UT TC-65 2018 free printable template

Show details

000000 or TC-20 Schedule J line 9 13 or 14 if applicable 14 Utah apportioned business income loss - multiply line 12 by line 13 15 Total Utah income loss allocated to pass-through entity taxpayers - add line 9 and line 14 20861 TC-20 Sch. H Pg. 1 use with TC-20 TC-20S and TC-65 Note Failure to complete this form may result in disallowance of the nonbusiness income. 0495 withholding credit enter X in column B and 0 in column F plus Utah source not less than zero C SSN or EIN of partner...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign UT TC-65

Edit your UT TC-65 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UT TC-65 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit UT TC-65 online

Follow the guidelines below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit UT TC-65. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UT TC-65 Form Versions

Version

Form Popularity

Fillable & printabley

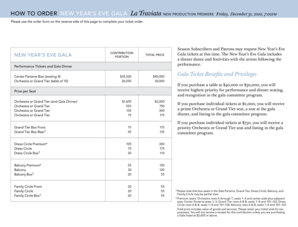

How to fill out UT TC-65

How to fill out UT TC-65

01

Obtain the UT TC-65 form from the appropriate regulatory agency's website or office.

02

Fill in your name and contact information at the top of the form.

03

Indicate the purpose of the form by checking the relevant box.

04

Provide detailed information as required in the designated sections, including any required documentation.

05

Review the information for accuracy and completeness.

06

Sign and date the form at the bottom.

07

Submit the completed form to the designated office either electronically or via mail.

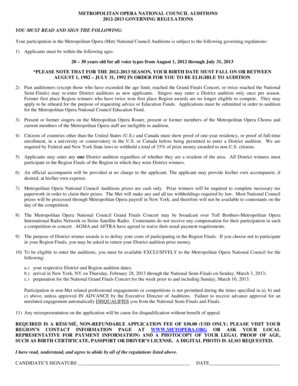

Who needs UT TC-65?

01

Individuals or entities applying for specific permits or licenses under UT regulations.

02

Businesses that require compliance with local or state regulations that necessitate the UT TC-65 form.

Fill

form

: Try Risk Free

People Also Ask about

Who must file a California partnership tax return?

LPs and LLPs. LPs and LLPs (both foreign, non-U.S., and domestic U.S.) doing business in California, that have a certificate on file, or are registered with the California SOS (whether or not doing business in California) must file a return and pay the $800 annual tax.

How do you calculate sales tax on a car in Utah?

All you need to do is enter your dealership's address and the price tag value of your vehicle. Key Takeaway To determine the car sales tax where you live, combine the statewide sales tax of 6.85% with your local or county sales tax.

What taxes do small businesses pay Utah?

Utah Tax Rates, Collections, and Burdens Utah also has a flat 4.85 percent corporate income tax. Utah has a 6.10 percent state sales tax rate, a max local sales tax rate of 2.95 percent, and an average combined state and local sales tax rate of 7.19 percent.

Does Utah have single member LLC?

For most formation purposes, a Utah single-member LLC is considered the same as a multi-member LLC. The steps to form a single-member LLC in Utah are the same as those listed above. Single-member LLCs do have additional flexibility when it comes to filing a tax return.

What is Form TC 65?

2022 Utah TC-65 Instructions. Mineral Producers or Payers. If the partnership is a producer paying proceeds in connec- tion with mineral properties located in Utah, the partnership must report to each recipient their share of mineral production withholding tax withheld and paid to the Tax Commission.

How are LLCS taxed in Utah?

As an LLC member in Utah, you'll pay both federal and state personal income tax, along with the federal self-employment tax of 15.3%. Utah collects personal income tax at a flat rate of 4.85%. Other taxes that may apply to your Utah LLC include the state's 6.1% sales tax, industry-specific taxes, and employer taxes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit UT TC-65 from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your UT TC-65 into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I edit UT TC-65 on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign UT TC-65. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

How can I fill out UT TC-65 on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your UT TC-65, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is UT TC-65?

UT TC-65 is a tax form used in Utah for reporting income and deductions from certain types of business activities, including partnerships and pass-through entities.

Who is required to file UT TC-65?

Entities such as partnerships, S corporations, and limited liability companies registered in Utah are required to file UT TC-65 if they have income or deductions to report.

How to fill out UT TC-65?

To fill out UT TC-65, taxpayers must provide information such as their entity type, federal employer identification number, total income, deductions, and allocate income to individual members, along with their signatures.

What is the purpose of UT TC-65?

The purpose of UT TC-65 is to report specific tax information to the state of Utah, ensuring that the income earned by partnerships and other pass-through entities is properly taxed and accounted for.

What information must be reported on UT TC-65?

The information required includes the entity's name, address, federal tax identification number, total income, and breakdown of distributions to individual partners or shareholders.

Fill out your UT TC-65 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UT TC-65 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.