HI BFS-RP-P-51 2018 free printable template

Show details

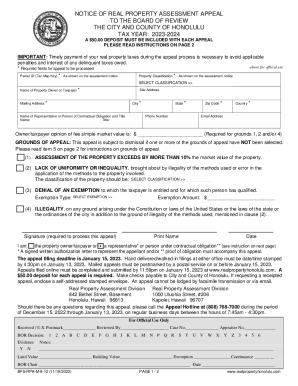

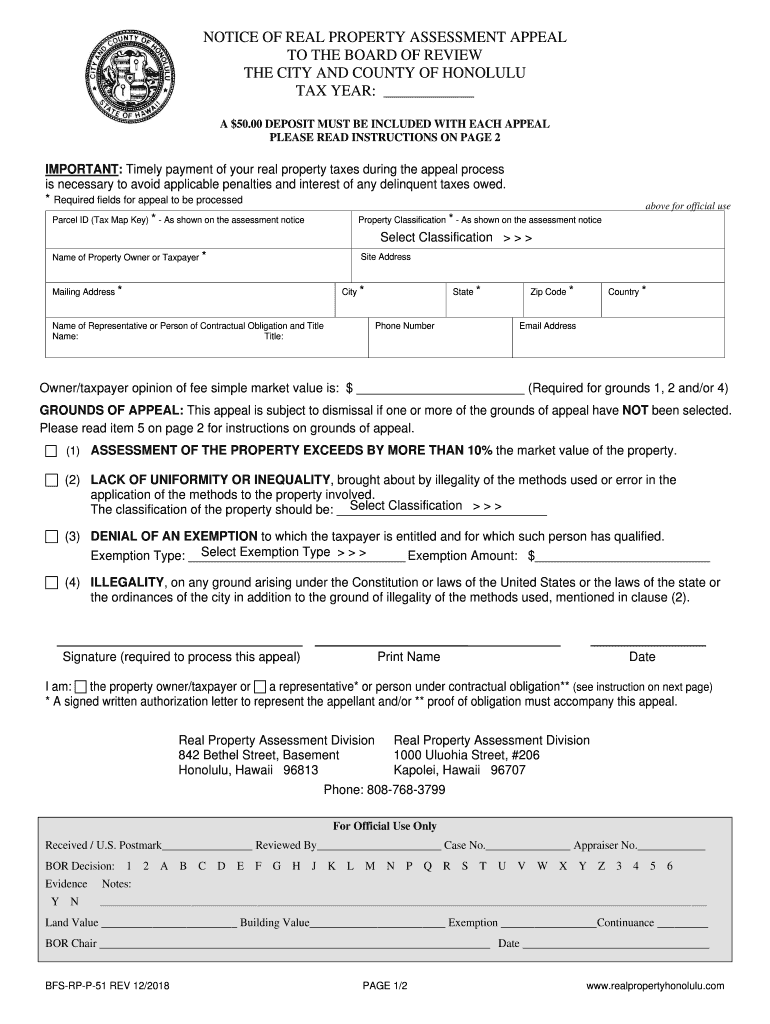

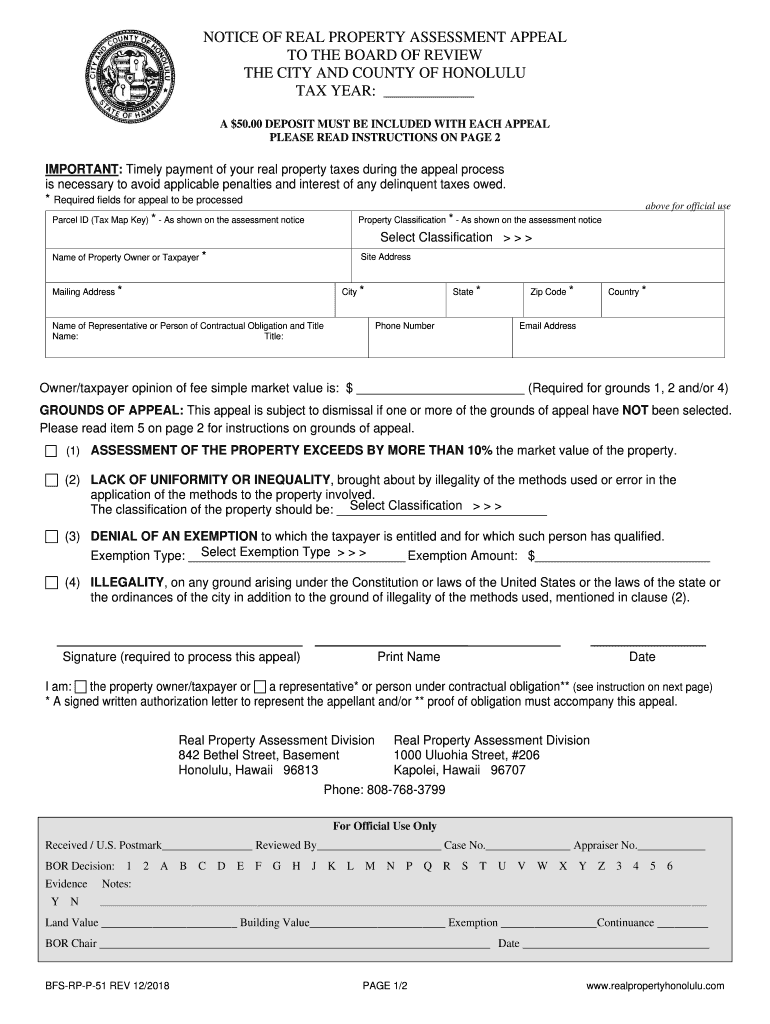

NOTICE OF REAL PROPERTY ASSESSMENT APPEAL TO THE BOARD OF REVIEW THE CITY AND COUNTY OF HONOLULU TAX YEAR: A ×50.00 DEPOSIT MUST BE INCLUDED WITH EACH APPEAL PLEASE READ INSTRUCTIONS ON PAGE 2IMPORTANT:

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign HI BFS-RP-P-51

Edit your HI BFS-RP-P-51 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your HI BFS-RP-P-51 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit HI BFS-RP-P-51 online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit HI BFS-RP-P-51. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

HI BFS-RP-P-51 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out HI BFS-RP-P-51

How to fill out HI BFS-RP-P-51

01

Obtain the HI BFS-RP-P-51 form from the official website or authorized office.

02

Carefully read the instructions provided with the form.

03

Fill in your personal information, including your name, address, and contact details.

04

Provide details regarding your current financial situation and any relevant background information.

05

Include any required documentation as specified in the instructions.

06

Review the form for accuracy and completeness.

07

Sign and date the form where indicated.

08

Submit the completed form to the designated office via mail or in person.

Who needs HI BFS-RP-P-51?

01

Individuals applying for financial assistance or benefits.

02

Residents seeking to report changes in their financial status.

03

Those participating in programs requiring proof of income or financial eligibility.

Fill

form

: Try Risk Free

People Also Ask about

Do you have to file home exemption every year in Hawaii?

Once filed and granted, these home and real property exemptions do not have to re-filed annually, as long as all requirements continue to be met.

What is property tax in Hawaii for primary residence?

A homeowner's exemption can be claimed if the home is the owner's primary residence. This exemption gives the 0.35% property tax rate whether the home is worth $2,000,000 or $350,000 – and also gives a sizable exemption amount: Under 65 yrs. old - $100,000.00 (previously $80,000.00)

What is the property tax exemption for primary residence in Hawaii?

The basic home exemption for homeowners under the age of 60 is $40,000. The basic home exemption for homeowners 60 to 69 years of age is $80,000. The basic home exemption for homeowners 70 years of age or over is $100,000.

