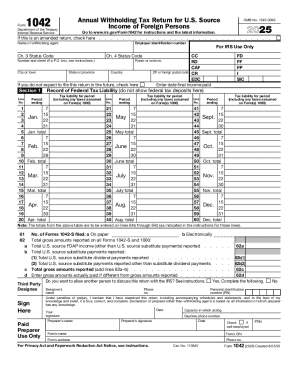

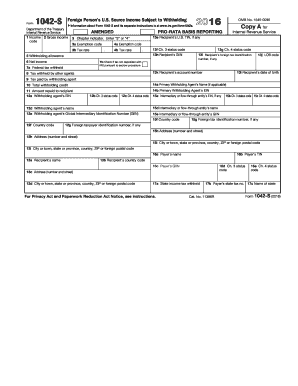

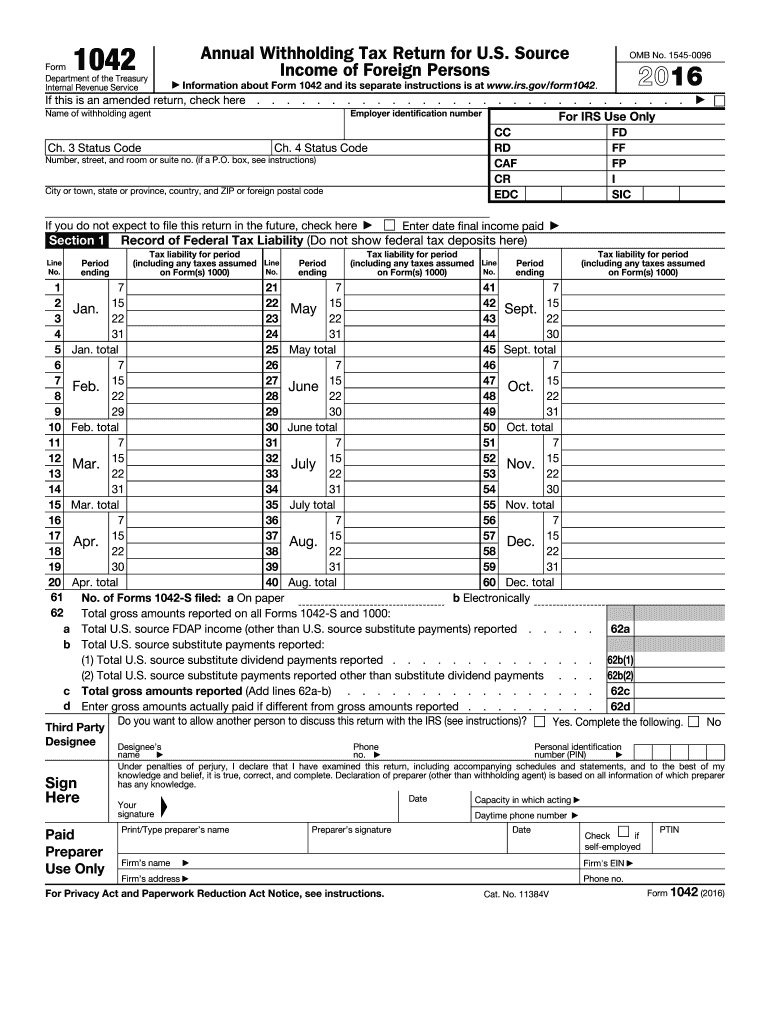

IRS 1042 2016 free printable template

Instructions and Help about IRS 1042

How to edit IRS 1042

How to fill out IRS 1042

About IRS previous version

What is IRS 1042?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What payments and purchases are reported?

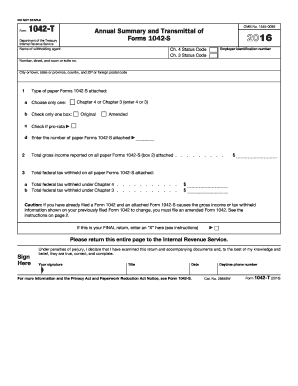

How many copies of the form should I complete?

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1042

How can I correct mistakes made on my form 1042pdffillercom 2016?

If you discover any mistakes after filing form 1042pdffillercom 2016, you can submit an amended return. This involves filling out a new form with the corrected information and clearly marking it as 'Amended' on the top. Make sure to keep records of both the original and amended forms for your personal documentation.

What should I do if my submission of form 1042pdffillercom 2016 is rejected?

If your form 1042pdffillercom 2016 is rejected during e-filing, check the rejection codes provided by the system. These codes typically indicate the nature of the error. Correct the identified issues, and resubmit the form as soon as possible to avoid any delays in processing.

Are there any specific record retention guidelines I should follow after filing form 1042pdffillercom 2016?

Yes, after filing form 1042pdffillercom 2016, you should retain a copy of the form along with any associated documentation for at least three years from the due date of the return or the date it was filed, whichever is later. This helps ensure compliance and provides necessary documentation in case of audits.

What if I need to e-file the form 1042pdffillercom 2016 for someone else as a representative?

When filing form 1042pdffillercom 2016 on behalf of someone else, you must have the appropriate power of attorney (POA) documentation. Ensure that you fill out the form accurately and provide the correct information for the individual or entity you are representing, maintaining the required privacy and security standards.

What common errors should I be aware of when submitting form 1042pdffillercom 2016?

Common errors when submitting form 1042pdffillercom 2016 include inaccurate taxpayer identification numbers, incorrect payment amounts, and failure to sign the form. Reviewing your entries thoroughly before submission can help minimize these mistakes and enhance processing efficiency.