IRS 1040 - Schedule H 2017 free printable template

Show details

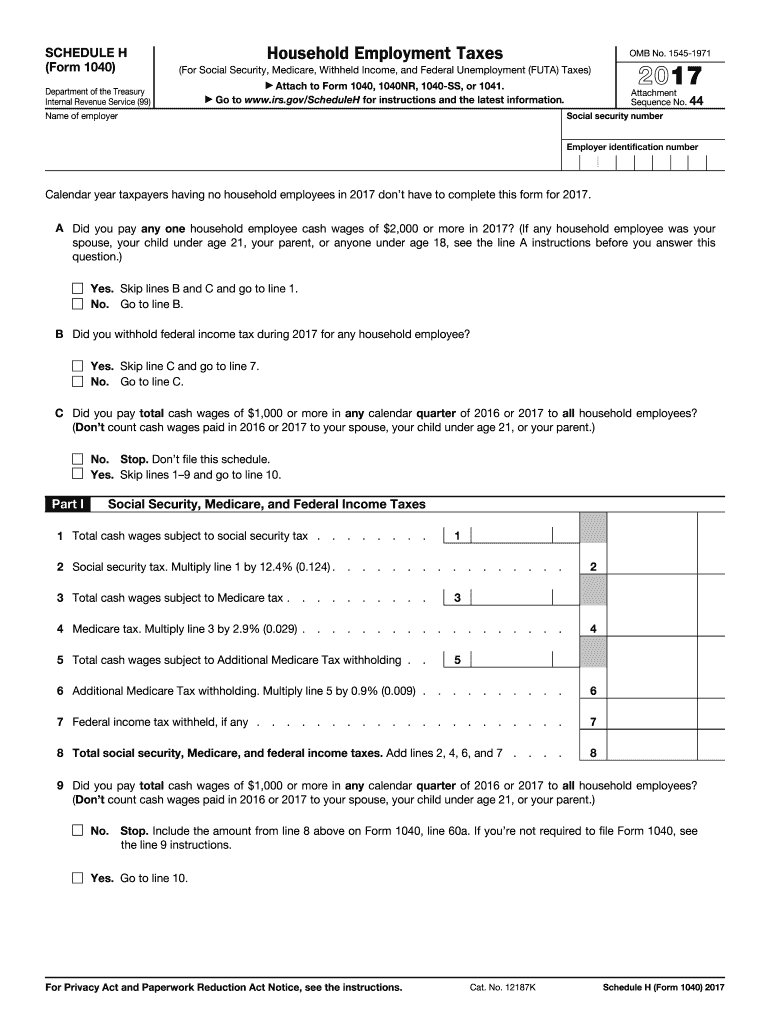

SCHEDULE H Form 1040 Household Employment Taxes OMB No. 1545-1971 For Social Security Medicare Withheld Income and Federal Unemployment FUTA Taxes Department of the Treasury Internal Revenue Service 99 Attach to Form 1040 1040NR 1040-SS or 1041. Go to www.irs.gov/ScheduleH for instructions and the latest information. Attachment Sequence No. 44 Social security number Name of employer Employer identification number Calendar year taxpayers having no household employees in 2017 don t have to...complete this form for 2017. If zero or less enter -0-. h paid to state unemployment fund Total Household Employment Taxes 25 Enter the amount from line 8. If you checked the Yes box on line C of page 1 enter -0-. 26 Add line 16 or line 24 and line 25. 27 Are you required to file Form 1040 Yes. Yes. Go to line 10. For Privacy Act and Paperwork Reduction Act Notice see the instructions. Cat. No. 12187K Schedule H Form 1040 2017 Page Federal Unemployment FUTA Tax Yes No 10 Did you pay unemployment...contributions to only one state If you paid contributions to a credit reduction state see instructions and check No.. A Did you pay any one household employee cash wages of 2 000 or more in 2017 If any household employee was your spouse your child under age 21 your parent or anyone under age 18 see the line A instructions before you answer this question* Yes. Skip lines B and C and go to line 1. No* Go to line B. B Did you withhold federal income tax during 2017 for any household employee C Did...you pay total cash wages of 1 000 or more in any calendar quarter of 2016 or 2017 to all household employees Don t count cash wages paid in 2016 or 2017 to your spouse your child under age 21 or your parent. No* Stop* Don t file this schedule. Part I 1 Total cash wages subject to social security tax. 4 Medicare tax. Multiply line 3 by 2. 9 0. 029. 6 Additional Medicare Tax withholding. Multiply line 5 by 0. 9 0. 009. 7 Federal income tax withheld if any. 8 Total social security Medicare and...federal income taxes. Add lines 2 4 6 and 7. No* Stop* Include the amount from line 8 above on Form 1040 line 60a* If you re not required to file Form 1040 see the line 9 instructions. 11 Did you pay all state unemployment contributions for 2017 by April 17 2018 Fiscal year filers see instructions 12 Were all wages that are taxable for FUTA tax also taxable for your state s unemployment tax. Next If you checked the Yes box on all the lines above complete Section A. If you checked the No box on...any of the lines above skip Section A and complete Section B. Section A 13 Name of the state where you paid unemployment contributions 14 Contributions paid to your state unemployment fund. 16 FUTA tax. Multiply line 15 by 0. 6 0. 006. Enter the result here skip Section B and go to line 25 17 Complete all columns below that apply if you need more space see instructions a Name of state b Taxable wages as defined in state act c State experience rate period From d State experience rate e Multiply...col* b by 0.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1040 - Schedule H

