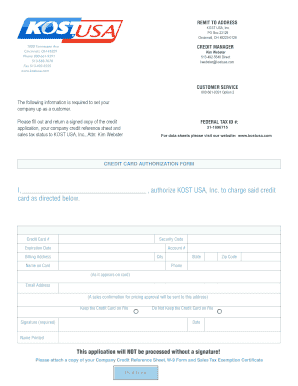

SC DoR SC1041 2021 free printable template

Show details

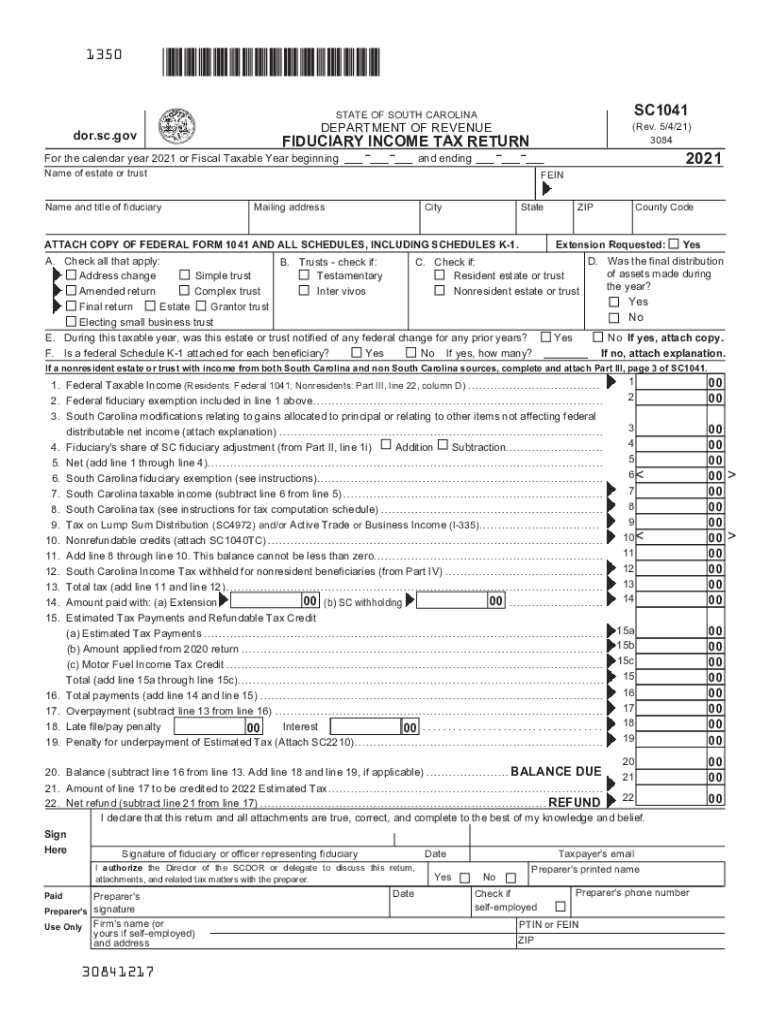

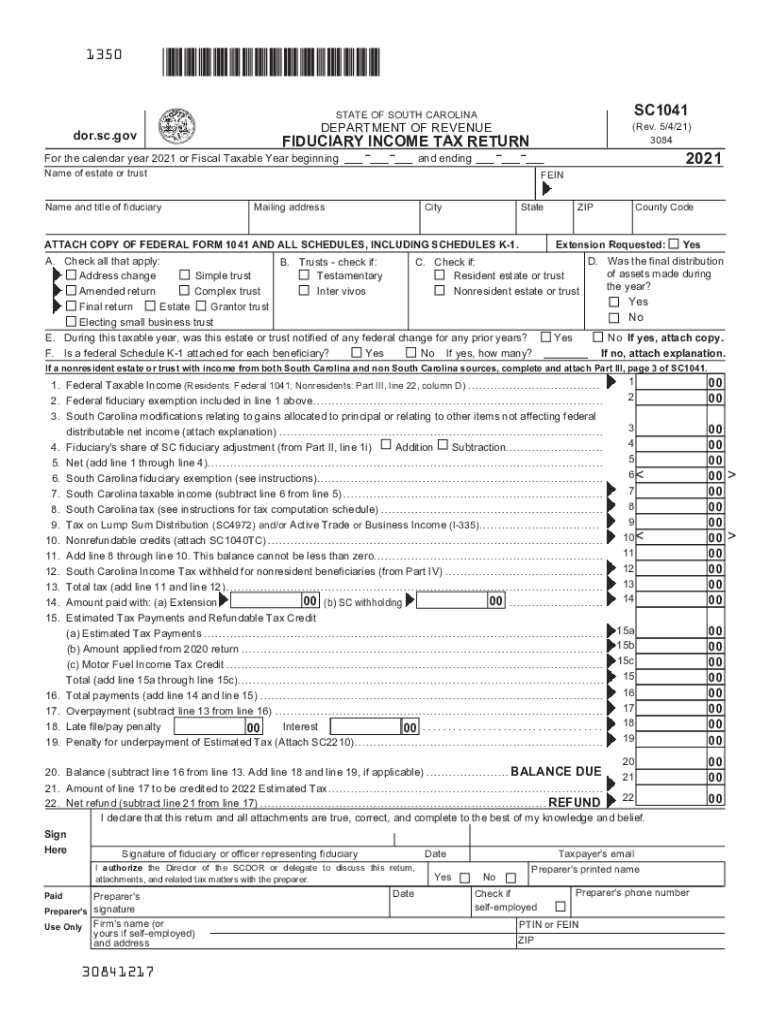

1350SC1041STATE OF South Carolina.SC.department OF REVENUE(Rev. 5/4/21)

3084FIDUCIARY INCOME TAX Returner the calendar year 2021 or Fiscal Taxable Year beginning and ending2021Name of estate or trust

Name

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign sc form 1041

Edit your sc form 1041 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sc form 1041 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing sc form 1041 online

Follow the guidelines below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit sc form 1041. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SC DoR SC1041 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out sc form 1041

How to fill out SC DoR SC1041

01

Obtain the SC DoR SC1041 form from the appropriate authority or website.

02

Fill in your personal information in the designated sections, including name, address, and contact details.

03

Provide specific information related to the purpose of the form, ensuring accuracy in all entries.

04

Attach any required supporting documents as specified in the instructions.

05

Review the form thoroughly for any errors before submission.

06

Submit the completed form through the specified method, either online or by mail, as instructed.

Who needs SC DoR SC1041?

01

Individuals or organizations requiring a change in records related to their legal status.

02

Those who need to report the death, change of address, or other pertinent information to the relevant authorities.

03

Professionals assisting clients in legal matters related to documentation and records.

Fill

form

: Try Risk Free

People Also Ask about

What is a Form 1041 used for?

The fiduciary of a domestic decedent's estate, trust, or bankruptcy estate files Form 1041 to report: The income, deductions, gains, losses, etc. of the estate or trust. The income that is either accumulated or held for future distribution or distributed currently to the beneficiaries.

Do you have to file an estate tax return in South Carolina?

South Carolina also does not impose an Estate Tax, which is a tax taken from the deceased's estate soon after the loved one has passed.

What are the filing requirements for a 1041 trust?

The Form 1041 filing threshold for any domestic estate is gross income of $600 or more, or when a beneficiary is a resident alien. The Form 1041 filing threshold for a trust is when it has any taxable income for the year, gross income of $600 or more, or a beneficiary who is a resident alien.

