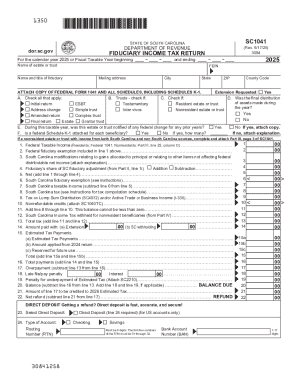

SC DoR SC1041 2022 free printable template

Show details

Estates and trusts with an adjusted gross income of more than 150 000 as shown on the return for the preceding tax year must pay 110 of their prior year s tax liability. To compute adjusted gross income use federal guidelines and make South Carolina adjustments. Failure to meet the estimate requirements may subject the fiduciary to an underpayment penalty. Or Subtraction Adjustments to amount included in federal 1f 2f PART II - ALLOCATION OF SOUTH CAROLINA FIDUCIARY ADJUSTMENT Complete ONLY...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign SC DoR SC1041

Edit your SC DoR SC1041 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your SC DoR SC1041 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing SC DoR SC1041 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit SC DoR SC1041. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SC DoR SC1041 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out SC DoR SC1041

How to fill out SC DoR SC1041

01

Obtain the SC DoR SC1041 form from the official website.

02

Fill in the personal information section including your full name, address, and contact details.

03

Provide the details of the vehicle or property concerned, including make, model, and VIN or property description.

04

Indicate the nature of the request or application you're submitting.

05

Review the form for completeness and accuracy before submitting.

06

Sign and date the form as required.

07

Submit the form via the designated method (online, mail, or in-person) according to the instructions provided.

Who needs SC DoR SC1041?

01

Individuals applying for a Certificate of Title.

02

Owners seeking to register a vehicle or property.

03

Those needing to notify authorities about changes in ownership.

04

Persons involved in legal transactions regarding vehicles or specific properties.

Fill

form

: Try Risk Free

People Also Ask about

What is a Form 1041 used for?

The fiduciary of a domestic decedent's estate, trust, or bankruptcy estate files Form 1041 to report: The income, deductions, gains, losses, etc. of the estate or trust. The income that is either accumulated or held for future distribution or distributed currently to the beneficiaries.

Do you have to file an estate tax return in South Carolina?

South Carolina also does not impose an Estate Tax, which is a tax taken from the deceased's estate soon after the loved one has passed.

What are the filing requirements for a 1041 trust?

The Form 1041 filing threshold for any domestic estate is gross income of $600 or more, or when a beneficiary is a resident alien. The Form 1041 filing threshold for a trust is when it has any taxable income for the year, gross income of $600 or more, or a beneficiary who is a resident alien.

Does SC accept federal extension for 1041?

Does South Carolina accept a federal extension? A. If the taxpayer files an extension with the Internal Revenue Service, then the Department accepts the federal extension and will grant an automatic extension of time to file the South Carolina return for the same length of time allowed by the Internal Revenue Service.

Does SC require an estate tax return?

South Carolina also does not impose an Estate Tax, which is a tax taken from the deceased's estate soon after the loved one has passed.

Does South Carolina have an inheritance tax or an estate tax?

South Carolina does not levy an estate or inheritance tax. Large estates may be subject to the federal estate tax, and you may need to pay inheritance if you inherit property from someone who lived in another state. You should also keep in mind that some of your property won't technically be a part of your estate.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get SC DoR SC1041?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific SC DoR SC1041 and other forms. Find the template you need and change it using powerful tools.

Can I create an eSignature for the SC DoR SC1041 in Gmail?

Create your eSignature using pdfFiller and then eSign your SC DoR SC1041 immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I edit SC DoR SC1041 on an Android device?

The pdfFiller app for Android allows you to edit PDF files like SC DoR SC1041. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is SC DoR SC1041?

SC DoR SC1041 is a form issued by the South Carolina Department of Revenue for reporting certain tax-related information.

Who is required to file SC DoR SC1041?

Individuals or entities that are required to report specific income or tax obligations as mandated by South Carolina tax law must file SC DoR SC1041.

How to fill out SC DoR SC1041?

To fill out SC DoR SC1041, you must provide accurate personal information, report applicable income, and follow the instructions regarding deductions and tax credits as outlined in the form.

What is the purpose of SC DoR SC1041?

The purpose of SC DoR SC1041 is to ensure compliance with South Carolina tax laws by collecting information required for tax assessment and revenue generation.

What information must be reported on SC DoR SC1041?

SC DoR SC1041 requires reporting of income, deductions, credits, and any other pertinent details that may affect an individual’s or entity's tax liability.

Fill out your SC DoR SC1041 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

SC DoR sc1041 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.