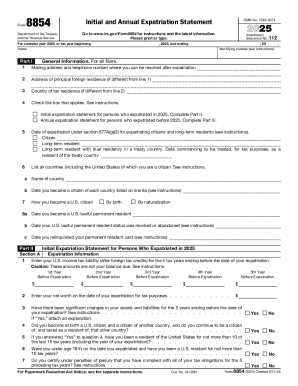

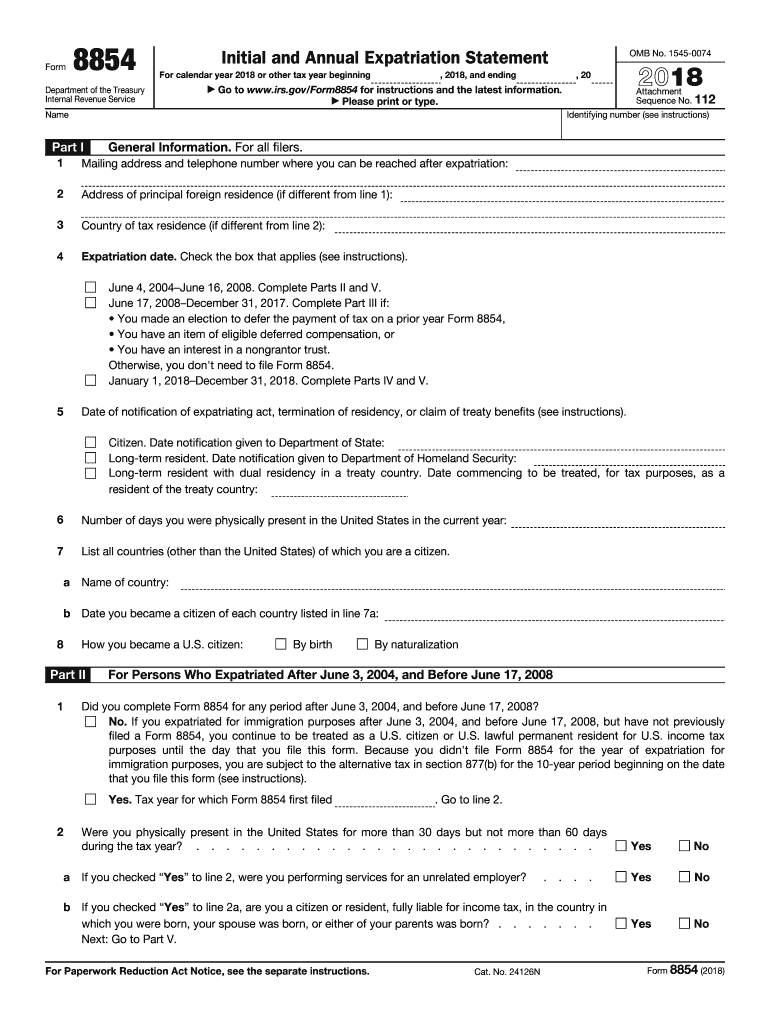

IRS 8854 2018 free printable template

Instructions and Help about IRS 8854

How to edit IRS 8854

How to fill out IRS 8854

About IRS 8 previous version

What is IRS 8854?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 8854

What should I do if I need to correct an error after filing my form 8854?

If you discover an error in your filed form 8854, you should prepare an amended return. You can submit the corrected form 8854 instructions using the standard filing method. Ensure to clearly indicate that it is an amendment, and provide any necessary documentation to support your corrections.

How can I track the status of my submitted form 8854?

To verify the receipt and processing of your form 8854, you can check online through the IRS e-file system if you submitted electronically. Watch for any confirmation emails or correspondence from the IRS, as they may include important information about your submission's status.

What is the retention period for records related to form 8854?

You should retain copies of your completed form 8854 and all supporting documents for at least three years from the date you filed the return or the date it was due, whichever is later. This retention period is crucial in case of any audits or inquiries from the IRS.

Are there any common mistakes to avoid when completing form 8854?

Common errors when filling out form 8854 include incorrect personal information, failing to report all required assets, or leaving necessary sections blank. Review the form carefully and compare it against the instructions to ensure all information is accurate and complete before submission.

What should I do if my e-filed form 8854 is rejected?

If your e-filed form 8854 is rejected, review the rejection notice for specific error codes and guidance on what caused the rejection. Correct the identified issues in your submission and refile promptly to comply with IRS requirements, ensuring that you keep a record of your corrections.