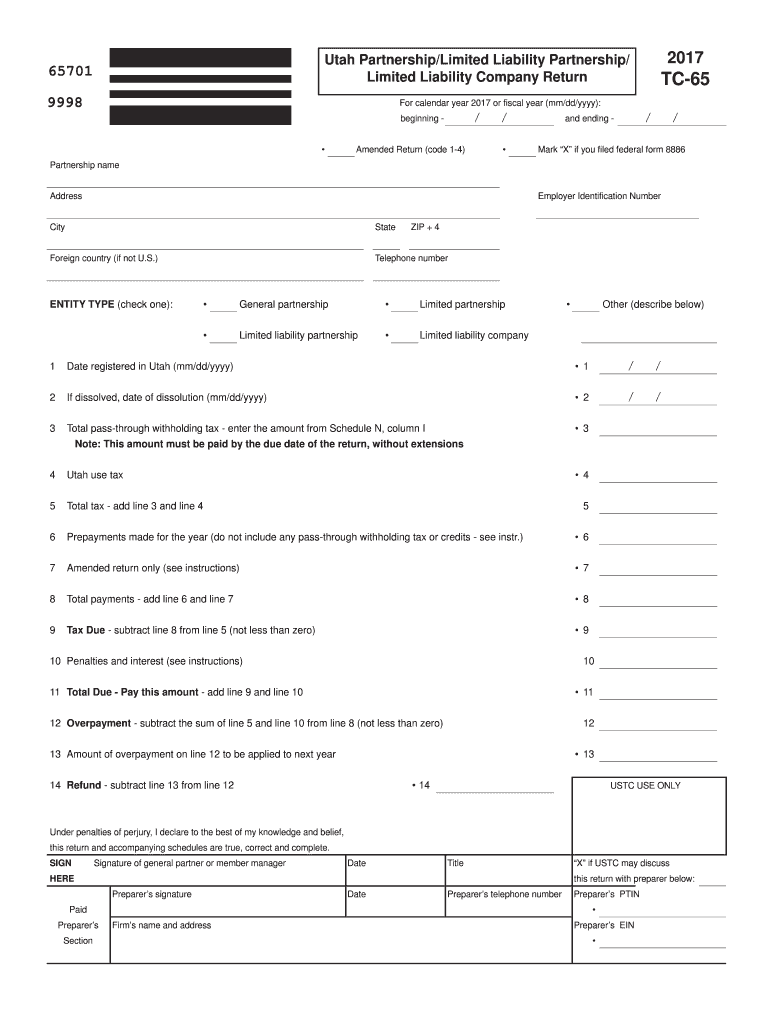

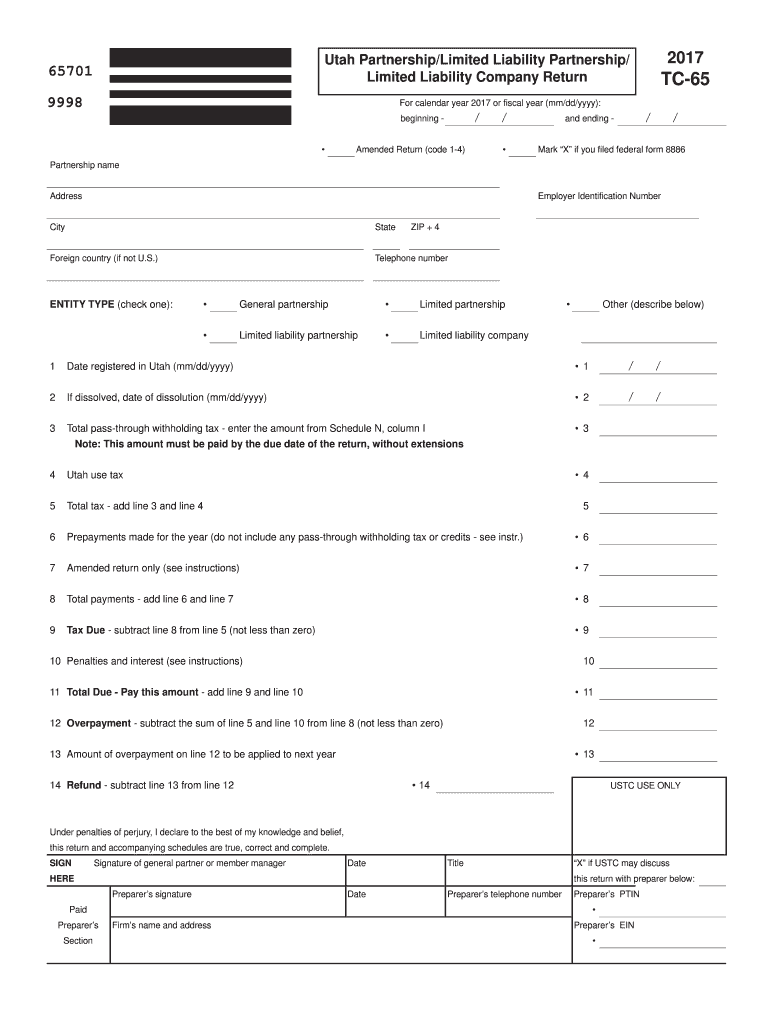

UT TC-65 2017 free printable template

Show details

000000 or TC-20 Schedule J line 9 13 or 14 if applicable 14 Utah apportioned business income loss - multiply line 12 by line 13 15 Total Utah income loss allocated to pass-through entity taxpayers - add line 9 and line 14 20761 TC-20 Sch. H Pg. 1 use with TC-20 TC-20S and TC-65 Note Failure to complete this form may result in disallowance of the nonbusiness income. 05 withholding credit enter X in column B and 0 in column F plus Utah source not less than zero C SSN or EIN of partner...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign UT TC-65

Edit your UT TC-65 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UT TC-65 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit UT TC-65 online

To use the professional PDF editor, follow these steps:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit UT TC-65. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UT TC-65 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out UT TC-65

How to fill out UT TC-65

01

Begin by downloading the UT TC-65 form from the official website or obtaining a physical copy.

02

Fill in your personal information including your name, address, and contact details in the designated fields.

03

Provide details about the type of transaction or information you are declaring.

04

If applicable, include any relevant identification numbers or codes related to your submission.

05

Review the form for accuracy and completeness before submission.

06

Sign and date the form in the specified area to certify the information is correct.

07

Submit the completed UT TC-65 form to the appropriate address as instructed.

Who needs UT TC-65?

01

Individuals or businesses that are required to declare certain information related to taxes, regulatory compliance, or specific transactions may need to fill out UT TC-65.

02

Tax professionals or accountants who assist clients with their tax obligations might also require UT TC-65 for their clients.

Fill

form

: Try Risk Free

People Also Ask about

Who must file a California partnership tax return?

LPs and LLPs. LPs and LLPs (both foreign, non-U.S., and domestic U.S.) doing business in California, that have a certificate on file, or are registered with the California SOS (whether or not doing business in California) must file a return and pay the $800 annual tax.

How do you calculate sales tax on a car in Utah?

All you need to do is enter your dealership's address and the price tag value of your vehicle. Key Takeaway To determine the car sales tax where you live, combine the statewide sales tax of 6.85% with your local or county sales tax.

