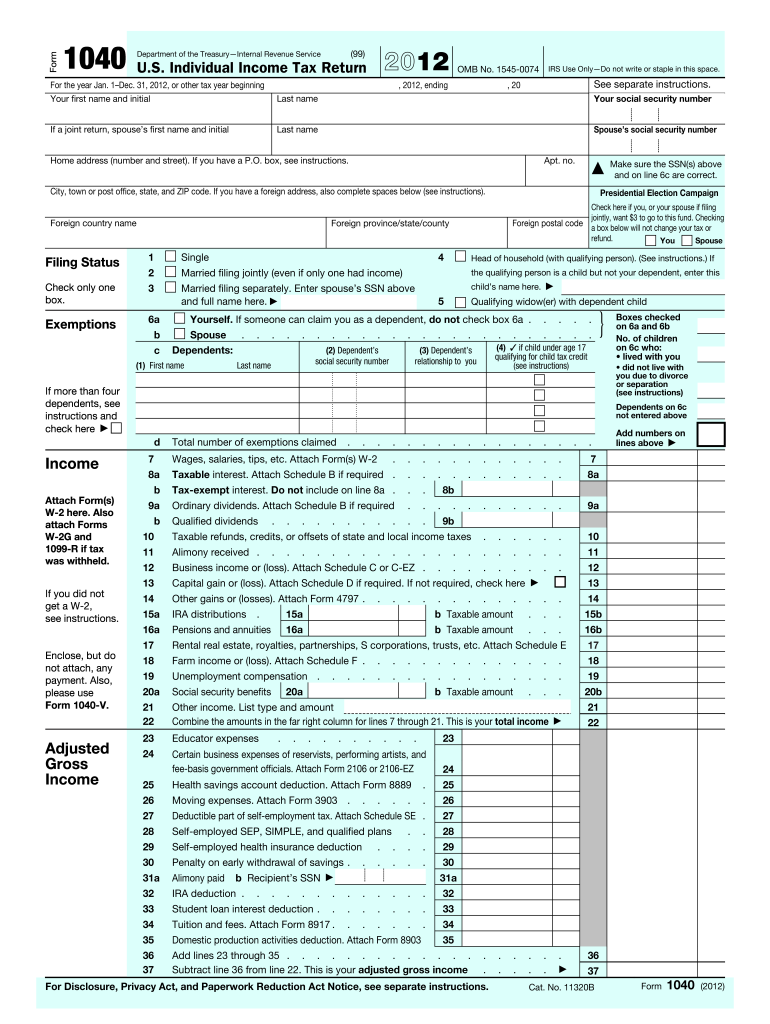

These are your total payments. Federal income tax withheld from Forms W-2 and 1099. 2012 estimated tax payments and amount applied from 2011 return 64a Earned income credit EIC. Form Department of the Treasury Internal Revenue Service U.S. Individual Income Tax Return For the year Jan. 1 Dec. 31 2012 or other tax year beginning OMB No. 1545-0074 2012 ending IRS Use Only Do not write or staple in this space. For Disclosure Privacy Act and Paperwork Reduction Act Notice see separate instructions....Cat. No. 11320B Page 2 Form 1040 2012 Tax and Credits Standard Deduction for People who check any box on line 39a or 39b or who can be claimed as a see All others separately jointly or Qualifying widow er 11 900 Head of household Other Taxes Amount from line 37 adjusted gross income 39a Check if You were born before January 2 1948 Spouse was born before January 2 1948 If you have a child attach Schedule EIC. See separate instructions. Your first name and initial Last name Your social security...number If a joint return spouse s first name and initial Spouse s social security number Apt. no. Home address number and street. If you have a P. O. box see instructions. City town or post office state and ZIP code. If you have a foreign address also complete spaces below see instructions. Foreign country name Filing Status Check only one box. Exemptions Presidential Election Campaign Check here if you or your spouse if filing jointly want 3 to go to this fund. Checking Foreign postal code a...box below will not change your tax or refund. You Spouse Foreign province/state/county Single Married filing jointly even if only one had income c Head of household with qualifying person. See instructions. If the qualifying person is a child but not your dependent enter this child s name here. and full name here. 6a b Qualifying widow er with dependent child Yourself* If someone can claim you as a dependent do not check box 6a. Dependents 1 First name social security number 4 if child under age...17 qualifying for child tax credit see instructions relationship to you not entered above d 8b. 9a Qualified dividends. 9b Taxable refunds credits or offsets of state and local income taxes Alimony received. Business income or loss. Attach Schedule C or C-EZ. Capital gain or loss. Attach Schedule D if required* If not required check here Other gains or losses. Attach Form 4797. 15a 16a IRA distributions. b Taxable amount. Pensions and annuities 16a Rental real estate royalties partnerships S...corporations trusts etc* Attach Schedule E 15b 16b 20a Farm income or loss. Attach Schedule F. Unemployment compensation. 20b Other income. List type and amount Combine the amounts in the far right column for lines 7 through 21. This is your total income Reserved Certain business expenses of reservists performing artists and fee-basis government officials. Attach Form 2106 or 2106-EZ Health savings account deduction* Attach Form 8889 Moving expenses. Attach Form 3903. Deductible part of...self-employment tax. Attach Schedule SE. Self-employed SEP SIMPLE and qualified plans Penalty on early withdrawal of savings.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1040

