OR OR-PS 2016 free printable template

Show details

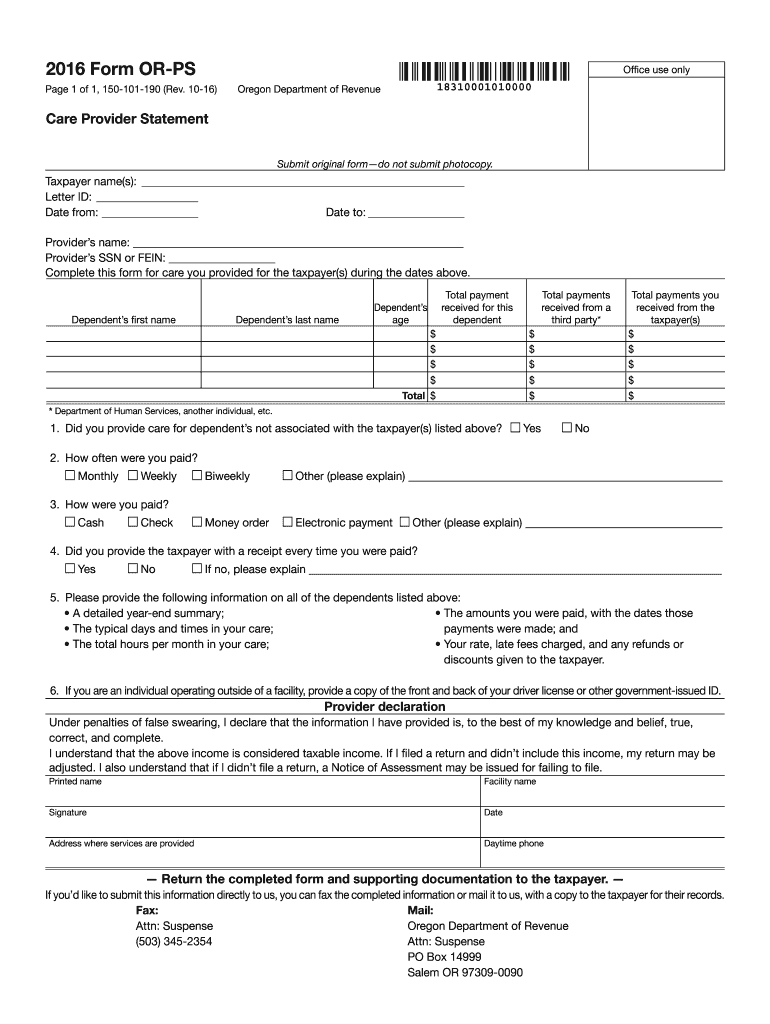

2016 Form CORPS Office use only Page 1 of 1, 150101190 (Rev. 1016) 18310001010000 Oregon Department of Revenue Care Provider Statement Submit original form do not submit photocopy. Taxpayer name(s):

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign OR OR-PS

Edit your OR OR-PS form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your OR OR-PS form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing OR OR-PS online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit OR OR-PS. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

The use of pdfFiller makes dealing with documents straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OR OR-PS Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out OR OR-PS

How to fill out OR OR-PS

01

Obtain the OR or OR-PS form from the designated authority or download it from the official website.

02

Read the instructions carefully to understand the required information.

03

Fill out the personal details section including name, address, and contact information.

04

Provide any necessary identification numbers such as Social Security Number or Tax Identification Number.

05

Complete the specific details related to the purpose of filling out the OR or OR-PS.

06

Review all the information filled in to ensure accuracy and completeness.

07

Sign and date the form in the designated areas.

08

Submit the completed form to the appropriate office or authority as instructed.

Who needs OR OR-PS?

01

Individuals applying for certain licenses or permits.

02

Businesses seeking registration or compliance.

03

Organizations needing to report financial activities.

04

Anyone required to document specific personal or financial information for regulatory purposes.

Fill

form

: Try Risk Free

People Also Ask about

What is an Oregon Form 24?

You must file this form for the tax year that you transferred property to another party in a like-kind exchange and annually thereafter until the disposition of the like-kind property. If you made more than one like-kind exchange, report each exchange on a separate form.

What is schedule or ASC Corp?

Purpose of this schedule Schedule OR-ASC-CORP is used to report Oregon additions, subtractions, and credits that don't have a specific line on the corporate return.

What is schedule or ASC?

Instructions: Use this schedule to report additions, subtractions, standard credits, carryforward credits, tax recaptures, and refundable credits that aren't included on Form OR-40. File an additional Schedule OR-ASC, if you are claiming more than what will fit on one schedule.

What does or ASC mean?

Subtractions with codes These subtractions are claimed using a subtraction code on Schedule OR-ASC (full-year filers) or Schedule OR-ASC-NP (part-year or nonresident filers): Subtraction with code.

What is Oregon, or ASC code 351?

Special Oregon medical subtraction [code 351]. You or your spouse turned age 66 by the end of the tax year; • Your federal AGI isn't more than $200,000 ($100,000 if your filing status is single or married filing separately); and • You or your spouse have qualifying medical or dental expenses.

What is Section 3 of Schedule or ASC?

In Section 3 of Schedule OR-ASC-NP, enter the amount of the federal tuition and fees deduction you would have claimed on your federal return if you hadn't claimed the federal credit. The maximum deduction you can claim is $4,000 or $2,000, depending on your income.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit OR OR-PS from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your OR OR-PS into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I execute OR OR-PS online?

Completing and signing OR OR-PS online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I make edits in OR OR-PS without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your OR OR-PS, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

What is OR OR-PS?

OR OR-PS refers to the Oregon Annual Tax Report for Pass-Through Entities, which includes information on the income and tax obligations of partnerships and S corporations operating in Oregon.

Who is required to file OR OR-PS?

Partnerships and S corporations that conduct business in Oregon and have income subject to state taxation are required to file OR OR-PS.

How to fill out OR OR-PS?

To fill out OR OR-PS, entities must provide details about their income, deductions, credits, and partner or shareholder information according to the provided instructions from the Oregon Department of Revenue.

What is the purpose of OR OR-PS?

The purpose of OR OR-PS is to report the tax liability and income distribution of Pass-Through Entities for proper state tax assessment and compliance.

What information must be reported on OR OR-PS?

The information that must be reported on OR OR-PS includes the entity's total income, deductions, tax credits, distributions to partners or shareholders, and any other relevant tax-related information.

Fill out your OR OR-PS online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

OR OR-PS is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.