HI BFS-RP-P-51 2023-2025 free printable template

Show details

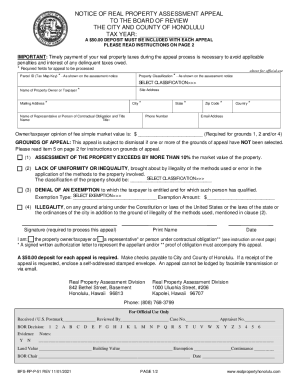

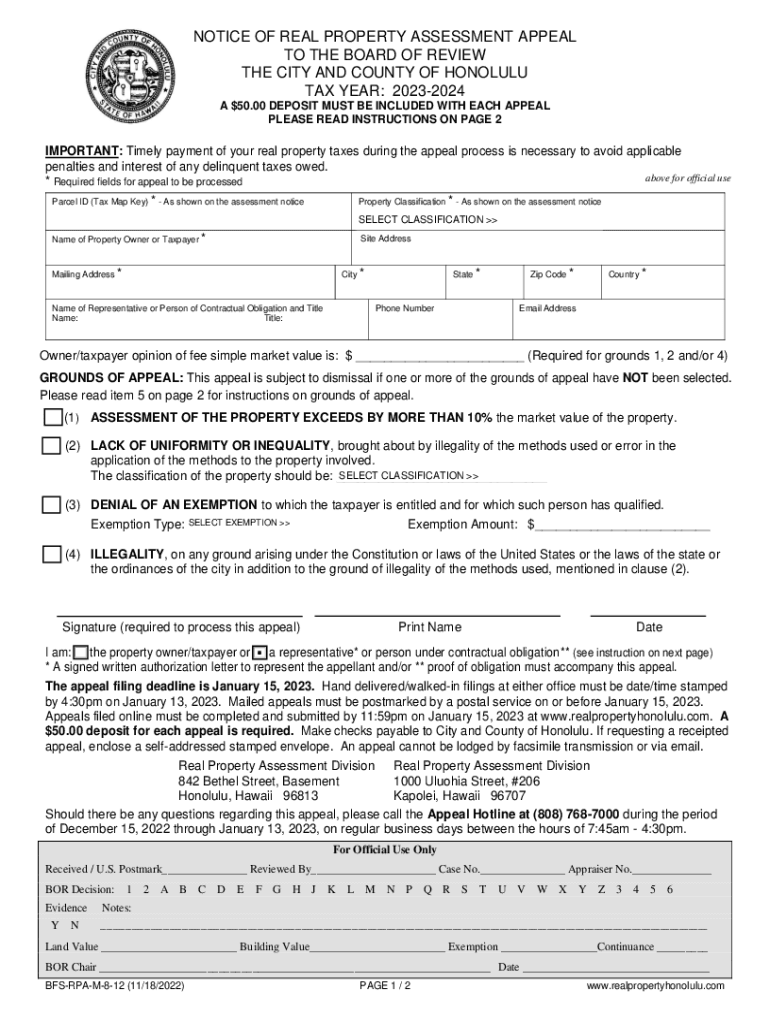

NOTICE OF REAL PROPERTY ASSESSMENT APPEAL

TO THE BOARD OF REVIEW

THE CITY AND COUNTY OF HONOLULU

TAX YEAR: 20232024

A $50.00 DEPOSIT MUST BE INCLUDED WITH EACH APPEAL

PLEASE READ INSTRUCTIONS ON PAGE

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign bfs rp p 51 form

Edit your hawaii bfs rp p download form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your hawaii bfs p 51 download form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit bfs rp 51 form create online

To use our professional PDF editor, follow these steps:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit rp p51 honolulu printable form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

HI BFS-RP-P-51 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out hawaii bfs rp p blank form

How to fill out HI BFS-RP-P-51

01

Start by gathering all necessary personal information such as your name, address, and contact details.

02

Provide your Social Security number if required.

03

Fill in the employment section with details about your current or previous job(s), including employer name and dates of employment.

04

Complete the income section by reporting your monthly income and any other sources of income.

05

If applicable, fill out the section regarding your dependents, including their names and relationship to you.

06

Review the completed form for accuracy and ensure all required fields are filled.

07

Sign and date the form to validate your submission.

08

Submit the form according to the instructions provided, either online or through physical mail.

Who needs HI BFS-RP-P-51?

01

Individuals applying for assistance programs.

02

People seeking unemployment benefits.

03

Workers undergoing job training or re-employment services.

04

Residents needing financial support due to unforeseen circumstances.

Fill

bfs rp p appeal search

: Try Risk Free

People Also Ask about rp p51 honolulu blank

Do you have to file home exemption every year in Hawaii?

Once filed and granted, these home and real property exemptions do not have to re-filed annually, as long as all requirements continue to be met.

What is property tax in Hawaii for primary residence?

A homeowner's exemption can be claimed if the home is the owner's primary residence. This exemption gives the 0.35% property tax rate whether the home is worth $2,000,000 or $350,000 – and also gives a sizable exemption amount: Under 65 yrs. old - $100,000.00 (previously $80,000.00)

What is the property tax exemption for primary residence in Hawaii?

The basic home exemption for homeowners under the age of 60 is $40,000. The basic home exemption for homeowners 60 to 69 years of age is $80,000. The basic home exemption for homeowners 70 years of age or over is $100,000.

What is the primary residence exemption in Hawaii?

HOME EXEMPTION REQUIREMENTS The real property must be owned and occupied as the owner's principal home as of the assessment date by an individual or individuals. Owner's principal home means occupancy by the owner of the home in the city for more than 270 calendar days of a calendar year.

What is the property tax exemption form in Hawaii?

You must file a claim for home exemption, RP Form 19-71, with the Real Property Tax Division on or before December 31 preceding the tax year for the first half payment or June 30 for the second half payment.

What is the real property tax credit for homeowners Honolulu 2023 2024?

The City and County of Honolulu offers a real property tax credit to property owners who meet certain eligibility requirements. If you qualify, you are entitled to a tax credit equal to the amount of taxes owed for the 2022 – 2023 tax year that exceed 3% of the titleholders' combined total gross income.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete bfs p 51 appeal form online?

Easy online hawaii bfs rp p latest completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I edit hawaii bfs rp p form in Chrome?

rp p 51 2023-2025 can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

Can I create an electronic signature for signing my rp p 51 2023-2025 in Gmail?

Create your eSignature using pdfFiller and then eSign your rp p 51 2023-2025 immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

What is HI BFS-RP-P-51?

HI BFS-RP-P-51 is a specific form or document used for reporting in the context of healthcare or business financial strategies.

Who is required to file HI BFS-RP-P-51?

Entities or individuals involved in healthcare services or businesses that are subject to specific reporting regulations must file HI BFS-RP-P-51.

How to fill out HI BFS-RP-P-51?

To fill out HI BFS-RP-P-51, one should gather the required information, carefully complete each section of the form according to the provided guidelines, and ensure to review for accuracy before submission.

What is the purpose of HI BFS-RP-P-51?

The purpose of HI BFS-RP-P-51 is to collect essential financial and operational data from reporting entities to ensure compliance with regulatory requirements.

What information must be reported on HI BFS-RP-P-51?

The information that must be reported on HI BFS-RP-P-51 typically includes financial statements, operational metrics, compliance data, and any other relevant details as specified by the regulatory authority.

Fill out your rp p 51 2023-2025 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Rp P 51 2023-2025 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.