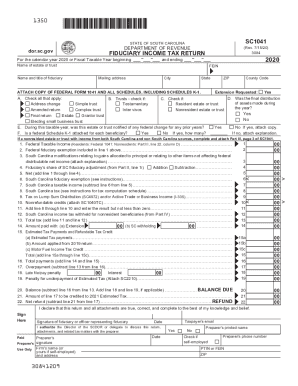

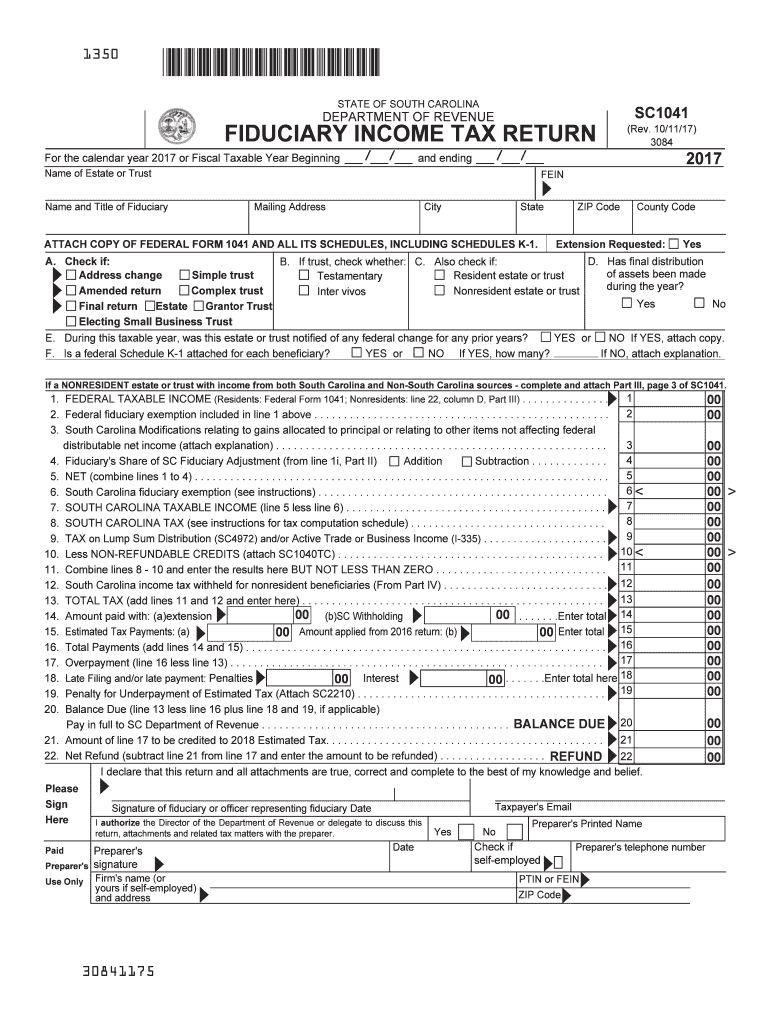

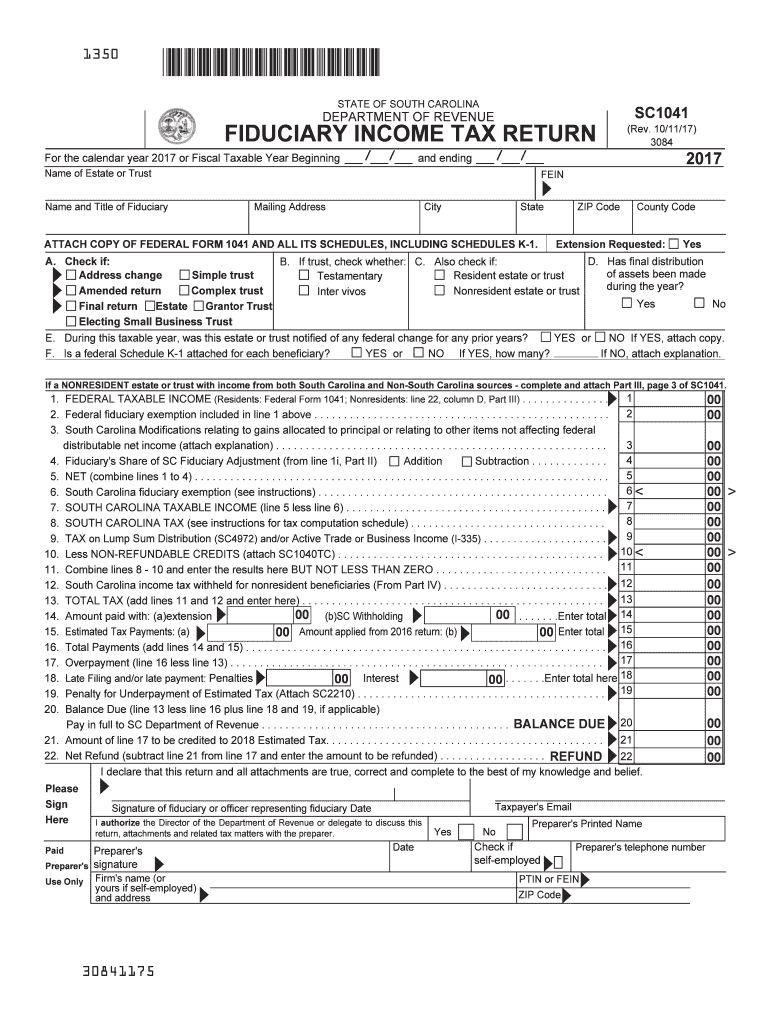

SC DoR SC1041 2017 free printable template

Show details

1. FEDERAL TAXABLE INCOME Residents Federal Form 1041 Nonresidents line 22 column D Part III. 2. Federal fiduciary exemption included in line 1 above. 3. South Carolina Modifications relating to gains allocated to principal or relating to other items not affecting federal distributable net income attach explanation. 4. Fiduciary s Share of SC Fiduciary Adjustment from line 1i Part II Addition Subtraction. 5. NET combine lines 1 to 4. An amended SC1041 must be filed whenever the Internal...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign sc 1041 2017-2019 form

Edit your sc 1041 2017-2019 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sc 1041 2017-2019 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing sc 1041 2017-2019 form online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit sc 1041 2017-2019 form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

The use of pdfFiller makes dealing with documents straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SC DoR SC1041 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out sc 1041 2017-2019 form

How to fill out SC DoR SC1041

01

Start with your personal information including your name, address, and contact details.

02

Specify the type of service or request you are submitting.

03

Provide any identification numbers or relevant account numbers associated with your request.

04

Clearly describe the nature of your request or the information you are providing.

05

Include any additional supporting documents if required.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form.

08

Submit the form as per the instructions provided (by mail, fax, or online if applicable).

Who needs SC DoR SC1041?

01

Individuals or entities seeking to request services or information from the relevant agency.

02

People who need to formalize a request or submit necessary documentation for review.

03

Anyone involved in a case or matter related to the documentation being requested.

Fill

form

: Try Risk Free

People Also Ask about

What is a Form 1041 used for?

The fiduciary of a domestic decedent's estate, trust, or bankruptcy estate files Form 1041 to report: The income, deductions, gains, losses, etc. of the estate or trust. The income that is either accumulated or held for future distribution or distributed currently to the beneficiaries.

Do you have to file an estate tax return in South Carolina?

South Carolina also does not impose an Estate Tax, which is a tax taken from the deceased's estate soon after the loved one has passed.

What are the filing requirements for a 1041 trust?

