Get the free CREDIT AND YOUR CREDIT REPORT - wiserwomen

Show details

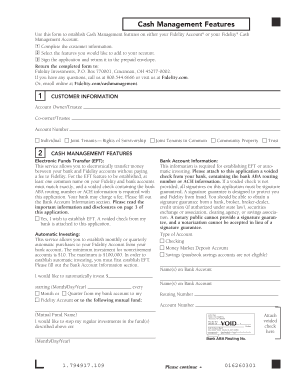

GET THE FACTS! CREDIT AND YOUR CREDIT REPORT What You Need to Know What is credit? Credit is money you borrow and repay at a later time. Often, there is a charge for borrowing the money, especially

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit and your credit

Edit your credit and your credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit and your credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit credit and your credit online

To use the professional PDF editor, follow these steps below:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit credit and your credit. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit and your credit

How to fill out credit and your credit:

01

Start by gathering all the necessary documents you will need to fill out your credit application. This typically includes your identification, proof of income, and any relevant financial statements.

02

Carefully read and understand the terms and conditions of the credit application before proceeding. Make sure you are aware of any fees, interest rates, and repayment terms.

03

Provide accurate and complete information on the credit application. This includes details about your personal information, employment history, financial status, and any outstanding debts or liabilities.

04

Double-check all the information you have provided on the credit application to ensure its accuracy. Incorrect or incomplete information could lead to delays or even denial of your credit application.

05

If necessary, attach any supporting documents that may strengthen your credit application. This can include proof of assets, employment letters, or credit references.

06

Once you have filled out the credit application, review it one last time to make sure that everything is in order and that you have not missed any important sections or details.

07

Submit your completed credit application to the appropriate financial institution or lender. Follow any specific instructions provided by the institution regarding submission methods and deadlines.

08

Wait for the credit decision. Depending on the nature of the credit and the institution's processes, this can take anywhere from a few hours to several weeks.

09

Track the progress of your credit application. If you have not received a decision within the expected timeframe, consider contacting the financial institution to inquire about the status of your application.

10

Once a decision has been made on your credit application, carefully review the terms and conditions presented by the financial institution. Assess whether the credit offered aligns with your financial goals and needs.

11

If approved for credit, make sure to use it responsibly and make timely payments to maintain a good credit history.

Who needs credit and your credit?

01

Individuals who are looking to make a major purchase, such as a home or a car, may need credit in order to finance the purchase. Credit allows them to spread the cost over time instead of paying for it immediately.

02

Business owners may need credit to invest in their operations, purchase inventory, or expand their business. Credit can provide them with the necessary funding to support their growth and development.

03

Students may need credit to pay for their education expenses, such as tuition fees, textbooks, and accommodation. Student loans or credit lines can help them manage their financial obligations while pursuing their studies.

04

Individuals who are facing unexpected expenses or emergencies may need credit as a temporary solution to cover these costs. This can provide them with the necessary funds until they are able to stabilize their financial situation.

05

People who want to build or improve their credit history may also need credit. By responsibly utilizing credit and making timely payments, individuals can establish a positive credit history, which may be beneficial for future financial endeavors.

06

Entrepreneurs or start-up companies may need credit to support their business ventures. Access to credit can help them fund their business operations, purchase equipment, hire employees, or invest in marketing and advertising efforts.

07

Individuals who want to take advantage of rewards programs and benefits offered by credit cards may also need credit. Credit cards can provide consumers with cashback, travel rewards, or other perks based on their spending habits and repayment behavior.

08

Homeowners or property investors may need credit to finance real estate purchases or renovations. Mortgages or home equity lines of credit can enable them to acquire or improve properties while spreading the payments over time.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify credit and your credit without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including credit and your credit, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I execute credit and your credit online?

Easy online credit and your credit completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I complete credit and your credit on an Android device?

Complete your credit and your credit and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

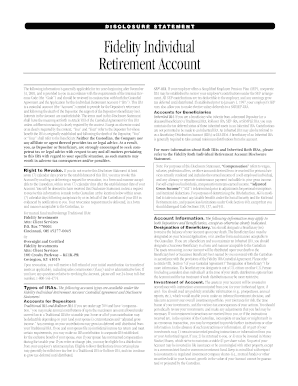

What is credit and your credit?

Credit is the ability of a customer to obtain goods or services before payment, based on the trust that payment will be made in the future. Your credit refers to your personal credit history and score.

Who is required to file credit and your credit?

Individuals who are applying for loans, credit cards, or other financial products may be required to provide information about their credit history.

How to fill out credit and your credit?

To fill out your credit information, you need to provide details about your credit accounts, payment history, and other relevant financial information.

What is the purpose of credit and your credit?

The purpose of credit is to assess a person's ability to repay borrowed money and to determine their creditworthiness. Your credit helps lenders evaluate your financial responsibility.

What information must be reported on credit and your credit?

Information such as credit accounts, payment history, credit inquiries, and public records may need to be reported on your credit.

Fill out your credit and your credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit And Your Credit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.