NJ EBF-1 2012-2026 free printable template

Show details

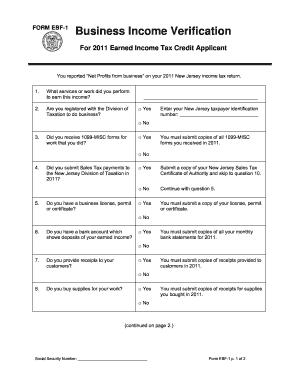

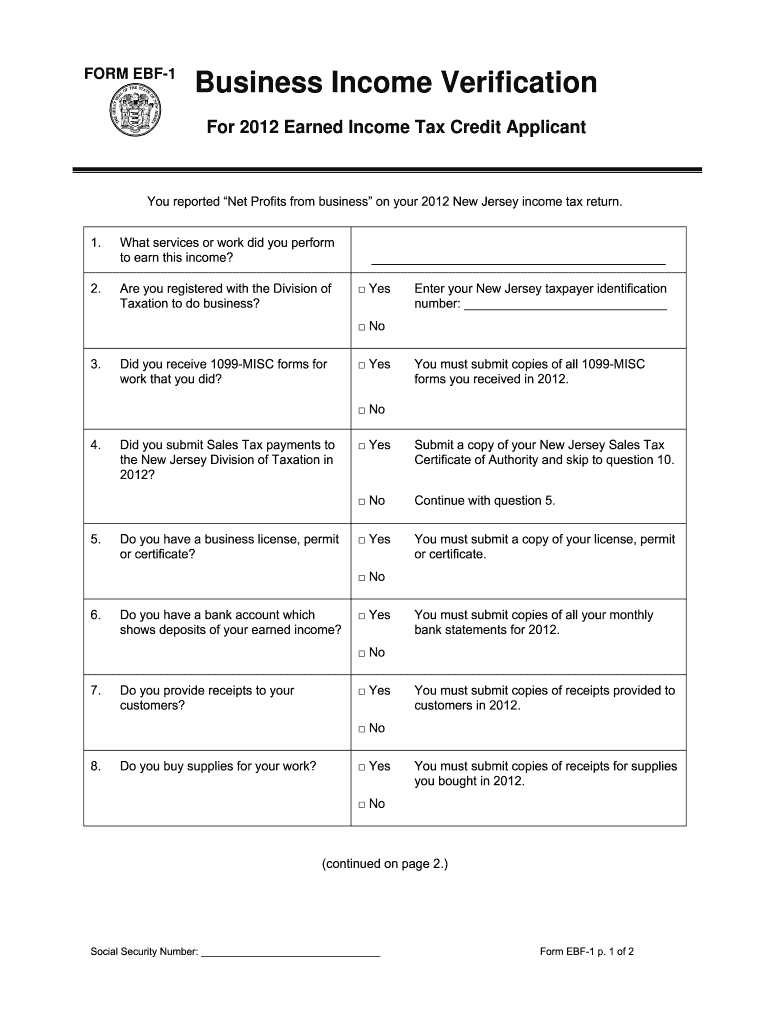

Do you buy supplies for your work you bought in 2012. continued on page 2. Social Security Number Form EBF-1 p. 1 of 2 Provide a list of your main clients or customers during 2012. FORM EBF-1 Business Income Verification For 2012 Earned Income Tax Credit Applicant You reported Net Profits from business on your 2012 New Jersey income tax return. What services or work did you perform to earn this income Are you registered with the Division of Taxat...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NJ EBF-1

Edit your NJ EBF-1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NJ EBF-1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NJ EBF-1 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit NJ EBF-1. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NJ EBF-1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NJ EBF-1

How to fill out NJ EBF-1

01

Obtain the NJ EBF-1 form from the New Jersey Department of Education's website or your school district.

02

Fill in the school district's name and the school code at the top of the form.

03

Enter the school year for which the form is being completed.

04

Provide detailed information regarding the student, including their name, grade, and date of birth.

05

List the names of the parents or guardians along with their contact information.

06

Input data regarding the student's academic and attendance record as required on the form.

07

Review all entries for accuracy and completeness.

08

Sign and date the form where needed.

09

Submit the completed form to the appropriate school district office by the specified deadline.

Who needs NJ EBF-1?

01

Parents or guardians of students enrolled in New Jersey public schools who are applying for state-funded educational benefits or need to report attendance and academic performance.

Fill

form

: Try Risk Free

People Also Ask about

How much is the EITC refund?

Earned income tax credit 2022 For the 2022 tax year (taxes filed in 2023), the earned income credit ranges from $560 to $6,935, depending on your filing status and how many children you have. Below are the maximum 2022 earned income tax credit amounts, plus the max you can earn before losing the benefit altogether.

Who is eligible for the EITC in NJ?

For tax year 2022, Earned Income and Adjusted Gross Income (AGI) must each be less than:: $53,057 ($59,187 married filing jointly) with three or more qualifying children. $49,399 ($55,529 married filing jointly) with two qualifying children. $43,492 ($49,622 married filing jointly) with one qualifying child.

How much does EITC give you?

Overview. You may be eligible for a California Earned Income Tax Credit (CalEITC) up to $3,417 for tax year 2022 as a working family or individual earning up to $30,000 per year.

What is the New Jersey state income tax credit?

NJEITC is a cash-back tax credit that puts money back into the pockets of working families and individuals, including the self-employed, who earn low to moderate income. Do not shortchange yourself. You worked for it, now get it. Many NJEITC filers will receive their refund within our normal estimated processing times.

How much do you get for EITC?

Overview. You may be eligible for a California Earned Income Tax Credit (CalEITC) up to $3,417 for tax year 2022 as a working family or individual earning up to $30,000 per year.

How do you qualify for Njeitc?

You must have earned income to qualify for an NJEITC.To be eligible for the NJEITC for Tax Year 2022, you must: Be a New Jersey resident who works or earns income; Be at least 18 years old, with or without a qualified dependent; Meet the federal income limits for your filing status and claimed dependents;

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit NJ EBF-1 from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your NJ EBF-1 into a fillable form that you can manage and sign from any internet-connected device with this add-on.

Can I edit NJ EBF-1 on an iOS device?

Use the pdfFiller mobile app to create, edit, and share NJ EBF-1 from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

How do I fill out NJ EBF-1 on an Android device?

Complete your NJ EBF-1 and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is NJ EBF-1?

NJ EBF-1 is the New Jersey Employer Business Filing form, used for reporting and filing business information related to employer obligations in New Jersey.

Who is required to file NJ EBF-1?

Employers who have employees working in New Jersey and are subject to New Jersey employment laws are required to file NJ EBF-1.

How to fill out NJ EBF-1?

To fill out NJ EBF-1, employers need to provide information such as their business name, address, tax identification number, and details regarding their employees and payroll.

What is the purpose of NJ EBF-1?

The purpose of NJ EBF-1 is to ensure compliance with state employment laws, enabling the state to track employer responsibilities regarding taxes and employee benefits.

What information must be reported on NJ EBF-1?

Information that must be reported on NJ EBF-1 includes employer identification information, details of employees, payroll information, and any applicable employment taxes.

Fill out your NJ EBF-1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NJ EBF-1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.