VT DoT CO-411 2015 free printable template

Show details

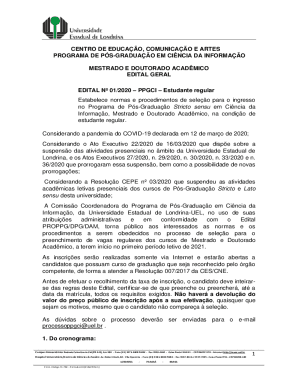

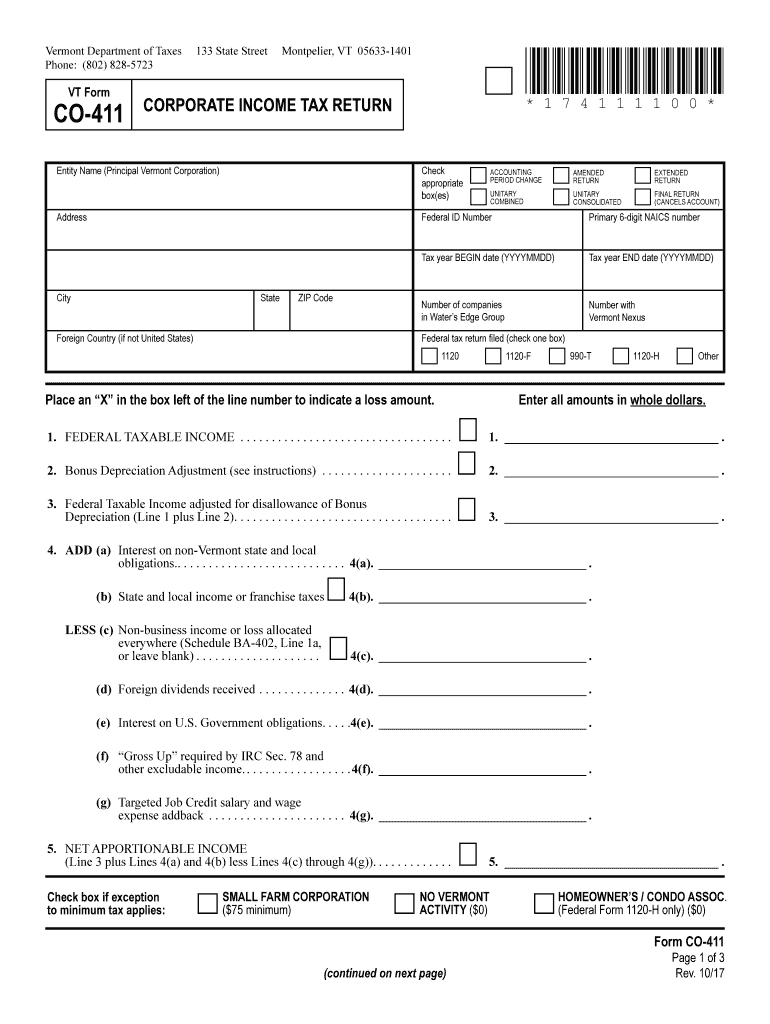

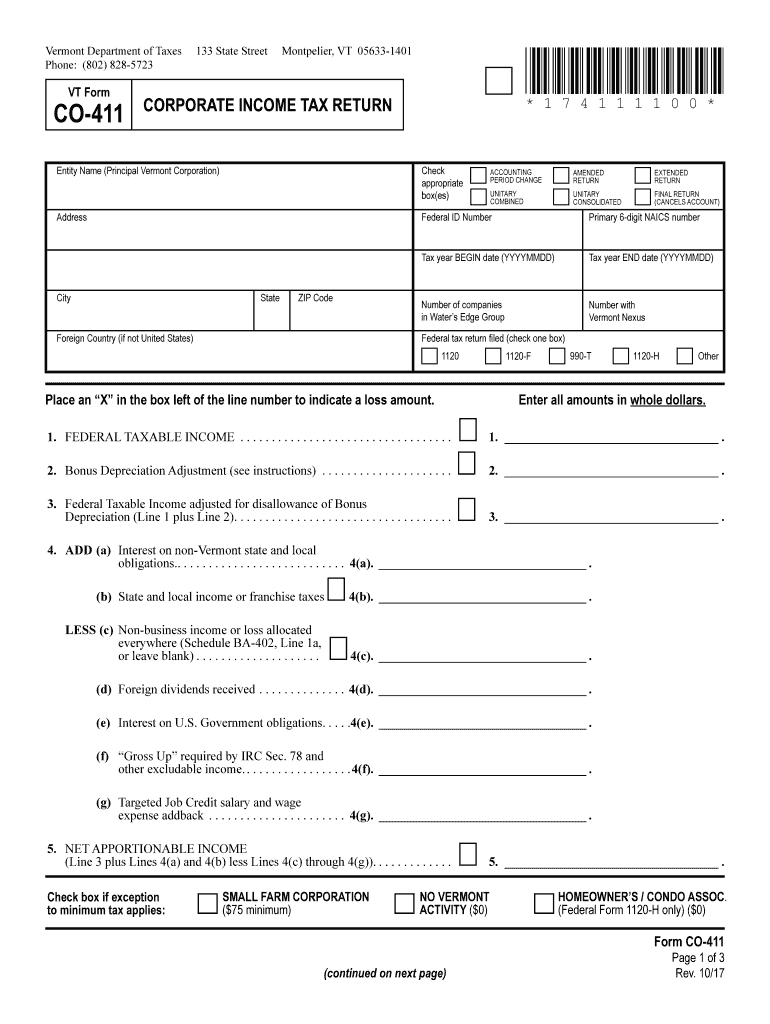

6. 7. Apportionable Income Form CO-411 Line 5. 8. Income Apportioned to Vermont Multiply Line 6 by Line 7. HOMEOWNER S Federal Form 1120-H only 0 Form CO-411 continued on next page Page 1 of 3 Rev. 10/17 Entity Name Fiscal Year Ending YYYYMMDD 6. Vermont Department of Taxes Phone 802 828-5723 VT Form CO-411 133 State Street Montpelier VT 05633-1401 174111100 CORPORATE INCOME TAX RETURN Entity Name Principal Vermont Corporation Check appropriate box es Address Federal ID Number Primary 6-digit...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign co 411 2015-2019 form

Edit your co 411 2015-2019 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your co 411 2015-2019 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing co 411 2015-2019 form online

Follow the guidelines below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit co 411 2015-2019 form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

VT DoT CO-411 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out co 411 2015-2019 form

How to fill out VT DoT CO-411

01

Obtain a copy of the VT DoT CO-411 form from the Vermont Department of Transportation website or office.

02

Begin by filling out the top section of the form with your personal and vehicle information including name, address, vehicle make, model, year, and VIN.

03

Indicate the reason for completing the form by checking the appropriate box provided.

04

Fill out any additional details as required by the specific situation, such as accident information or repair details if applicable.

05

Sign and date the form at the bottom.

06

Submit the completed form to your local Vermont Department of Transportation office or as instructed on the form.

Who needs VT DoT CO-411?

01

Anyone who has been involved in a vehicle accident in Vermont.

02

Individuals needing to report repairs or changes to their vehicle status.

03

Vehicle owners seeking to fulfill their state reporting requirements.

Instructions and Help about co 411 2015-2019 form

Fill

form

: Try Risk Free

People Also Ask about

How much does Vermont take out of paycheck for taxes?

The state's top tax rate is 8.75%, but it only applies to single filers making more than $213,150 and joint filers making more than $259,500 in taxable income. If you're a single filer with $42,150 or below in annual taxable income, you'll pay the lowest state income tax rate in Vermont, at 3.35%.

What is the capital gains tax in Vermont?