What taxes do small businesses pay Utah?

Utah Tax Rates, Collections, and Burdens Utah also has a flat 4.85 percent corporate income tax. Utah has a 6.10 percent state sales tax rate, a max local sales tax rate of 2.95 percent, and an average combined state and local sales tax rate of 7.19 percent.

Does Utah have single member LLC?

For most formation purposes, a Utah single-member LLC is considered the same as a multi-member LLC. The steps to form a single-member LLC in Utah are the same as those listed above. Single-member LLCs do have additional flexibility when it comes to filing a tax return.

What is Form TC 65?

2022 Utah TC-65 Instructions. Mineral Producers or Payers. If the partnership is a producer paying proceeds in connec- tion with mineral properties located in Utah, the partnership must report to each recipient their share of mineral production withholding tax withheld and paid to the Tax Commission.

How are LLCS taxed in Utah?

As an LLC member in Utah, you'll pay both federal and state personal income tax, along with the federal self-employment tax of 15.3%. Utah collects personal income tax at a flat rate of 4.85%. Other taxes that may apply to your Utah LLC include the state's 6.1% sales tax, industry-specific taxes, and employer taxes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit UT TC-65 from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including UT TC-65, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

Can I sign the UT TC-65 electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your UT TC-65 in minutes.

Can I create an electronic signature for signing my UT TC-65 in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your UT TC-65 and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

What is UT TC-65?

UT TC-65 is a form used for reporting certain tax information in the state of Utah.

Who is required to file UT TC-65?

Individuals or entities who have certain tax obligations in Utah are required to file UT TC-65.

How to fill out UT TC-65?

To fill out UT TC-65, you must provide your personal or business information, income details, and any applicable deductions as instructed on the form.

What is the purpose of UT TC-65?

The purpose of UT TC-65 is to collect necessary tax information to ensure compliance with state tax laws.

What information must be reported on UT TC-65?

The information that must be reported on UT TC-65 includes personal identification details, income sources, applicable deductions, and other relevant tax information.

Fill out your UT TC-65 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UT TC-65 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.