VT DoT CO-411 2019 free printable template

Show details

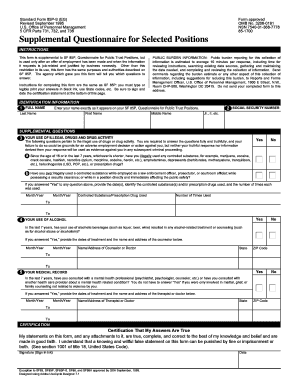

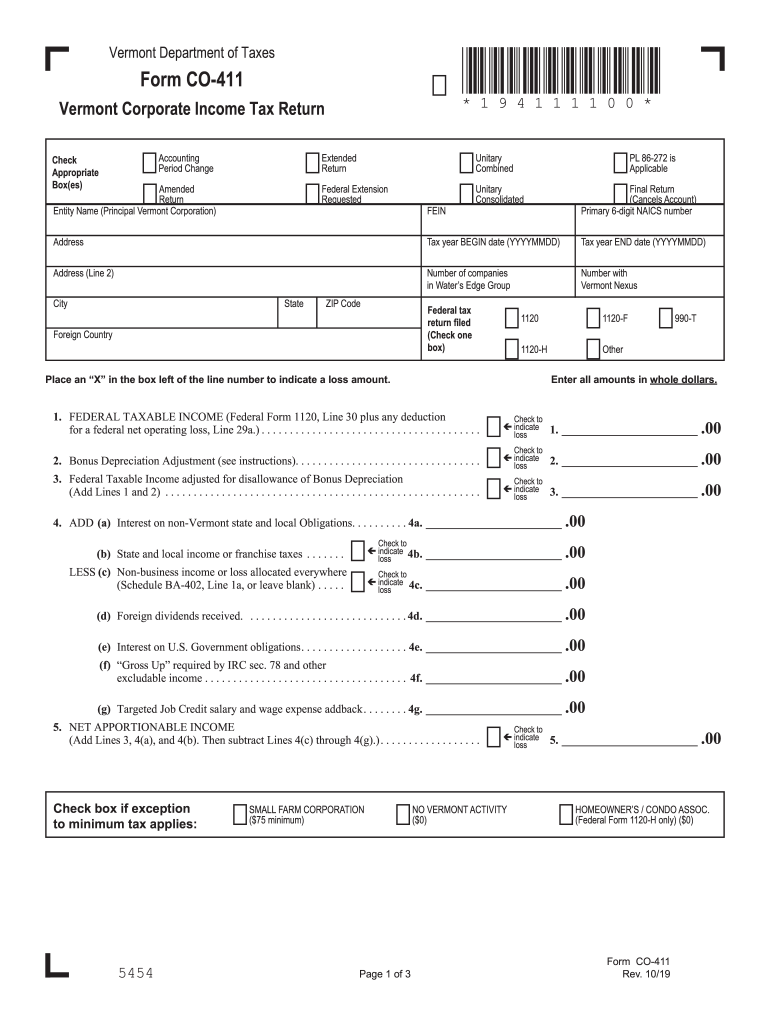

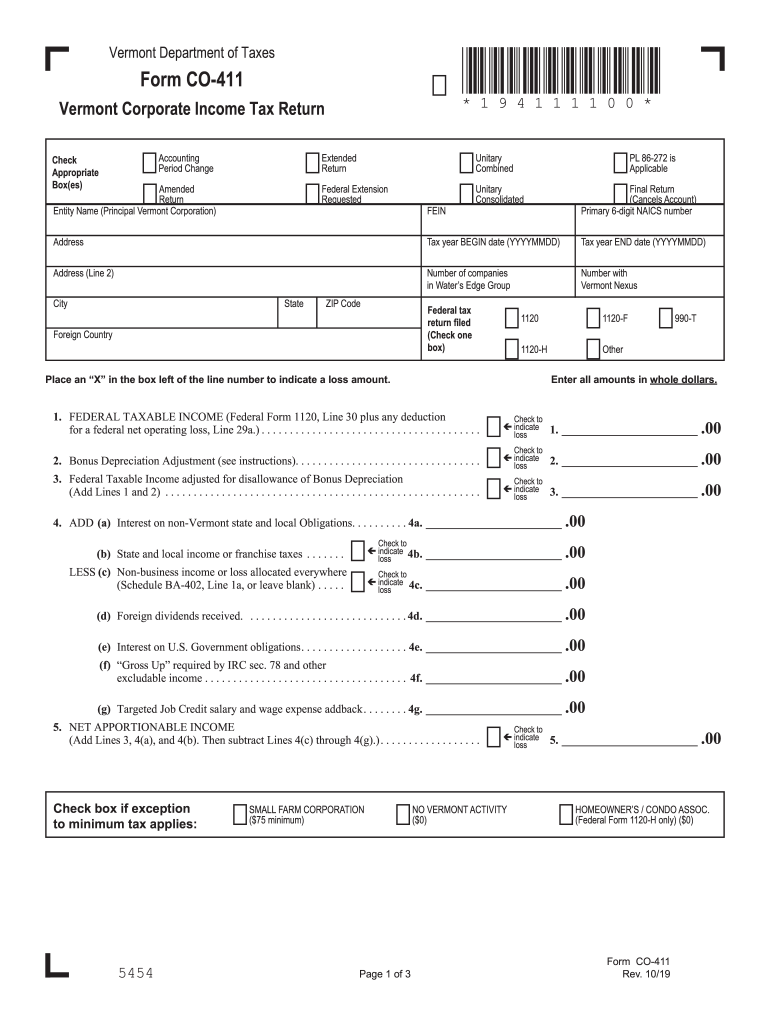

Vermont Department of Taxes×194111100×Form CO411* 1 9 4 1 1 1 1 0 0 *Vermont Corporate Income Tax Return

Accounting

Period ChangeCheck

Appropriate

Box(BS)Extended

ReturnUnitary

Combined PL 86272

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign vermont form co 411

Edit your vermont form co 411 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your vermont form co 411 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit vermont form co 411 online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit vermont form co 411. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

VT DoT CO-411 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out vermont form co 411

How to fill out VT DoT CO-411

01

Obtain the VT DoT CO-411 form from the Vermont Department of Transportation website or office.

02

Fill in the required personal information, including your name, address, and contact details.

03

Provide vehicle information such as the make, model, year, and VIN (Vehicle Identification Number).

04

Indicate the purpose of the application by selecting the appropriate option from the provided choices.

05

Attach any necessary documents or evidence required for your submission.

06

Review the completed form to ensure all information is accurate and complete.

07

Sign and date the form at the designated spaces.

08

Submit the form to the appropriate Vermont Department of Transportation office, either in person or via mail.

Who needs VT DoT CO-411?

01

Individuals applying for a special registration or certification related to their vehicle.

02

Vehicle owners seeking to report changes or updates to their vehicle information.

03

Those requiring a duplicate registration or authorization for their vehicle.

Instructions and Help about vermont form co 411

Fill

form

: Try Risk Free

People Also Ask about

How much does Vermont take out of paycheck for taxes?

The state's top tax rate is 8.75%, but it only applies to single filers making more than $213,150 and joint filers making more than $259,500 in taxable income. If you're a single filer with $42,150 or below in annual taxable income, you'll pay the lowest state income tax rate in Vermont, at 3.35%.

What is the capital gains tax in Vermont?

Vermont Capital Gains Tax Most capital gains in Vermont are subject to the personal income tax rates of 3.35% - 8.75%. This includes all short-term gains, but long term-gains may be eligible for an exclusion.

