UT TC-65 2016 free printable template

Show details

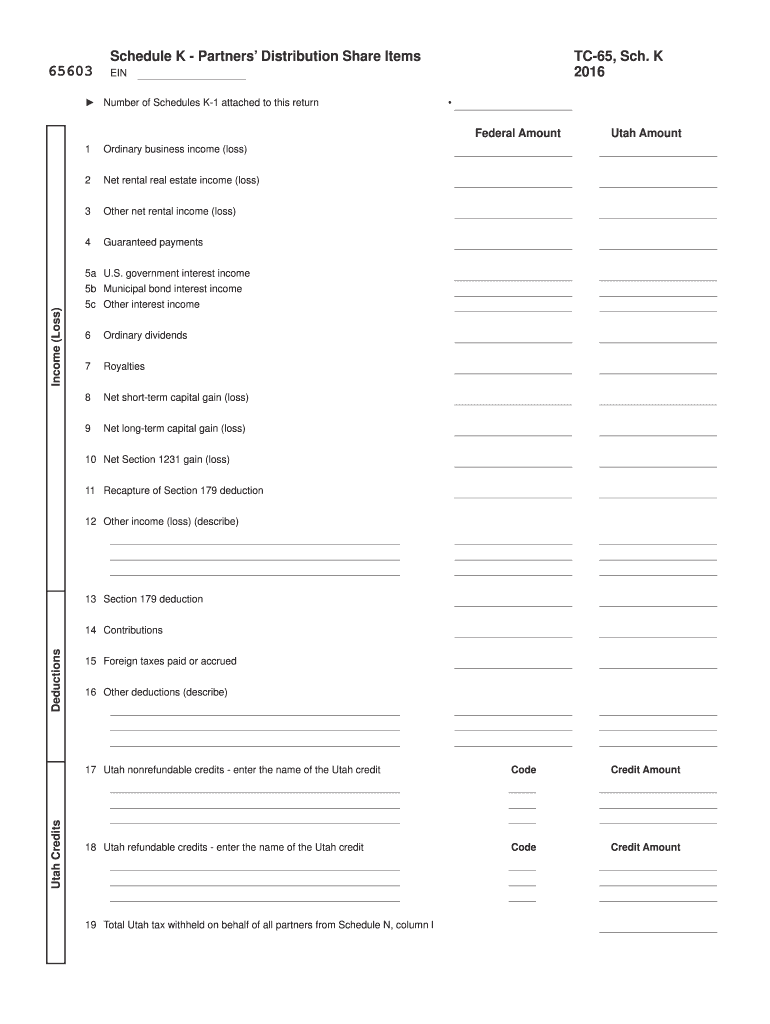

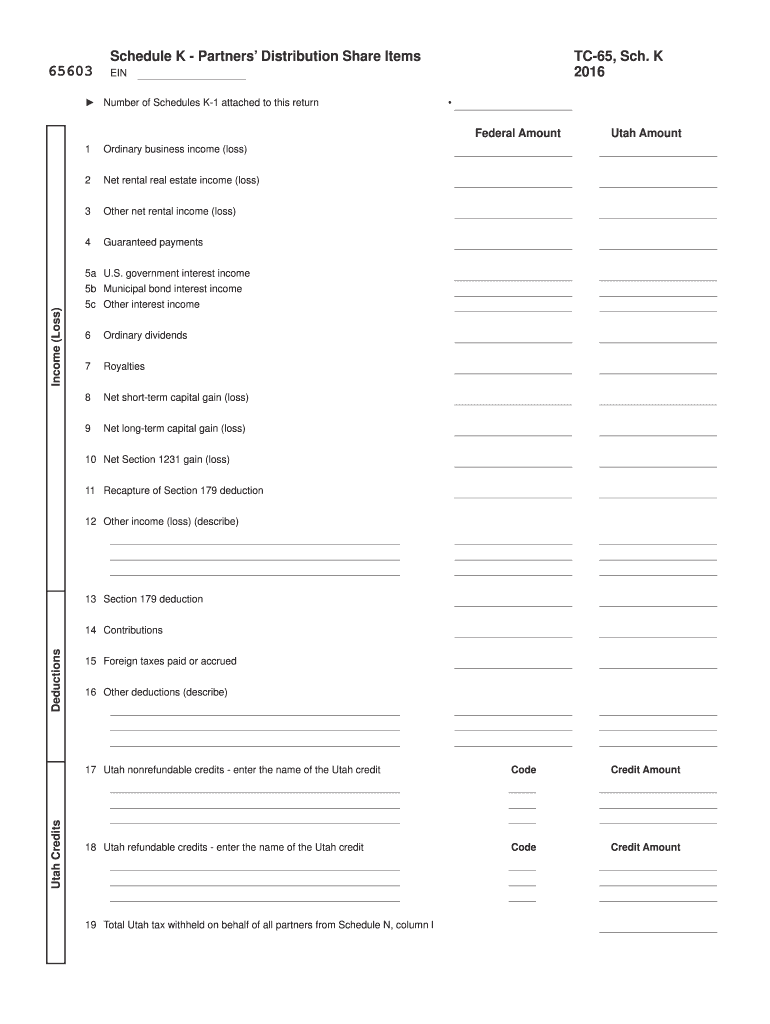

05 withholding credit enter X in column B and 0 in column F plus Utah source not less than zero C SSN or EIN of partner guaranteed pymts H Upper-tier passD Partner s of income or ownership see instructions through withholding 1 A G C H D 2 A 6 A 7 A 5 A 4 A 3 A Report the partner s pass-through withholding tax from column I on Schedule K-1 line 19 Total Utah withholding tax to be paid by this partnership Enter on TC-65 line 3 and on Sch. K line 19. Schedule K - Partners Distribution Share...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign UT TC-65

Edit your UT TC-65 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UT TC-65 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit UT TC-65 online

Follow the steps below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit UT TC-65. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UT TC-65 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out UT TC-65

How to fill out UT TC-65

01

Gather all necessary personal and vehicle information required for the form.

02

Start by filling out the top section with your name, full address, and contact information.

03

Provide the vehicle details, including make, model, year, and VIN (Vehicle Identification Number).

04

Indicate the type of application (initial or renewal) as applicable.

05

Complete the sections related to sales tax exemption, if applicable, by providing the required documentation.

06

Review all entered information for accuracy and completeness.

07

Sign and date the form where indicated.

08

Submit the form according to the instructions provided, either online or via mail.

Who needs UT TC-65?

01

Individuals who are registering a vehicle in Utah for the first time.

02

Current vehicle owners who are renewing their registration.

03

Those seeking sales tax exemptions for their vehicle registration.

Fill

form

: Try Risk Free

People Also Ask about

Who must file a California partnership tax return?

LPs and LLPs. LPs and LLPs (both foreign, non-U.S., and domestic U.S.) doing business in California, that have a certificate on file, or are registered with the California SOS (whether or not doing business in California) must file a return and pay the $800 annual tax.

How do you calculate sales tax on a car in Utah?

All you need to do is enter your dealership's address and the price tag value of your vehicle. Key Takeaway To determine the car sales tax where you live, combine the statewide sales tax of 6.85% with your local or county sales tax.

What taxes do small businesses pay Utah?

