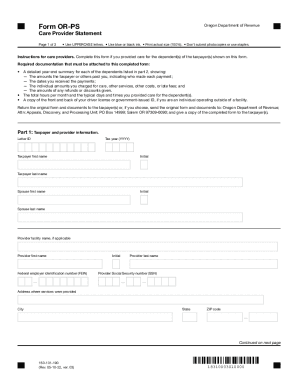

OR OR-PS 2019 free printable template

Show details

Clear former OpenOffice use only18310001010000Oregon Department of Revenue Page 1 of 2, 150101190

(Rev. 072319, very. 01)Care Provider Statement

Submit original form do not submit photocopy

Taxpayers

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign OR OR-PS

Edit your OR OR-PS form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your OR OR-PS form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit OR OR-PS online

To use the services of a skilled PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit OR OR-PS. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OR OR-PS Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out OR OR-PS

How to fill out OR OR-PS

01

Gather all necessary information required for the OR OR-PS form.

02

Start filling out the form with your personal details such as name, address, and contact information.

03

Provide the specific details regarding the purpose of the form, ensuring accuracy.

04

Attach any required documentation that supports your application or request.

05

Review the form for completeness and accuracy before submission.

06

Submit the form as per the applicable guidelines or protocols.

Who needs OR OR-PS?

01

Individuals or organizations looking to request permission or official documentation.

02

Healthcare providers or institutions that require authorization forms.

03

Anyone involved in legal or administrative processes requiring formal records.

Fill

form

: Try Risk Free

People Also Ask about

What is an Oregon Form 24?

You must file this form for the tax year that you transferred property to another party in a like-kind exchange and annually thereafter until the disposition of the like-kind property. If you made more than one like-kind exchange, report each exchange on a separate form.

What is schedule or ASC Corp?

Purpose of this schedule Schedule OR-ASC-CORP is used to report Oregon additions, subtractions, and credits that don't have a specific line on the corporate return.

What is schedule or ASC?

Instructions: Use this schedule to report additions, subtractions, standard credits, carryforward credits, tax recaptures, and refundable credits that aren't included on Form OR-40. File an additional Schedule OR-ASC, if you are claiming more than what will fit on one schedule.

What does or ASC mean?

Subtractions with codes These subtractions are claimed using a subtraction code on Schedule OR-ASC (full-year filers) or Schedule OR-ASC-NP (part-year or nonresident filers): Subtraction with code.

What is Oregon, or ASC code 351?

Special Oregon medical subtraction [code 351]. You or your spouse turned age 66 by the end of the tax year; • Your federal AGI isn't more than $200,000 ($100,000 if your filing status is single or married filing separately); and • You or your spouse have qualifying medical or dental expenses.

What is Section 3 of Schedule or ASC?

In Section 3 of Schedule OR-ASC-NP, enter the amount of the federal tuition and fees deduction you would have claimed on your federal return if you hadn't claimed the federal credit. The maximum deduction you can claim is $4,000 or $2,000, depending on your income.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit OR OR-PS from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including OR OR-PS. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How can I send OR OR-PS to be eSigned by others?

When you're ready to share your OR OR-PS, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

Can I create an electronic signature for the OR OR-PS in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your OR OR-PS and you'll be done in minutes.

What is OR OR-PS?

OR OR-PS is a tax form used for reporting certain income, deductions, and credits by businesses, typically in the context of Oregon state taxation.

Who is required to file OR OR-PS?

Businesses operating in Oregon that meet certain income thresholds or are engaged in specific activities are required to file OR OR-PS.

How to fill out OR OR-PS?

To fill out OR OR-PS, businesses need to provide accurate financial information, including income, expenses, and deductions, according to the guidelines provided by the Oregon Department of Revenue.

What is the purpose of OR OR-PS?

The purpose of OR OR-PS is to ensure that businesses report their taxable income and claim any applicable deductions and credits, thus facilitating accurate tax assessment and compliance.

What information must be reported on OR OR-PS?

Information that must be reported on OR OR-PS includes gross income, deductions, credit claims, and any other relevant financial data pertaining to the business operations.

Fill out your OR OR-PS online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

OR OR-PS is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.