HI BFS-RP-P-51 2014 free printable template

Show details

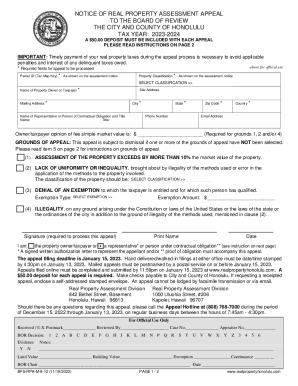

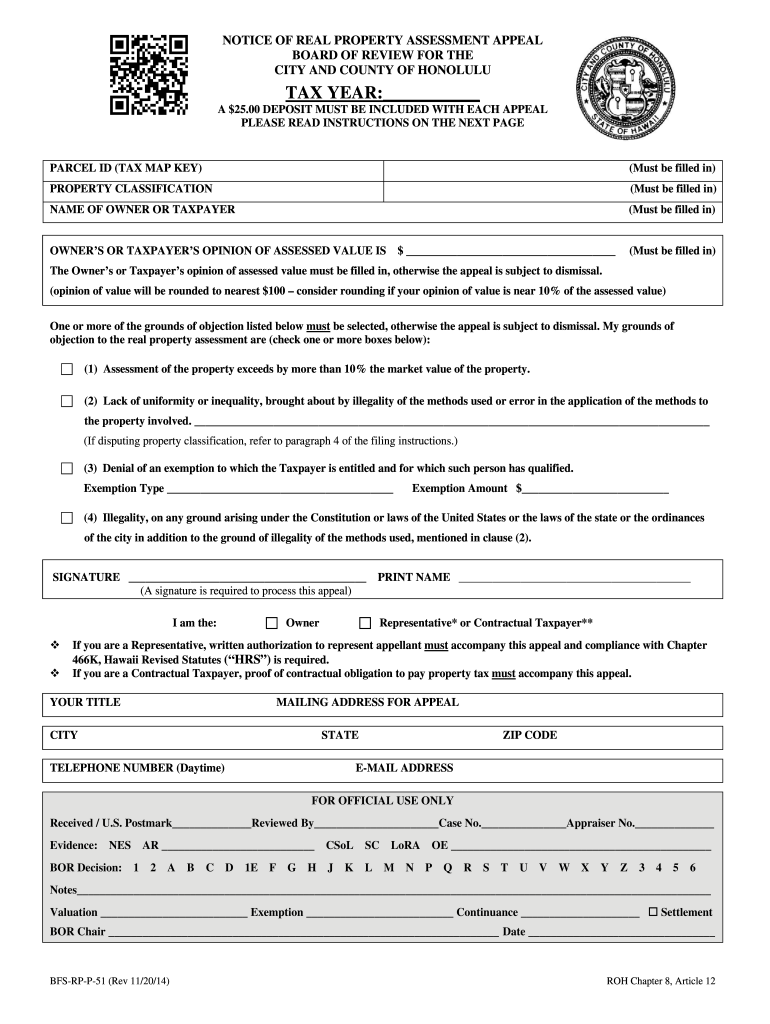

NOTICE OF REAL PROPERTY ASSESSMENT APPEAL BOARD OF REVIEW FOR THE CITY AND COUNTY OF HONOLULU TAX YEAR: APPEAL FILING DEADLINE IS JANUARY 15th A ×25.00 DEPOSIT MUST BE INCLUDED WITH EACH APPEAL PLEASE

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign HI BFS-RP-P-51

Edit your HI BFS-RP-P-51 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your HI BFS-RP-P-51 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit HI BFS-RP-P-51 online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit HI BFS-RP-P-51. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

HI BFS-RP-P-51 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out HI BFS-RP-P-51

How to fill out HI BFS-RP-P-51

01

Begin by obtaining a blank HI BFS-RP-P-51 form from the appropriate office or website.

02

Fill out your personal information in the designated sections, including your name, address, and contact information.

03

Provide details about the specific program you are applying for or inquiring about.

04

If required, include any income or financial information as stipulated on the form.

05

Review the form for completeness, ensuring all sections are filled out correctly.

06

Sign and date the form in the required fields.

07

Submit the form as per the instructions provided, whether electronically or by mail.

Who needs HI BFS-RP-P-51?

01

Individuals or families applying for public assistance programs.

02

Residents seeking specific state or local benefits.

03

Anyone who needs to update their information related to existing assistance programs.

Fill

form

: Try Risk Free

People Also Ask about

What is the property tax discount for seniors in Hawaii?

The basic home exemption for homeowners 60 to 69 years of age is $80,000. The basic home exemption for homeowners 70 years of age or over is $100,000. In addition to the basic exemption amount, an additional exemption of 20 percent of the assessed value of the property is also applied to reduce the net taxable value.

What is the property tax exemption form in Hawaii?

You must file a claim for home exemption, RP Form 19-71, with the Real Property Tax Division on or before December 31 preceding the tax year for the first half payment or June 30 for the second half payment.

Do you have to file home exemption every year in Hawaii?

Once filed and granted, these home and real property exemptions do not have to re-filed annually, as long as all requirements continue to be met.

How do I file for property tax exemption in Hawaii?

You must file a claim for home exemption, RP Form 19-71, with the Real Property Tax Division on or before December 31 preceding the tax year for the first half payment or June 30 for the second half payment.

What is the senior exemption for property taxes in Hawaii?

Beginning with the 2020 assessment (2020-2021 tax year) the basic home exemption for homeowners under 65 will be $100,000. This means that $100,000 is deducted from the assessed value of the property and the homeowner is taxed on the balance. For homeowners 65 years and older the home exemption will be $140,000.

What age is exempt from Honolulu property taxes?

To qualify for this exemption, you must be 65 years or older on or before June 30 preceding the tax year for which the exemption is claimed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in HI BFS-RP-P-51 without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your HI BFS-RP-P-51, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How can I fill out HI BFS-RP-P-51 on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your HI BFS-RP-P-51. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

How do I fill out HI BFS-RP-P-51 on an Android device?

Complete your HI BFS-RP-P-51 and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is HI BFS-RP-P-51?

HI BFS-RP-P-51 is a form used by businesses to report specific financial and operational information to a governing authority.

Who is required to file HI BFS-RP-P-51?

Businesses and organizations that meet certain criteria set by the governing authority, such as size, revenue, or industry type, are typically required to file HI BFS-RP-P-51.

How to fill out HI BFS-RP-P-51?

To fill out HI BFS-RP-P-51, one must complete the required sections of the form with accurate data, ensuring to follow the instructions provided by the governing authority regarding submission and required documentation.

What is the purpose of HI BFS-RP-P-51?

The purpose of HI BFS-RP-P-51 is to collect essential data that assists the governing authority in monitoring and regulating business activities within the sector.

What information must be reported on HI BFS-RP-P-51?

The information that must be reported on HI BFS-RP-P-51 includes financial data, operational metrics, and any specific data points mandated by the governing authority relevant to the reporting entity.

Fill out your HI BFS-RP-P-51 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

HI BFS-RP-P-51 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.