The Form 1041 filing threshold for any domestic estate is gross income of $600 or more, or when a beneficiary is a resident alien. The Form 1041 filing threshold for a trust is when it has any taxable income for the year, gross income of $600 or more, or a beneficiary who is a resident alien.

Does SC accept federal extension for 1041?

Does South Carolina accept a federal extension? A. If the taxpayer files an extension with the Internal Revenue Service, then the Department accepts the federal extension and will grant an automatic extension of time to file the South Carolina return for the same length of time allowed by the Internal Revenue Service.

Does SC require an estate tax return?

South Carolina also does not impose an Estate Tax, which is a tax taken from the deceased's estate soon after the loved one has passed.

Does South Carolina have an inheritance tax or an estate tax?

South Carolina does not levy an estate or inheritance tax. Large estates may be subject to the federal estate tax, and you may need to pay inheritance if you inherit property from someone who lived in another state. You should also keep in mind that some of your property won't technically be a part of your estate.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send sc 1041 2017-2019 form for eSignature?

When you're ready to share your sc 1041 2017-2019 form, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I make edits in sc 1041 2017-2019 form without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing sc 1041 2017-2019 form and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

Can I sign the sc 1041 2017-2019 form electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your sc 1041 2017-2019 form in minutes.

What is SC DoR SC1041?

SC DoR SC1041 is a form used for reporting specific tax-related information to the South Carolina Department of Revenue.

Who is required to file SC DoR SC1041?

Individuals and entities that meet certain criteria, such as earning income in South Carolina or conducting business within the state, are required to file SC DoR SC1041.

How to fill out SC DoR SC1041?

To fill out SC DoR SC1041, taxpayers should provide accurate information about their income, deductions, and any relevant business activities, following the instructions provided by the South Carolina Department of Revenue.

What is the purpose of SC DoR SC1041?

The purpose of SC DoR SC1041 is to ensure compliance with South Carolina tax laws by reporting income and determining tax liability.

What information must be reported on SC DoR SC1041?

Information that must be reported on SC DoR SC1041 includes taxpayer identification details, total income, deductions, credits being claimed, and any other relevant financial information.

Fill out your sc 1041 2017-2019 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sc 1041 2017-2019 Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.