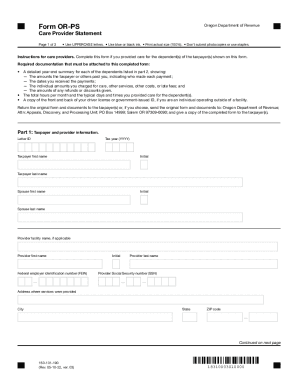

OR OR-PS 2021 free printable template

Show details

Clear former ORPSOregon Department of Revenuers Provider Statement

Page 1 of 3 Use UPPERCASE letters. Use blue or black ink. Print actual size (100%). Don't submit photocopies or use staples. Instructions

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign OR OR-PS

Edit your OR OR-PS form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your OR OR-PS form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit OR OR-PS online

To use our professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit OR OR-PS. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OR OR-PS Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out OR OR-PS

How to fill out OR OR-PS

01

Obtain the OR or OR-PS form from the appropriate authority or official website.

02

Review the instructions provided with the form to understand the requirements.

03

Fill out the personal information section accurately, ensuring all details match official documents.

04

Complete the sections related to the transaction or purpose for which you are using the OR or OR-PS.

05

Double-check the amount and any relevant dates to ensure accuracy.

06

Sign and date the form where indicated.

07

Submit the completed form to the designated office or entity either in person or electronically, as per guidelines.

Who needs OR OR-PS?

01

Individuals or organizations that need to officially document a transaction or payment.

02

Business owners filing for permits or licenses requiring verification.

03

Employees claiming reimbursements for business expenses related to work.

04

Any applicant needing proof of payment for taxes, licenses, or permits.

Fill

form

: Try Risk Free

People Also Ask about

What is an Oregon Form 24?

You must file this form for the tax year that you transferred property to another party in a like-kind exchange and annually thereafter until the disposition of the like-kind property. If you made more than one like-kind exchange, report each exchange on a separate form.

What is schedule or ASC Corp?

Purpose of this schedule Schedule OR-ASC-CORP is used to report Oregon additions, subtractions, and credits that don't have a specific line on the corporate return.

What is schedule or ASC?

Instructions: Use this schedule to report additions, subtractions, standard credits, carryforward credits, tax recaptures, and refundable credits that aren't included on Form OR-40. File an additional Schedule OR-ASC, if you are claiming more than what will fit on one schedule.

What does or ASC mean?

Subtractions with codes These subtractions are claimed using a subtraction code on Schedule OR-ASC (full-year filers) or Schedule OR-ASC-NP (part-year or nonresident filers): Subtraction with code.

What is Oregon, or ASC code 351?

Special Oregon medical subtraction [code 351]. You or your spouse turned age 66 by the end of the tax year; • Your federal AGI isn't more than $200,000 ($100,000 if your filing status is single or married filing separately); and • You or your spouse have qualifying medical or dental expenses.

What is Section 3 of Schedule or ASC?

In Section 3 of Schedule OR-ASC-NP, enter the amount of the federal tuition and fees deduction you would have claimed on your federal return if you hadn't claimed the federal credit. The maximum deduction you can claim is $4,000 or $2,000, depending on your income.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my OR OR-PS directly from Gmail?

OR OR-PS and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I send OR OR-PS for eSignature?

Once your OR OR-PS is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How can I edit OR OR-PS on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing OR OR-PS, you need to install and log in to the app.

What is OR OR-PS?

OR OR-PS refers to an official reporting form used by certain organizations or taxpayers to provide specific financial or operational data to the relevant authority.

Who is required to file OR OR-PS?

Organizations and entities that meet certain criteria set by the regulatory authority, typically those involved in specific industries or operations that require accountability, are required to file OR OR-PS.

How to fill out OR OR-PS?

To fill out OR OR-PS, one must carefully review the instructions provided with the form, input necessary information accurately, and ensure all required fields are completed before submission.

What is the purpose of OR OR-PS?

The purpose of OR OR-PS is to ensure compliance with reporting regulations, provide transparency of operations, and facilitate oversight by the governing body.

What information must be reported on OR OR-PS?

Information that must be reported on OR OR-PS typically includes financial data, operational metrics, compliance information, and any other relevant details as mandated by the authority.

Fill out your OR OR-PS online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

OR OR-PS is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.