HI BFS-RP-P-51 2016 free printable template

Show details

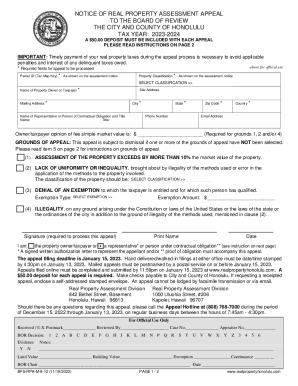

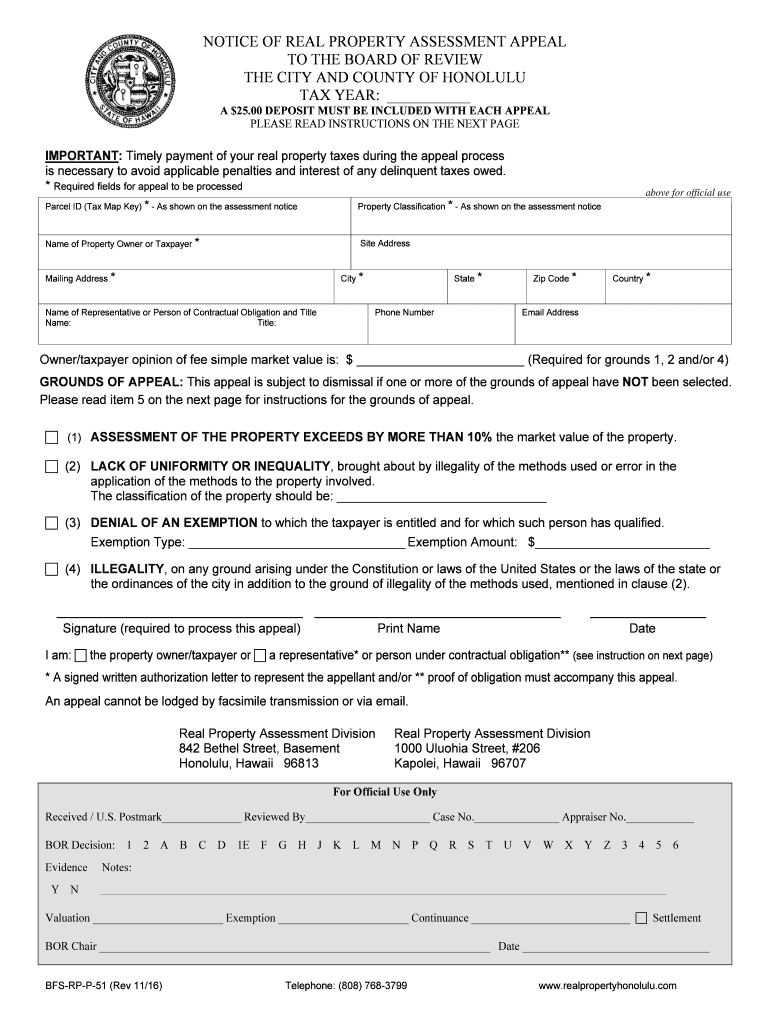

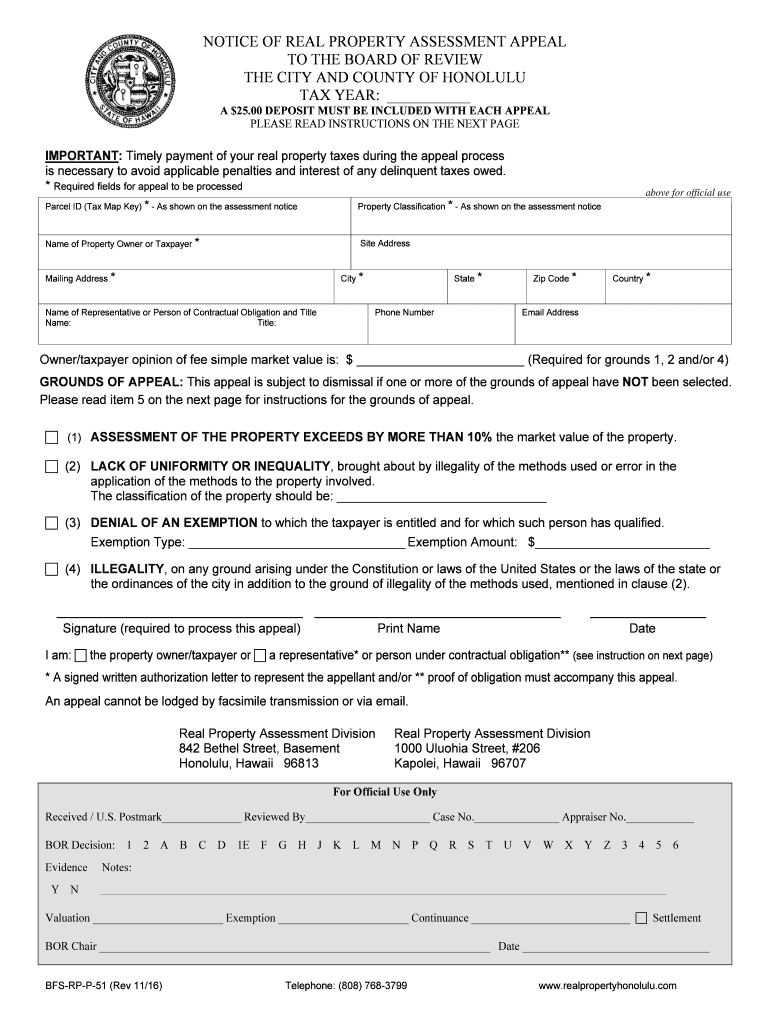

NOTICE OF REAL PROPERTY ASSESSMENT APPEAL TO THE BOARD OF REVIEW THE CITY AND COUNTY OF HONOLULU TAX YEAR: A $25.00 DEPOSIT MUST BE INCLUDED WITH EACH APPEAL PLEASE READ INSTRUCTIONS ON THE NEXT PAGE

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign HI BFS-RP-P-51

Edit your HI BFS-RP-P-51 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your HI BFS-RP-P-51 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit HI BFS-RP-P-51 online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit HI BFS-RP-P-51. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

HI BFS-RP-P-51 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out HI BFS-RP-P-51

How to fill out HI BFS-RP-P-51

01

Obtain the HI BFS-RP-P-51 form from the official website or office.

02

Read the instructions carefully to understand the requirements.

03

Fill in your personal information in the designated sections.

04

Provide any requested financial information accurately.

05

Review the form for any errors or omissions.

06

Sign and date the form where indicated.

07

Submit the completed form to the appropriate office or department.

Who needs HI BFS-RP-P-51?

01

Individuals applying for benefits or services from the relevant agency.

02

Organizations or groups that require assistance related to the program.

Fill

form

: Try Risk Free

People Also Ask about

Do you have to file home exemption every year in Hawaii?

Once filed and granted, these home and real property exemptions do not have to re-filed annually, as long as all requirements continue to be met.

What is property tax in Hawaii for primary residence?

A homeowner's exemption can be claimed if the home is the owner's primary residence. This exemption gives the 0.35% property tax rate whether the home is worth $2,000,000 or $350,000 – and also gives a sizable exemption amount: Under 65 yrs. old - $100,000.00 (previously $80,000.00)

What is the property tax exemption for primary residence in Hawaii?

The basic home exemption for homeowners under the age of 60 is $40,000. The basic home exemption for homeowners 60 to 69 years of age is $80,000. The basic home exemption for homeowners 70 years of age or over is $100,000.

What is the primary residence exemption in Hawaii?