Vermont Capital Gains Tax Most capital gains in Vermont are subject to the personal income tax rates of 3.35% - 8.75%. This includes all short-term gains, but long term-gains may be eligible for an exclusion.

What is Vermont Form LC 142?

The Vermont Department of Taxes has released guidance for Landlords on how to report any Rental Housing Stablization Program (RHSP) funds received.

How much does Vermont take out in taxes?

The state's top tax rate is 8.75%, but it only applies to single filers making more than $213,150 and joint filers making more than $259,500 in taxable income. If you're a single filer with $42,150 or below in annual taxable income, you'll pay the lowest state income tax rate in Vermont, at 3.35%.

What percent of taxes are taken out of paycheck?

There are seven tax brackets in 2022 and 2023: 12%. 22%, 24%, 32%, 35%, and 37%. FICA and federal withholding are taken out of adjusted gross pay, meaning any deductions from contributing to a 401(k) or other tax-deferred accounts are factored in beforehand.

What is the tax rate for C Corp in 2023?

State corporate income tax rate StateTax RateCalifornia8.84%Colorado4.55%Connecticut7.50%D.C.8.25%41 more rows • Apr 19, 2023

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find co 411 2015-2019 form?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific co 411 2015-2019 form and other forms. Find the template you want and tweak it with powerful editing tools.

How do I execute co 411 2015-2019 form online?

pdfFiller has made it easy to fill out and sign co 411 2015-2019 form. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I edit co 411 2015-2019 form straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing co 411 2015-2019 form.

What is VT DoT CO-411?

VT DoT CO-411 is a form used in Vermont for reporting certain transportation-related data.

Who is required to file VT DoT CO-411?

Individuals or entities involved in transportation operations within Vermont are required to file the VT DoT CO-411.

How to fill out VT DoT CO-411?

To fill out VT DoT CO-411, you need to provide the required data accurately, following the instructions on the form regarding each section.

What is the purpose of VT DoT CO-411?

The purpose of VT DoT CO-411 is to collect data that helps the Vermont Department of Transportation in managing and planning transportation systems.

What information must be reported on VT DoT CO-411?

The information that must be reported on VT DoT CO-411 includes details about transportation operations, vehicle types, and any relevant metrics as specified in the form.

Fill out your co 411 2015-2019 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Co 411 2015-2019 Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.