VT DoT CO-411 2022 free printable template

Show details

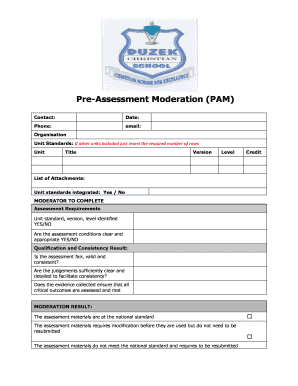

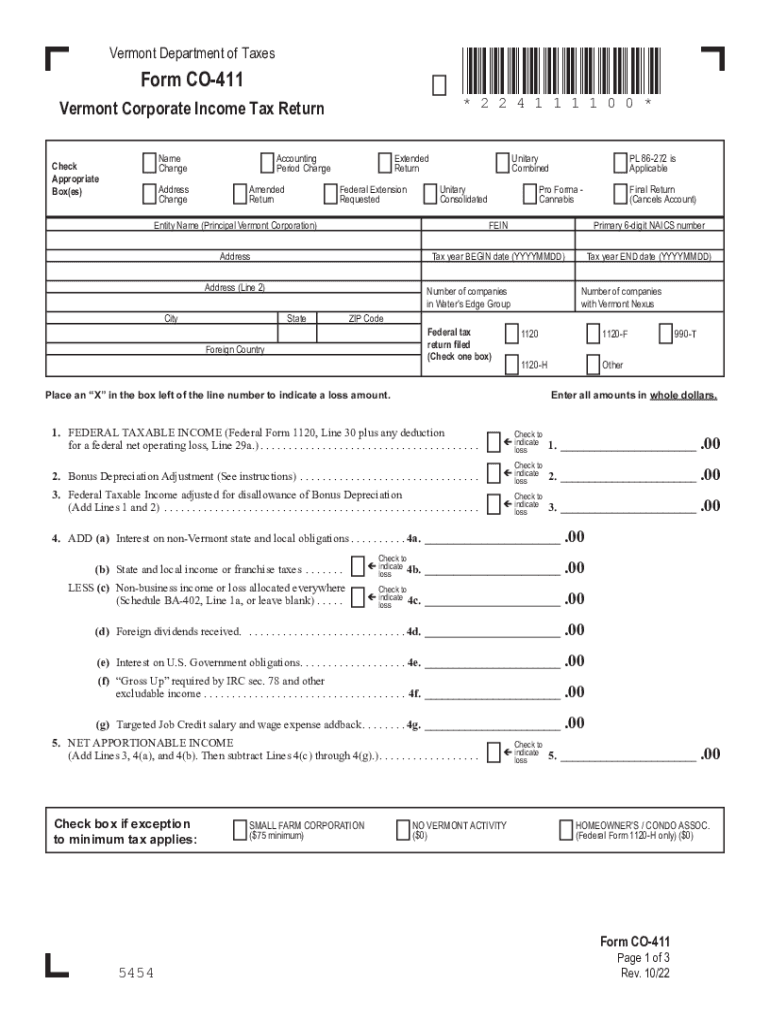

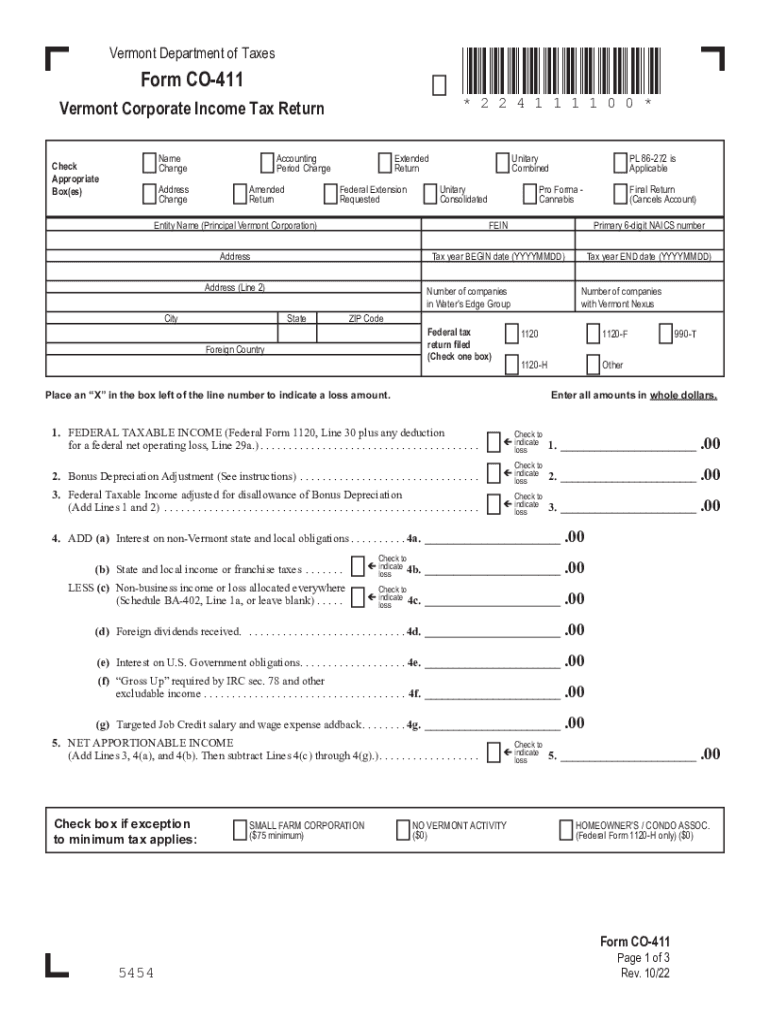

Vermont Department of Taxes×224111100×Form CO411* 2 2 4 1 1 1 1 0 0 *Vermont Corporate Income Tax Return

Name

ChangeCheck

Appropriate

Box(BS)Address

ChangeAccounting

Period Change

Amended

ReturnExtended

Return

Federal

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign vermont form co 411

Edit your vermont form co 411 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your vermont form co 411 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing vermont form co 411 online

To use our professional PDF editor, follow these steps:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit vermont form co 411. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

VT DoT CO-411 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out vermont form co 411

How to fill out VT DoT CO-411

01

Gather necessary documentation: Obtain your vehicle title, identification, and any other required paperwork.

02

Download the VT DoT CO-411 form: Access the form from the Vermont Department of Transportation website or request a physical copy.

03

Fill out your personal information: Enter your full name, address, phone number, and email address in the designated sections.

04

Provide vehicle information: Input the vehicle's make, model, year, VIN (Vehicle Identification Number), and current mileage.

05

Indicate the purpose of the application: Specify why you are submitting the form (e.g., transferring ownership, applying for a new title).

06

Sign and date the form: Ensure that you sign the application and include the date of submission.

07

Submit the form: Send the completed form and any required fees to the appropriate Vermont Department of Transportation office.

Who needs VT DoT CO-411?

01

Any individual or entity looking to transfer ownership of a vehicle in Vermont.

02

New vehicle owners who need to register their vehicle in Vermont.

03

Individuals applying for a replacement title or correcting information on an existing title.

Instructions and Help about vermont form co 411

Fill

form

: Try Risk Free

People Also Ask about

How much does Vermont take out of paycheck for taxes?

The state's top tax rate is 8.75%, but it only applies to single filers making more than $213,150 and joint filers making more than $259,500 in taxable income. If you're a single filer with $42,150 or below in annual taxable income, you'll pay the lowest state income tax rate in Vermont, at 3.35%.

What is the capital gains tax in Vermont?

Vermont Capital Gains Tax Most capital gains in Vermont are subject to the personal income tax rates of 3.35% - 8.75%. This includes all short-term gains, but long term-gains may be eligible for an exclusion.

