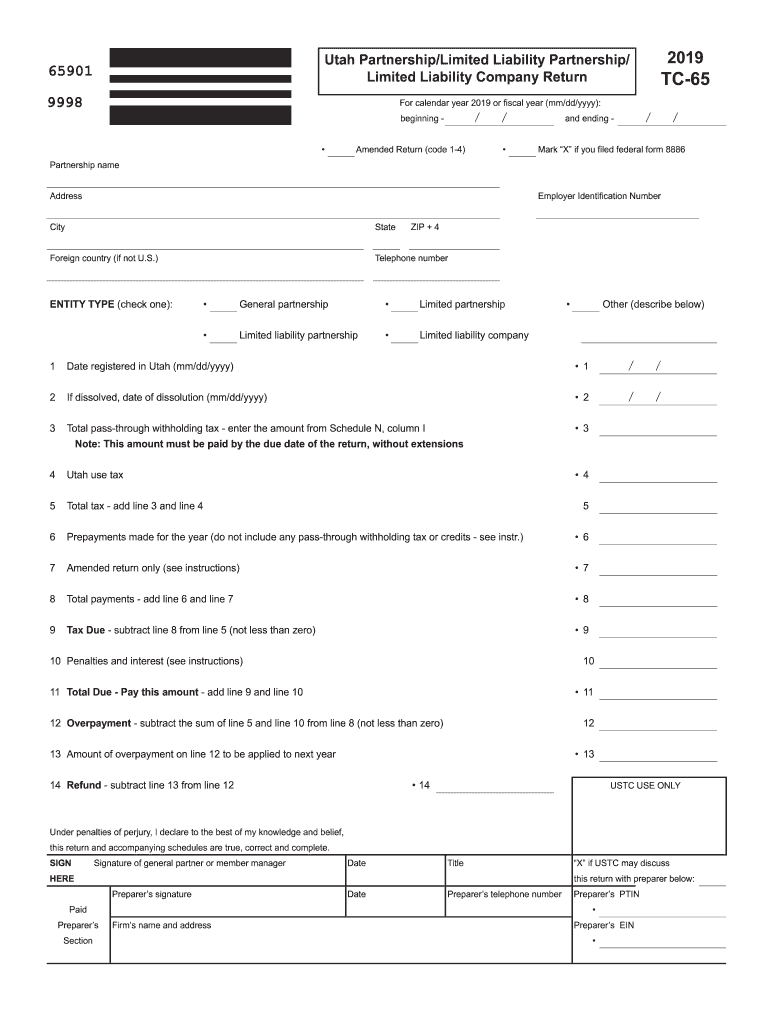

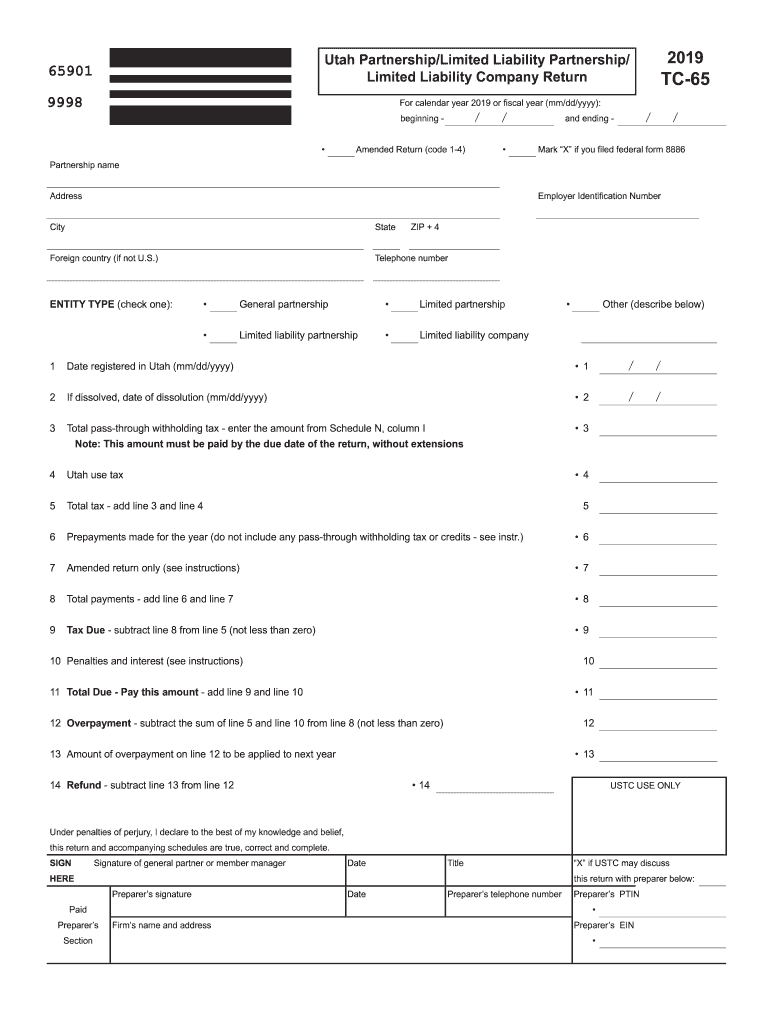

UT TC-65 2019 free printable template

Show details

000000 or TC-20 Schedule J line 9 13 or 14 if applicable 14 Utah apportioned business income loss - multiply line 12 by line 13 15 Total Utah income loss allocated to pass-through entity taxpayers - add line 9 and line 14 20861 TC-20 Sch. H Pg. 1 use with TC-20 TC-20S and TC-65 Note Failure to complete this form may result in disallowance of the nonbusiness income. 0495 withholding credit enter X in column B and 0 in column F plus Utah source not less than zero C SSN or EIN of partner...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign UT TC-65

Edit your UT TC-65 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UT TC-65 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing UT TC-65 online

To use the services of a skilled PDF editor, follow these steps below:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit UT TC-65. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UT TC-65 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out UT TC-65

How to fill out UT TC-65

01

Start by obtaining the UT TC-65 form from the official website or local tax office.

02

Fill out your personal information at the top of the form, including your name, address, and social security number.

03

Provide the details of your income sources as indicated in the designated sections of the form.

04

Calculate any deductions you are eligible for and fill them out in the appropriate sections.

05

Be sure to double-check all entries for accuracy to avoid any mistakes.

06

Sign and date the form at the bottom to certify that the information provided is true and accurate.

07

Submit the completed form as instructed, either online or by mailing it to the appropriate office.

Who needs UT TC-65?

01

Individuals who have earned income in Utah and need to report it for tax purposes.

02

Residents of Utah who are claiming tax credits or deductions.

03

Anyone required to file a Utah tax return based on their income level.

Fill

form

: Try Risk Free

People Also Ask about

Who must file a California partnership tax return?

LPs and LLPs. LPs and LLPs (both foreign, non-U.S., and domestic U.S.) doing business in California, that have a certificate on file, or are registered with the California SOS (whether or not doing business in California) must file a return and pay the $800 annual tax.

Does Utah require a state tax form?

ing to Utah Instructions for Form TC-40, you must file a Utah income tax return if: You were a resident or part year resident of Utah that must file a federal return.

What is a TC 675rs form?

