VT DoT CO-411 2018 free printable template

Show details

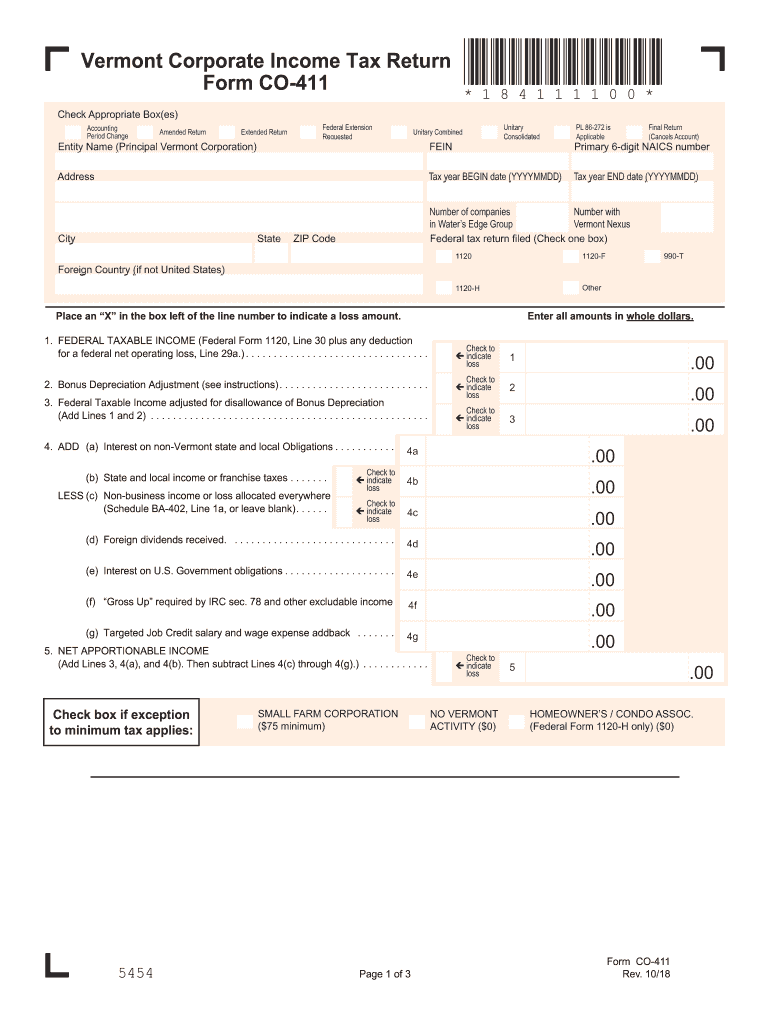

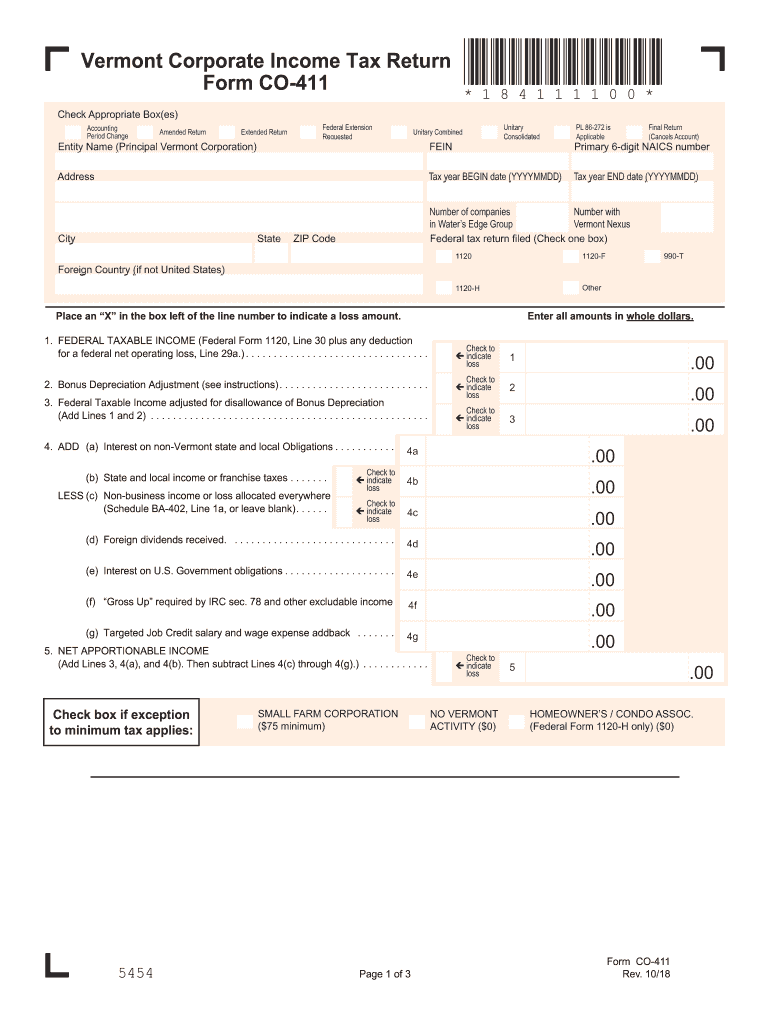

Apportionable Income From CO-411 Line 5. Income Apportioned to Vermont Multiply Lines 6 and 7. Income Allocated to Vermont Schedule BA-402 Line 1b. 184111100 Vermont Corporate Income Tax Return Form CO-411 Check Appropriate Appropriate Box es Box es Check Accounting PeriodChange Change Period AmendedReturn Return Amended Extended Entity Name Name Principal Principal Vermont Corporation Entity FederalExtension Extension Federal Requested UnitaryCombined Combined Unitary FEIN Consolidated...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign vt co 411