What is Vermont Form LC 142?

The Vermont Department of Taxes has released guidance for Landlords on how to report any Rental Housing Stablization Program (RHSP) funds received.

How much does Vermont take out in taxes?

The state's top tax rate is 8.75%, but it only applies to single filers making more than $213,150 and joint filers making more than $259,500 in taxable income. If you're a single filer with $42,150 or below in annual taxable income, you'll pay the lowest state income tax rate in Vermont, at 3.35%.

What percent of taxes are taken out of paycheck?

There are seven tax brackets in 2022 and 2023: 12%. 22%, 24%, 32%, 35%, and 37%. FICA and federal withholding are taken out of adjusted gross pay, meaning any deductions from contributing to a 401(k) or other tax-deferred accounts are factored in beforehand.

What is the tax rate for C Corp in 2023?

State corporate income tax rate StateTax RateCalifornia8.84%Colorado4.55%Connecticut7.50%D.C.8.25%41 more rows • Apr 19, 2023

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get vermont form co 411?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific vermont form co 411 and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

Can I create an eSignature for the vermont form co 411 in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your vermont form co 411 right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I edit vermont form co 411 on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share vermont form co 411 from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is VT DoT CO-411?

VT DoT CO-411 is a form used by the Vermont Department of Taxes to report the calculation of state sales and use tax for specific vendors and transactions.

Who is required to file VT DoT CO-411?

Vendors that are registered to collect sales tax in Vermont and have sales tax liability are required to file VT DoT CO-411.

How to fill out VT DoT CO-411?

To fill out VT DoT CO-411, provide the necessary business information and details about sales transactions, including taxable amounts and calculated taxes, following the instructions provided on the form.

What is the purpose of VT DoT CO-411?

The purpose of VT DoT CO-411 is to ensure accurate reporting and payment of sales and use tax, thereby aiding in the state's tax compliance and revenue collection.

What information must be reported on VT DoT CO-411?

Information that must be reported on VT DoT CO-411 includes the vendor's name, address, sales tax identification number, total sales, taxable sales, and the amount of tax collected.

Fill out your vermont form co 411 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Vermont Form Co 411 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.