Utah Tax Rates, Collections, and Burdens Utah also has a flat 4.85 percent corporate income tax. Utah has a 6.10 percent state sales tax rate, a max local sales tax rate of 2.95 percent, and an average combined state and local sales tax rate of 7.19 percent.

Does Utah have single member LLC?

For most formation purposes, a Utah single-member LLC is considered the same as a multi-member LLC. The steps to form a single-member LLC in Utah are the same as those listed above. Single-member LLCs do have additional flexibility when it comes to filing a tax return.

What is Form TC 65?

2022 Utah TC-65 Instructions. Mineral Producers or Payers. If the partnership is a producer paying proceeds in connec- tion with mineral properties located in Utah, the partnership must report to each recipient their share of mineral production withholding tax withheld and paid to the Tax Commission.

How are LLCS taxed in Utah?

As an LLC member in Utah, you'll pay both federal and state personal income tax, along with the federal self-employment tax of 15.3%. Utah collects personal income tax at a flat rate of 4.85%. Other taxes that may apply to your Utah LLC include the state's 6.1% sales tax, industry-specific taxes, and employer taxes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send UT TC-65 to be eSigned by others?

UT TC-65 is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I make edits in UT TC-65 without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your UT TC-65, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How do I edit UT TC-65 straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing UT TC-65.

What is UT TC-65?

UT TC-65 is a tax form used by the state of Utah for reporting certain financial information related to taxes.

Who is required to file UT TC-65?

Individuals or businesses that meet specific criteria outlined by the Utah state tax authority are required to file UT TC-65.

How to fill out UT TC-65?

To fill out UT TC-65, gather all necessary financial documents and follow the instructions provided on the form, detailing income, deductions, and other relevant information.

What is the purpose of UT TC-65?

The purpose of UT TC-65 is to accurately report tax-related information to ensure compliance with state tax laws and to calculate any taxes owed or refunds due.

What information must be reported on UT TC-65?

The information required on UT TC-65 includes taxable income, deductions, credits, and any other tax-related data specified by the Utah tax authority.

Fill out your UT TC-65 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UT TC-65 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.