What is the primary residence exemption in Hawaii?

HOME EXEMPTION REQUIREMENTS The real property must be owned and occupied as the owner's principal home as of the assessment date by an individual or individuals. Owner's principal home means occupancy by the owner of the home in the city for more than 270 calendar days of a calendar year.

What is the property tax exemption form in Hawaii?

You must file a claim for home exemption, RP Form 19-71, with the Real Property Tax Division on or before December 31 preceding the tax year for the first half payment or June 30 for the second half payment.

What is the real property tax credit for homeowners Honolulu 2023 2024?

The City and County of Honolulu offers a real property tax credit to property owners who meet certain eligibility requirements. If you qualify, you are entitled to a tax credit equal to the amount of taxes owed for the 2022 – 2023 tax year that exceed 3% of the titleholders' combined total gross income.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send HI BFS-RP-P-51 to be eSigned by others?

When you're ready to share your HI BFS-RP-P-51, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I make changes in HI BFS-RP-P-51?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your HI BFS-RP-P-51 to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I edit HI BFS-RP-P-51 on an Android device?

With the pdfFiller Android app, you can edit, sign, and share HI BFS-RP-P-51 on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is HI BFS-RP-P-51?

HI BFS-RP-P-51 is a specific form or document used for reporting certain information related to health insurance and benefits.

Who is required to file HI BFS-RP-P-51?

Individuals or entities involved in providing health insurance coverage or benefits, as specified by regulatory guidelines, are required to file the HI BFS-RP-P-51.

How to fill out HI BFS-RP-P-51?

To fill out HI BFS-RP-P-51, gather the required information, and follow the instructions provided in the form to accurately report the necessary data.

What is the purpose of HI BFS-RP-P-51?

The purpose of HI BFS-RP-P-51 is to collect and report data relevant to health insurance and benefits, facilitating compliance and regulatory oversight.

What information must be reported on HI BFS-RP-P-51?

The information that must be reported on HI BFS-RP-P-51 typically includes details about policyholders, coverage types, benefits provided, and any pertinent financial data.

Fill out your HI BFS-RP-P-51 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

HI BFS-RP-P-51 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.