How to edit IRS 1040

How to fill out IRS 1040

Instructions and Help about IRS 1040

How to edit IRS 1040

To edit the IRS 1040 form, you need access to a digital version, which can be done through pdfFiller. Make sure to download the form in a compatible format. You can then use pdfFiller to input your edits directly on the document, ensuring that all changes are saved and updated correctly.

How to fill out IRS 1040

To fill out the IRS 1040, gather all necessary financial documents such as W-2s, 1099s, and receipts for deductions. Follow these steps:

01

Enter your personal information, including your name, address, and Social Security number.

02

Report your financial income from various sources on the form.

03

Claim deductions or credits where applicable to reduce your taxable income.

04

Calculate your total tax due or potential refund based on this information.

Review the completed form for accuracy to ensure all data is correct before submission.

About IRS previous version

What is IRS 1040?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS previous version

What is IRS 1040?

The IRS 1040 form is used by individual taxpayers in the United States to report their annual income. This form allows taxpayers to calculate the amount of tax they owe or the refund they can expect. It is one of the most common tax forms used for individual federal income tax filing.

What is the purpose of this form?

The primary purpose of the IRS 1040 form is to provide the IRS with information about your income, deductions, and credits. This information assists in determining your overall tax liability for the year. Properly completing the form is essential for compliance with federal tax laws.

Who needs the form?

Most U.S. citizens and residents who earn income are required to file IRS 1040. If you earn above the minimum income threshold set by the IRS, you must fill out this form. Special circumstances, such as being self-employed or claiming certain credits, also necessitate its use.

When am I exempt from filling out this form?

You may be exempt from filing IRS 1040 if your income falls below the set threshold for your filing status. Additionally, certain non-residents and specific types of income, such as those not subject to U.S. taxes, may also provide grounds for exemption.

Components of the form

The IRS 1040 consists of several key components, including: personal information sections, income reporting lines, deductions and credits sections, and tax liability calculations. Each part is designed to gather accurate information which determines your tax obligations or refund eligibility.

Due date

The due date for filing IRS 1040 for the previous tax year is typically April 15th, unless it falls on a weekend or holiday. It's essential to meet this deadline to avoid penalties and interest on unpaid taxes.

What are the penalties for not issuing the form?

Failing to file IRS 1040 when required can result in penalties, which may include a failure-to-file fee and accumulated interest on unpaid taxes. The longer you wait to file, the higher the potential penalties, making timely submission important for compliance.

What information do you need when you file the form?

When filing IRS 1040, you need to gather essential information, including:

01

Your Social Security number.

02

Income statements such as W-2s and 1099s.

03

Deductions and credits documentation, such as receipts and prior tax returns.

Having this information on hand will streamline the filing process and ensure accurate reporting.

Is the form accompanied by other forms?

Yes, the IRS 1040 may require accompanying schedules or forms depending on your taxable situation. Common additional forms include Schedule A for itemized deductions and Schedule C for business income. Always check the IRS guidelines for any forms that may need to accompany your submission.

Where do I send the form?

The mailing address for IRS 1040 depends on your location and whether you are enclosing payment. Generally, the IRS provides a list of mailing addresses based on your state and tax situation on their website. Note that electronic filing is also available and may expedite processing.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

Was not satisfied with the rate of $72 charged whereas I was under the impression that %65 percent would be taken from that rate.

When trying to save a completed document to my hard drive it becomes confusing. I cannot find the saved files anywhere. Other than that the program is great.

See what our users say