VALIC VL 20798 2015-2026 free printable template

Show details

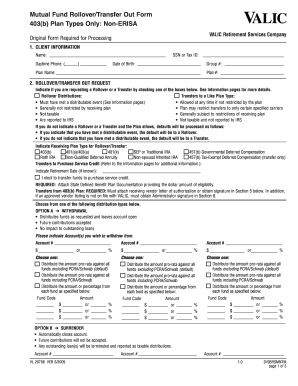

Roth IRA Nonqualified Deferred Annuity Non ... option A Withdrawal Distributes funds as requested and leaves ... your life or life expectancy (or ...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign vl 20798 non erisa form

Edit your VALIC VL 20798 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your VALIC VL 20798 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit VALIC VL 20798 online

Follow the guidelines below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit VALIC VL 20798. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

VALIC VL 20798 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out VALIC VL 20798

How to fill out VALIC VL 20798

01

Gather necessary personal information such as your name, address, and social security number.

02

Fill in the 'Participant Information' section with your details.

03

Complete the 'Plan Information' section by selecting the appropriate options for your retirement plan.

04

Specify your contribution amounts in the 'Contribution Allocation' section.

05

Review the 'Investment Options' and make your selections accordingly.

06

Read the 'Terms and Conditions' carefully before signing.

07

Sign and date the form at the designated area.

08

Submit the completed form to your plan administrator.

Who needs VALIC VL 20798?

01

Individuals who are participating in a retirement plan offered by their employer.

02

Employees looking to allocate contributions to a specific retirement investment option.

03

Those who wish to enroll, update, or modify their existing retirement plan contributions.

Fill

form

: Try Risk Free

People Also Ask about

How do I get money from my Valic account?

Send valic withdrawal forms via email, link, or fax. You can also download it, export it or print it out. Type text, add images, blackout confidential details, add comments, highlights and more. Draw your signature, type it, upload its image, or use your mobile device as a signature pad.

How do I avoid surrender charges?

How to Avoid Surrender Charges. This is simple: Avoid touching any of the money you deposited before the end of the surrender charge period. Annuities are meant to be long-term investments. Be sure that you can commit to living without your deposit amount for the next 3, 5, or 7 years.

What is the Valic surrender fee?

VALIC – now called AIG Retirement Services – sells annuity contracts to employers of all sizes as an investment vehicle for their retirement plans. In doing so, it gives itself the right to impose a 5% “surrender charge” or “withdrawal fee” on the participants who have invested in the contract.

What is the surrender penalty?

A surrender charge is a penalty an insurance company charges when an annuity owner cancels or withdraws too much from the annuity before an agreed period of time called the surrender period has passed.

Can I withdraw money from my VALIC account?

You can withdraw money from your IRA at any time. However, a 10% additional tax generally applies if you withdraw IRA or retirement plan assets before you reach age 59½, unless you qualify for another exception to the tax.

Can I roll over a 403b to an IRA?

If you have a traditional 401(k) or 403(b), you can roll over your money into a Roth IRA. However, this would be considered a "Roth conversion," so you'd have to report the money as income at tax time and pay ordinary income tax on it.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in VALIC VL 20798 without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your VALIC VL 20798, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How do I fill out the VALIC VL 20798 form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign VALIC VL 20798 and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

How do I edit VALIC VL 20798 on an iOS device?

You certainly can. You can quickly edit, distribute, and sign VALIC VL 20798 on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

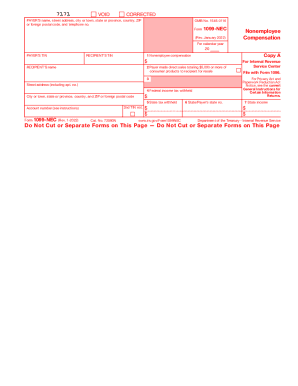

What is VALIC VL 20798?

VALIC VL 20798 is a specific tax form used for reporting certain retirement plan contributions and distributions.

Who is required to file VALIC VL 20798?

Typically, plan administrators or sponsors of qualified retirement plans are required to file VALIC VL 20798.

How to fill out VALIC VL 20798?

To fill out VALIC VL 20798, you need to provide accurate financial data regarding contributions and distributions, follow the instructions provided by the IRS, and ensure all required fields are completed.

What is the purpose of VALIC VL 20798?

The purpose of VALIC VL 20798 is to ensure compliance with federal tax regulations regarding retirement plans and to accurately report contributions and distributions to the IRS.

What information must be reported on VALIC VL 20798?

Information that must be reported on VALIC VL 20798 includes the total contributions made, distributions taken, the plan participant's information, and any applicable tax withholdings.

Fill out your VALIC VL 20798 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

VALIC VL 20798 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.