How to edit IRS 1040 - Schedule H

How to fill out IRS 1040 - Schedule H

Instructions and Help about IRS 1040 - Schedule H

How to edit IRS 1040 - Schedule H

To edit the IRS 1040 - Schedule H, you can utilize tools that allow you to fill in, correct, or alter any necessary information on the form. Start by downloading the form from the IRS website or accessing it through a tool like pdfFiller, which offers direct editing capabilities. Ensure all entries reflect your accurate tax information prior to submission to avoid potential penalties.

How to fill out IRS 1040 - Schedule H

Filling out the IRS 1040 - Schedule H requires careful attention to your income as a household employer. Begin by gathering all necessary information, including the amount paid to household employees and applicable taxes withheld. Follow these steps:

01

Download the IRS 1040 - Schedule H form from the IRS website or through a reliable tool like pdfFiller.

02

Complete your personal details at the top of the form, including your name and Social Security Number.

03

Document the total wages paid to your household employees in the designated lines.

04

Calculate and report any applicable employment taxes, such as Social Security and Medicare.

05

Review the completed form for accuracy and save it for filing.

About IRS 1040 - Schedule H 2017 previous version

What is IRS 1040 - Schedule H?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 1040 - Schedule H 2017 previous version

What is IRS 1040 - Schedule H?

IRS 1040 - Schedule H is a tax form specifically used for reporting household employment taxes. This schedule is attached to your Form 1040 and is meant for taxpayers who pay wages to individuals performing household services, such as nannies, housekeepers, or caregivers. The information contained in this form ensures proper tax reporting and compliance with federal employment tax laws.

What is the purpose of this form?

The purpose of IRS 1040 - Schedule H is to calculate and report household employment taxes. Specifically, it details the wages paid to household employees and the associated Social Security, Medicare, and federal unemployment taxes owed. This form helps ensure that all taxes relevant to household employment are accurately reported and paid to the IRS.

Who needs the form?

Individuals who employ household employees, such as babysitters, caretakers, or housecleaners, may need to file IRS 1040 - Schedule H. If you have paid any household employee $2,400 or more in a calendar year, or if you are required to withhold Social Security and Medicare taxes, you must file this form. Additionally, if you owe federal unemployment taxes, you are also required to complete Schedule H.

When am I exempt from filling out this form?

You may be exempt from filing IRS 1040 - Schedule H if you have not paid any household employee $2,400 or more in the tax year. Other exemptions may apply if the employee is not categorized as a household worker or if wages are not subject to Social Security and Medicare taxes. Always consult the current IRS guidelines or a tax professional to confirm your eligibility for exemptions.

Components of the form

The components of IRS 1040 - Schedule H include several sections for reporting employee information, wages paid, and calculated tax liabilities. Key sections cover basic identification details, total wages, tax calculations, and signature. Each section is designed to gather specific tax-relevant information to ensure compliance with employment tax obligations.

What are the penalties for not issuing the form?

Failing to issue IRS 1040 - Schedule H when necessary can result in significant penalties. The IRS may impose fines for late filings, non-filing, or underpayment of taxes. Penalties can include monetary fines and interest on late payments, which can accumulate quickly, so it's essential to comply with filing requirements and deadlines.

What information do you need when you file the form?

When filing IRS 1040 - Schedule H, you need the following information:

01

Your personal information, including your name and Social Security Number.

02

Details about your household employees, such as names and Social Security Numbers.

03

Total wages you paid to employees during the year.

04

Any applicable taxes withheld, including Social Security, Medicare, and federal unemployment taxes.

Is the form accompanied by other forms?

IRS 1040 - Schedule H may need to be attached to your main tax return, Form 1040, but it typically does not require additional forms to be filed simultaneously. If you have other tax liabilities or circumstances, such as state employment taxes, you may need to include additional documentation as advised by state tax laws.

Where do I send the form?

IRS 1040 - Schedule H should be sent to the address specified in the form instructions, which can vary based on your filing situation and location. Generally, if you are mailing your tax return, include Schedule H with your Form 1040 and send it to the appropriate IRS processing center. Always check the latest IRS guidelines for specific mailing requirements each tax season.

See what our users say