HOME EXEMPTION REQUIREMENTS The real property must be owned and occupied as the owner's principal home as of the assessment date by an individual or individuals. Owner's principal home means occupancy by the owner of the home in the city for more than 270 calendar days of a calendar year.

What is the property tax exemption form in Hawaii?

You must file a claim for home exemption, RP Form 19-71, with the Real Property Tax Division on or before December 31 preceding the tax year for the first half payment or June 30 for the second half payment.

What is the real property tax credit for homeowners Honolulu 2023 2024?

The City and County of Honolulu offers a real property tax credit to property owners who meet certain eligibility requirements. If you qualify, you are entitled to a tax credit equal to the amount of taxes owed for the 2022 – 2023 tax year that exceed 3% of the titleholders' combined total gross income.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my HI BFS-RP-P-51 in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your HI BFS-RP-P-51 as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

Can I create an electronic signature for signing my HI BFS-RP-P-51 in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your HI BFS-RP-P-51 and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I fill out HI BFS-RP-P-51 using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign HI BFS-RP-P-51 and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is HI BFS-RP-P-51?

HI BFS-RP-P-51 is a form used for reporting specific health insurance details by healthcare providers and organizations.

Who is required to file HI BFS-RP-P-51?

Healthcare providers, insurance companies, and other organizations that offer health insurance coverage are required to file HI BFS-RP-P-51.

How to fill out HI BFS-RP-P-51?

To fill out HI BFS-RP-P-51, you must provide accurate information regarding patient details, insurance policy information, and relevant healthcare services rendered.

What is the purpose of HI BFS-RP-P-51?

The purpose of HI BFS-RP-P-51 is to ensure accurate reporting of health insurance information for regulatory and auditing purposes.

What information must be reported on HI BFS-RP-P-51?

The report must include information such as patient identification, service dates, insurance policy numbers, and details of the healthcare services provided.

Fill out your HI BFS-RP-P-51 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

HI BFS-RP-P-51 is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.