General Information. Use this spreadsheet to complete your Mineral Production Withholding Tax Return. Always check the revision date to be sure you have the newest form.

Is there a Utah withholding form?

Report Utah withholding tax from the following forms: Federal form W-2, Wage and Tax Statement. Federal form 1099 (with Utah withholding), including 1099-R, 1099-MISC, 1099-G, etc.

When must a partnership file its return?

Most partnerships use the calendar year. The partnership tax return is generally due by the 15th day of the third month following the end of the tax year. See the Instructions for Form 1065, U.S. Return of Partnership Income.

What is Form TC 65?

2022 Utah TC-65 Instructions. Mineral Producers or Payers. If the partnership is a producer paying proceeds in connec- tion with mineral properties located in Utah, the partnership must report to each recipient their share of mineral production withholding tax withheld and paid to the Tax Commission.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the UT TC-65 in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your UT TC-65 right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How can I edit UT TC-65 on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing UT TC-65 right away.

Can I edit UT TC-65 on an Android device?

You can make any changes to PDF files, like UT TC-65, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is UT TC-65?

UT TC-65 is a tax form used in Utah for reporting certain individual income tax details, particularly related to certain tax credits and deductions.

Who is required to file UT TC-65?

Individuals who qualify for specific tax credits and deductions in Utah, such as the nonrefundable credits or certain subtractions from income, are required to file UT TC-65.

How to fill out UT TC-65?

To fill out UT TC-65, gather the necessary financial documents, complete the required sections of the form according to the instructions provided, and ensure all calculations are accurate before submitting it to the Utah State Tax Commission.

What is the purpose of UT TC-65?

The purpose of UT TC-65 is to allow taxpayers to report qualifying tax credits and deductions to accurately calculate their state tax liabilities and ensure compliance with Utah tax laws.

What information must be reported on UT TC-65?

Information that must be reported on UT TC-65 includes personal identification details, income information, the specifics of tax credits and deductions claimed, and any other required financial data as outlined in the form instructions.

Fill out your UT TC-65 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UT TC-65 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.