SC DoR SC1041 2018 free printable template

Show details

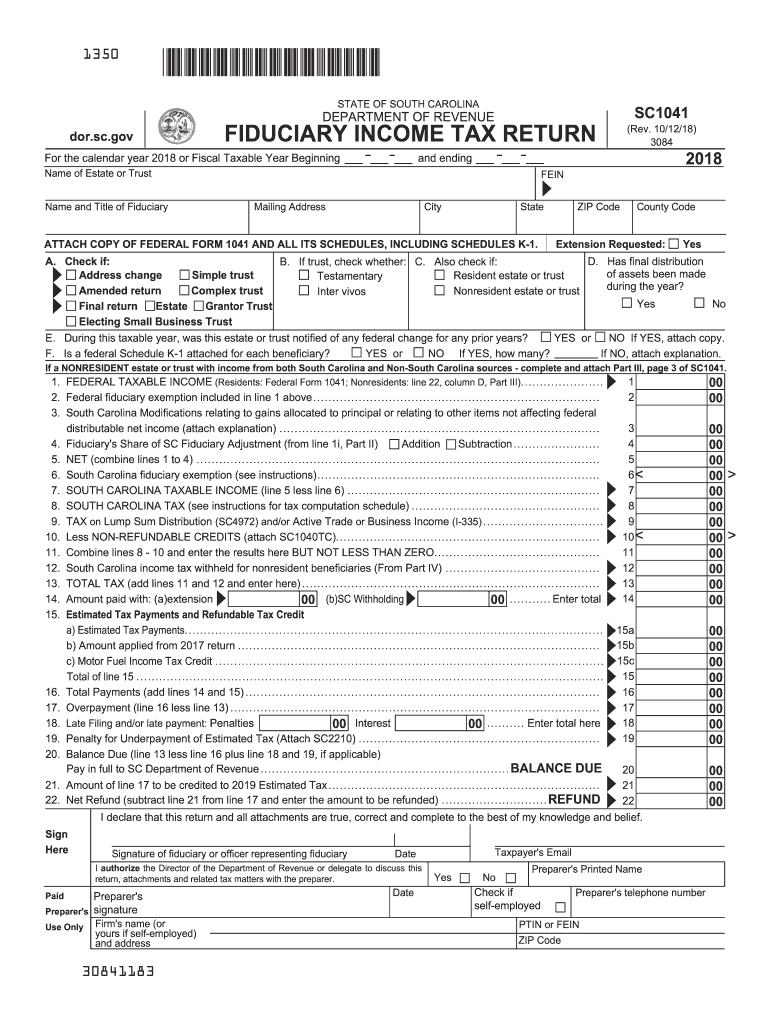

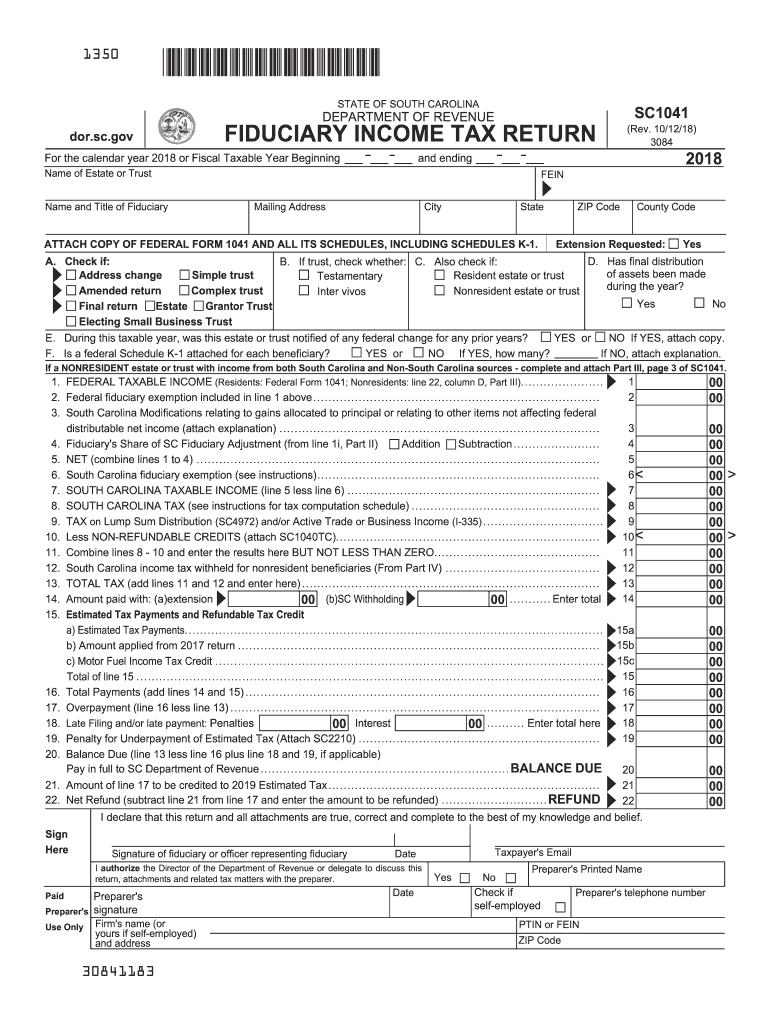

STATE OF SOUTH CAROLINA SC1041 DEPARTMENT OF REVENUE dor. sc.gov FIDUCIARY INCOME TAX RETURN For the calendar year 2018 or Fiscal Taxable Year Beginning - and ending Name of Estate or Trust Name and Title of Fiduciary Rev. 10/12/18 FEIN Mailing Address City State ATTACH COPY OF FEDERAL FORM 1041 AND ALL ITS SCHEDULES INCLUDING SCHEDULES K-1. An amended SC1041 must be filed whenever the Internal Revenue Service adjusts a Federal Form 1041. Attach form I-385 if claiming the refundable Motor...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign 2108 sc 1041

Edit your 2108 sc 1041 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2108 sc 1041 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2108 sc 1041 online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 2108 sc 1041. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SC DoR SC1041 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out 2108 sc 1041

How to fill out SC DoR SC1041

01

Obtain Form SC DoR SC1041 from the official website or relevant office.

02

Fill in your personal details accurately, including your name, address, and contact information.

03

Provide the necessary information regarding the specific issue you are addressing in the form.

04

Include any required documentation or supporting materials as specified in the form instructions.

05

Review the completed form to ensure all information is correct and complete.

06

Sign and date the form where indicated.

07

Submit the form by mail or in person to the designated office.

Who needs SC DoR SC1041?

01

Individuals or organizations required to report specific information to the authorities.

02

Those involved in legal processes that necessitate this form for documentation.

Fill

form

: Try Risk Free

People Also Ask about

Does SC have fillable tax forms?

What is South Carolina Fillable Forms? South Carolina Fillable Forms is a FREE online forms based tool enabling you to: Prepare your South Carolina resident income tax return and limited schedules by filling in your tax information online just like completing a paper return.

What items are added back to your federal taxable income for South Carolina purposes?

Add back any expenses deducted on the federal return related to any income not taxed by South Carolina. Some examples are investment interest to out-of-state partnerships and interest paid to purchase US obligations. Add back foreign area allowances, cost of living allowances, and income from US possessions.

What is the difference between a fiduciary tax return and an estate tax return?

While fiduciary income tax is the income taxation of a person's estate or trust assets, estate tax is a tax on the right to transfer property when a person passes away.

