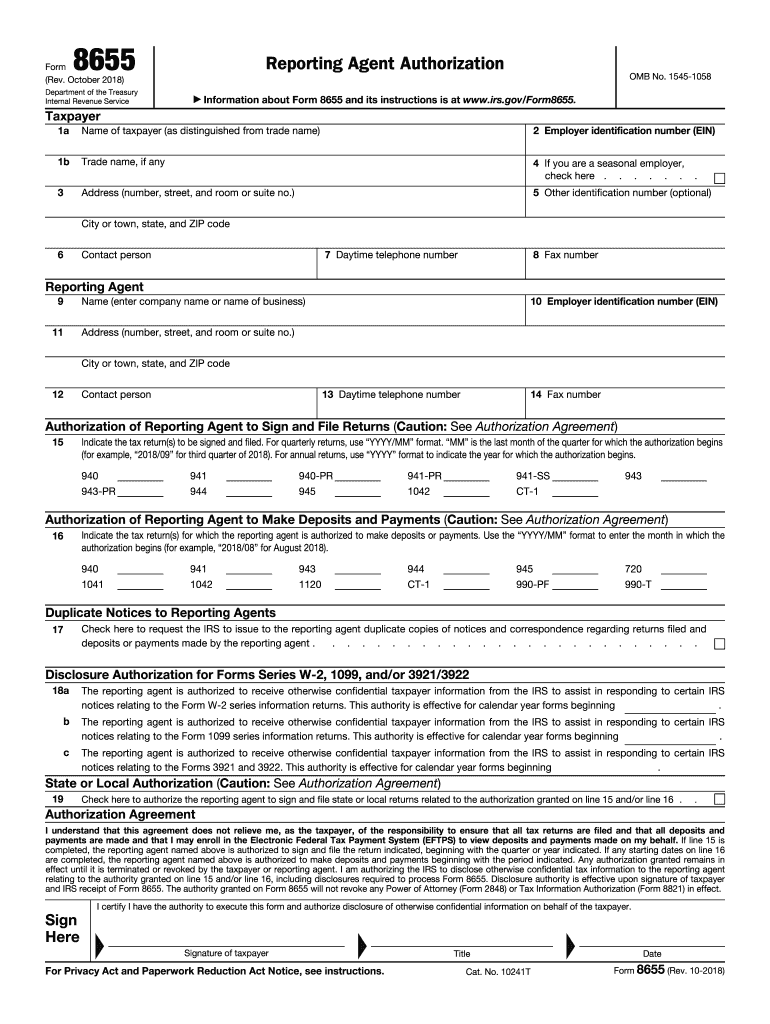

Who Files Form 8655?

The US Internal Revenue Service has created Form 8655 Reporting Agent Authorization for taxpayers that are willing to delegate their duties of filing and paying taxes to a registered authorized agent.

What is Form 8655 for?

The form confirms the eligibility of the agent to submit tax reports and forms, and it also defines the responsibilities of the parties and the scope of duties delegated:

- Signing and filing returns;

- Making deposits and tax payments;

- Receiving duplicate copies of tax information, notices, and other communication concerning any authority granted;

- Providing information to the IRS to assist in penalty relief determinations related to the authority granted on Form 8655.

Does Form 8655 Require the Submission of Other Documents?

As long as Form 8655 is filed with reference to the Forms that the agent will be authorized to file for the taxpayer, it typically does not require submission of any other documents except for the ones agreed on by the parties.

How Long is Form 8655 Effective?

When available on file for the IRS, the Reporting Agent Authorization is in effect unless it is revoked or the agent is substituted by another person. If the taxpayer wants to change the agent, they must file another Form 8655 automatically canceling the previous authorization. If the taxpayer wants to cancel the authorization, Form 8655 must bear “REVOKE” inscription across the whole page of the form and be sent to the IRS.

Where do I File Form 8655?

The filled out document must be signed by the taxpayer and the agent and submitted to the local IRS office.