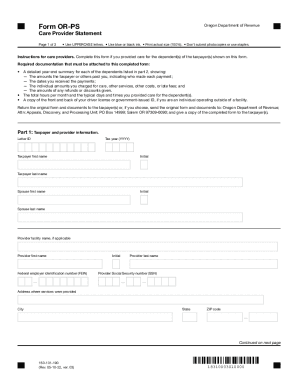

OR OR-PS 2017 free printable template

Show details

Form OR-PS. Care Provider Statement. Submit original form do not submit photocopy. Office use only. Page 1 of 2, 150-101-190 (Rev. 12-17). Date to.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign OR OR-PS

Edit your OR OR-PS form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your OR OR-PS form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing OR OR-PS online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit OR OR-PS. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OR OR-PS Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out OR OR-PS

How to fill out OR OR-PS

01

Gather necessary information: Ensure you have all required documents and information at hand, such as personal details and any relevant statistics.

02

Fill out your personal information: Complete sections that request your name, address, date of birth, and contact information accurately.

03

Provide the necessary data: Fill in any required data related to the purpose for which you are completing the OR OR-PS.

04

Review your entries: Double-check all information entered to ensure it is accurate and complete.

05

Submit the form: Follow the appropriate submission guidelines, whether it is online or via mail.

Who needs OR OR-PS?

01

Individuals applying for a license or permit.

02

Businesses needing to report operational statistics.

03

Organizations applying for grants or funding.

Fill

form

: Try Risk Free

People Also Ask about

What is an Oregon Form 24?

You must file this form for the tax year that you transferred property to another party in a like-kind exchange and annually thereafter until the disposition of the like-kind property. If you made more than one like-kind exchange, report each exchange on a separate form.

What is schedule or ASC Corp?

Purpose of this schedule Schedule OR-ASC-CORP is used to report Oregon additions, subtractions, and credits that don't have a specific line on the corporate return.

What is schedule or ASC?

Instructions: Use this schedule to report additions, subtractions, standard credits, carryforward credits, tax recaptures, and refundable credits that aren't included on Form OR-40. File an additional Schedule OR-ASC, if you are claiming more than what will fit on one schedule.

What does or ASC mean?

Subtractions with codes These subtractions are claimed using a subtraction code on Schedule OR-ASC (full-year filers) or Schedule OR-ASC-NP (part-year or nonresident filers): Subtraction with code.

What is Oregon, or ASC code 351?

Special Oregon medical subtraction [code 351]. You or your spouse turned age 66 by the end of the tax year; • Your federal AGI isn't more than $200,000 ($100,000 if your filing status is single or married filing separately); and • You or your spouse have qualifying medical or dental expenses.

What is Section 3 of Schedule or ASC?

In Section 3 of Schedule OR-ASC-NP, enter the amount of the federal tuition and fees deduction you would have claimed on your federal return if you hadn't claimed the federal credit. The maximum deduction you can claim is $4,000 or $2,000, depending on your income.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get OR OR-PS?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific OR OR-PS and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

Can I sign the OR OR-PS electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your OR OR-PS in seconds.

How can I edit OR OR-PS on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing OR OR-PS.

What is OR OR-PS?

OR OR-PS is a tax form used for reporting income and expenses related to certain business activities in Oregon.

Who is required to file OR OR-PS?

Individuals and businesses in Oregon that earn income from sources such as self-employment or business operations must file OR OR-PS.

How to fill out OR OR-PS?

To fill out OR OR-PS, gather your income and expense information, follow the provided instructions on the form, and report your financial data accurately.

What is the purpose of OR OR-PS?

The purpose of OR OR-PS is to ensure that taxpayers report their business income and expenses, allowing the state to assess and collect income tax correctly.

What information must be reported on OR OR-PS?

The OR OR-PS requires reporting of gross income, deductible expenses, and other relevant financial information pertaining to the business activity.

Fill out your OR OR-PS online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

OR OR-PS is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.