What is Vermont Form LC 142?

The Vermont Department of Taxes has released guidance for Landlords on how to report any Rental Housing Stablization Program (RHSP) funds received.

How much does Vermont take out in taxes?

The state's top tax rate is 8.75%, but it only applies to single filers making more than $213,150 and joint filers making more than $259,500 in taxable income. If you're a single filer with $42,150 or below in annual taxable income, you'll pay the lowest state income tax rate in Vermont, at 3.35%.

What percent of taxes are taken out of paycheck?

There are seven tax brackets in 2022 and 2023: 12%. 22%, 24%, 32%, 35%, and 37%. FICA and federal withholding are taken out of adjusted gross pay, meaning any deductions from contributing to a 401(k) or other tax-deferred accounts are factored in beforehand.

What is the tax rate for C Corp in 2023?

State corporate income tax rate StateTax RateCalifornia8.84%Colorado4.55%Connecticut7.50%D.C.8.25%41 more rows • Apr 19, 2023

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my vermont form co 411 in Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your vermont form co 411 and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How do I edit vermont form co 411 straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing vermont form co 411.

How do I complete vermont form co 411 on an Android device?

On an Android device, use the pdfFiller mobile app to finish your vermont form co 411. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is VT DoT CO-411?

VT DoT CO-411 is a form used to report the weight and distribution of loads for commercial vehicles traveling in Vermont.

Who is required to file VT DoT CO-411?

Commercial vehicle operators that exceed the state's weight limits or operate under special permits are required to file VT DoT CO-411.

How to fill out VT DoT CO-411?

To fill out VT DoT CO-411, provide details such as the vehicle's identification, weight information, load details, and signature of the operator.

What is the purpose of VT DoT CO-411?

The purpose of VT DoT CO-411 is to ensure compliance with state weight regulations and to provide the state with information on commercial vehicle loads.

What information must be reported on VT DoT CO-411?

Information that must be reported includes vehicle identification numbers, gross weight, axle weights, and the nature of the load being transported.

Fill out your vermont form co 411 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Vermont Form Co 411 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.