Edit your vt co 411 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your vt co 411 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

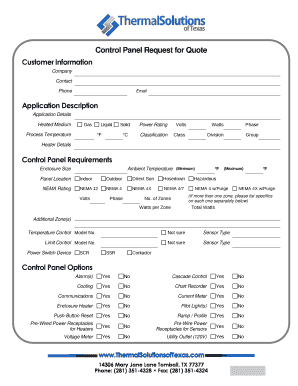

How to edit vt co 411 online

To use our professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit vt co 411. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

VT DoT CO-411 Form Versions

Version

Form Popularity

Fillable & printabley

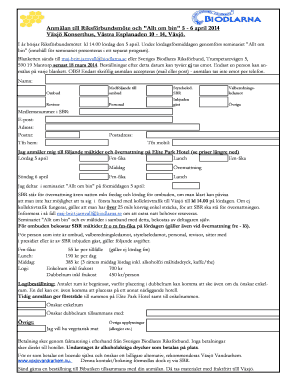

How to fill out vt co 411

How to fill out VT DoT CO-411

01

Gather necessary information: You will need your vehicle information, insurance details, and personal identification.

02

Access the VT DoT CO-411 form: Download it from the Vermont Department of Transportation website or obtain a physical copy.

03

Fill in your personal details: Enter your name, address, and contact information accurately.

04

Provide vehicle details: Include the make, model, year, and Vehicle Identification Number (VIN) of your vehicle.

05

Enter insurance information: Fill in the name of your insurance provider, policy number, and effective date.

06

Complete any additional sections: Follow any specific instructions for additional information required on the form.

07

Review your entries: Ensure all information is correct and complete to avoid delays.

08

Submit the form: Send the completed form to the appropriate department as indicated in the instructions.

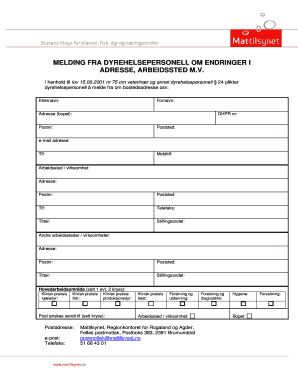

Who needs VT DoT CO-411?

01

Persons registering a vehicle in Vermont for the first time.

02

Individuals transferring vehicle ownership.

03

Those applying for a title for their vehicle.

04

People needing to report a loss of title or other related vehicle documentation.

Instructions and Help about vt co 411

Fill

form

: Try Risk Free

People Also Ask about

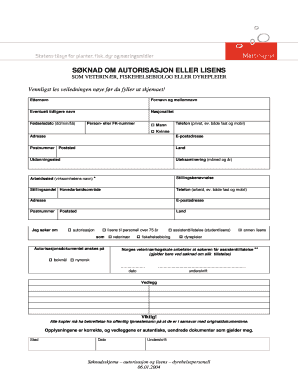

How much does Vermont take out of paycheck for taxes?

The state's top tax rate is 8.75%, but it only applies to single filers making more than $213,150 and joint filers making more than $259,500 in taxable income. If you're a single filer with $42,150 or below in annual taxable income, you'll pay the lowest state income tax rate in Vermont, at 3.35%.

What is the capital gains tax in Vermont?

Vermont Capital Gains Tax Most capital gains in Vermont are subject to the personal income tax rates of 3.35% - 8.75%. This includes all short-term gains, but long term-gains may be eligible for an exclusion.

What is Vermont Form LC 142?

The Vermont Department of Taxes has released guidance for Landlords on how to report any Rental Housing Stablization Program (RHSP) funds received.

How much does Vermont take out in taxes?

The state's top tax rate is 8.75%, but it only applies to single filers making more than $213,150 and joint filers making more than $259,500 in taxable income. If you're a single filer with $42,150 or below in annual taxable income, you'll pay the lowest state income tax rate in Vermont, at 3.35%.

What percent of taxes are taken out of paycheck?

There are seven tax brackets in 2022 and 2023: 12%. 22%, 24%, 32%, 35%, and 37%. FICA and federal withholding are taken out of adjusted gross pay, meaning any deductions from contributing to a 401(k) or other tax-deferred accounts are factored in beforehand.

What is the tax rate for C Corp in 2023?

State corporate income tax rate StateTax RateCalifornia8.84%Colorado4.55%Connecticut7.50%D.C.8.25%41 more rows • Apr 19, 2023

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in vt co 411 without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your vt co 411, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How do I edit vt co 411 on an iOS device?

You certainly can. You can quickly edit, distribute, and sign vt co 411 on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

How do I complete vt co 411 on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your vt co 411 by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is VT DoT CO-411?

VT DoT CO-411 is a form used by the Vermont Department of Taxes that reports the sale or transfer of a motor vehicle in the state of Vermont.

Who is required to file VT DoT CO-411?

Any individual or entity that sells or transfers ownership of a motor vehicle in Vermont is required to file the VT DoT CO-411 form.

How to fill out VT DoT CO-411?

To fill out VT DoT CO-411, complete the required fields including the seller's information, buyer's information, vehicle details, and transaction date. Ensure that all information is accurate and sign the form.

What is the purpose of VT DoT CO-411?

The purpose of VT DoT CO-411 is to provide the state with details about motor vehicle sales and transfers, helping to maintain accurate vehicle registration records and assess any applicable taxes.

What information must be reported on VT DoT CO-411?

VT DoT CO-411 must report information such as the names and addresses of both the seller and buyer, the vehicle identification number (VIN), make and model of the vehicle, sale price, and transaction date.

Fill out your vt co 411 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Vt Co 411 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.