What are additions to federal taxable income?

Adjustments to Income include such items as Educator expenses, Student loan interest, Alimony payments or contributions to a retirement account. Your AGI will never be more than your Gross Total Income on you return and in some cases may be lower. Refer to the 1040 instructions (Schedule 1)PDF for more information.

Does SC accept federal extension for 1041?

Does South Carolina accept a federal extension? A. If the taxpayer files an extension with the Internal Revenue Service, then the Department accepts the federal extension and will grant an automatic extension of time to file the South Carolina return for the same length of time allowed by the Internal Revenue Service.

What items are included in taxable income?

Generally, you must include in gross income everything you receive in payment for personal services. In addition to wages, salaries, commissions, fees, and tips, this includes other forms of compensation such as fringe benefits and stock options.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 2108 sc 1041 for eSignature?

2108 sc 1041 is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I make edits in 2108 sc 1041 without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your 2108 sc 1041, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How do I edit 2108 sc 1041 on an iOS device?

Create, modify, and share 2108 sc 1041 using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

What is SC DoR SC1041?

SC DoR SC1041 is a form used in South Carolina for reporting the income, deductions, and credits of a pass-through entity for state tax purposes.

Who is required to file SC DoR SC1041?

Pass-through entities such as partnerships and S corporations that conduct business in South Carolina and have South Carolina source income are required to file SC DoR SC1041.

How to fill out SC DoR SC1041?

To fill out SC DoR SC1041, you need to provide the entity's identifying information, report income, expenses, and any credits, and ensure that each partner or shareholder's share of income and deductions is correctly calculated.

What is the purpose of SC DoR SC1041?

The purpose of SC DoR SC1041 is to report income and expenses from a pass-through entity so that the income can be taxed appropriately at the individual level by the state of South Carolina.

What information must be reported on SC DoR SC1041?

SC DoR SC1041 requires reporting of the entity's total income, deductions, credits, the names and Tax IDs of partners or shareholders, and the distribution of income and deductions to each individual.

Fill out your 2108 sc 1041 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2108 Sc 1041 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.