Who needs a 01-339 form?

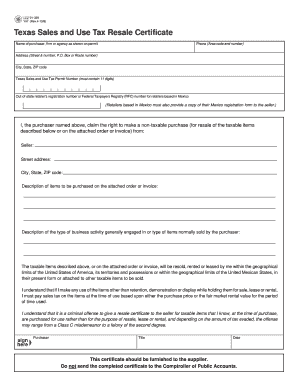

This form has two parts: Texas Sales and Use Tax Resale Certificate and Texas Sales and Use Tax Exemption Certification. The individuals who are going to make a free of taxes purchase in Texas (for resale of the taxable goods) should fill out this form to get an exemption from sales and use tax.

What is the 01-339 form for?

This form is used to claim the right to make non-taxable purchase as well as get an exemption from payment of sales and use taxes. However, it shouldn’t be used for the purchase, lease, or rental of a motor vehicle.

Is the 01-339 form accompanied by other forms?

The purchaser should attach a purchase order or invoice to this form.

When is the 01-339 form due?

The individual should complete this form before the purchase of the non-taxable goods.

How do I fill out the 01-339 form?

The purchaser should provide the following information:

-

Full Name

-

Address

-

Phone number

-

City, state, ZIP code

-

11 digits of Texas Sales and Use Tax Permit

-

Out-of-state retailer’s registration number or Federal Taxpayers Registry number for retailers based in Mexico

-

Seller’s information (name, address, city, state, ZIP code)

-

Detailed description of the items she or he wants to purchase

-

Description of the of business activity or type of items usually sold by the purchaser

-

Reasons for the tax exemption

The purchaser should also sign and date both pages. By signing the document, the purchaser certifies that the taxable goods will be resold in the USA or in the United Mexican States, and they will not be used for other purposes. If this condition is violated, the purchaser is subject to criminal liability.

Where do I send the 01-339 form?

This form should be furnished to the supplier of the goods.