Does SC accept federal extension for 1041?

Does South Carolina accept a federal extension? A. If the taxpayer files an extension with the Internal Revenue Service, then the Department accepts the federal extension and will grant an automatic extension of time to file the South Carolina return for the same length of time allowed by the Internal Revenue Service.

Does SC require an estate tax return?

South Carolina also does not impose an Estate Tax, which is a tax taken from the deceased's estate soon after the loved one has passed.

Does South Carolina have an inheritance tax or an estate tax?

South Carolina does not levy an estate or inheritance tax. Large estates may be subject to the federal estate tax, and you may need to pay inheritance if you inherit property from someone who lived in another state. You should also keep in mind that some of your property won't technically be a part of your estate.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my sc form 1041 in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your sc form 1041 and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How can I get sc form 1041?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the sc form 1041 in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I fill out sc form 1041 on an Android device?

Complete sc form 1041 and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is SC DoR SC1041?

SC DoR SC1041 is a tax form used in South Carolina for reporting certain types of income, specifically for fiduciaries.

Who is required to file SC DoR SC1041?

Fiduciaries managing estates or trusts in South Carolina are required to file SC DoR SC1041 if the estate or trust has taxable income.

How to fill out SC DoR SC1041?

To fill out SC DoR SC1041, provide details about the fiduciary, the estate or trust, and report income, deductions, and other required financial information.

What is the purpose of SC DoR SC1041?

The purpose of SC DoR SC1041 is to report the income earned by estates and trusts to the South Carolina Department of Revenue.

What information must be reported on SC DoR SC1041?

The SC DoR SC1041 must report the name and address of the estate or trust, the federal identification number, the income and deductions, and any applicable credits.

Fill out your sc form 1041 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sc Form 1041 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.