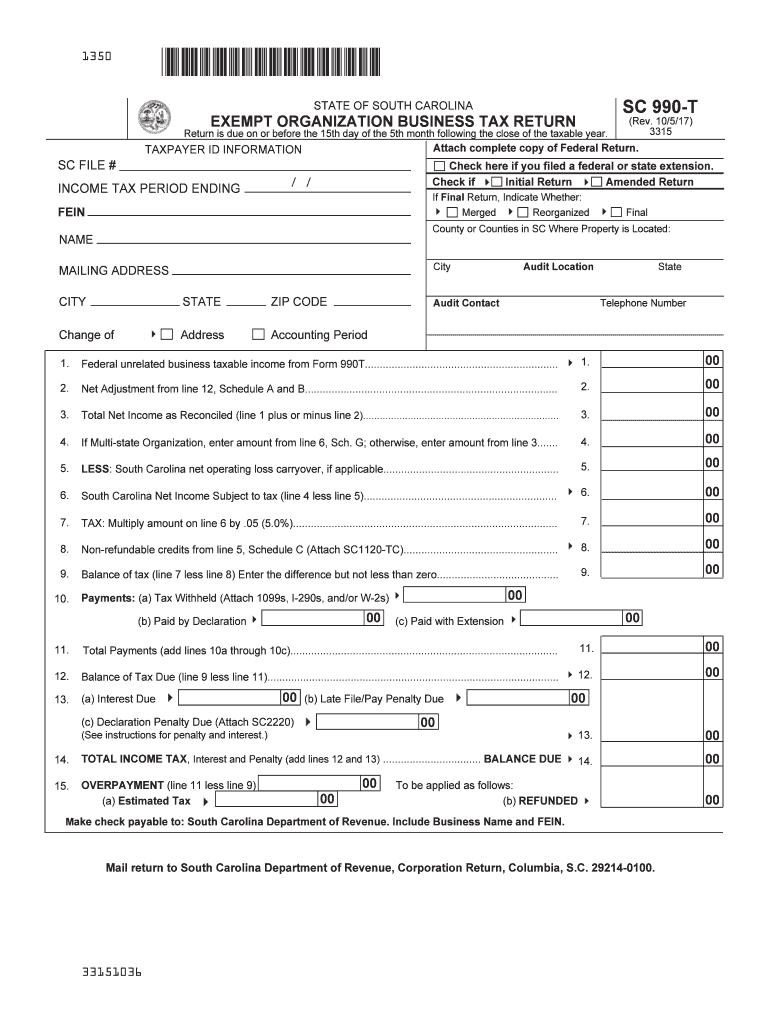

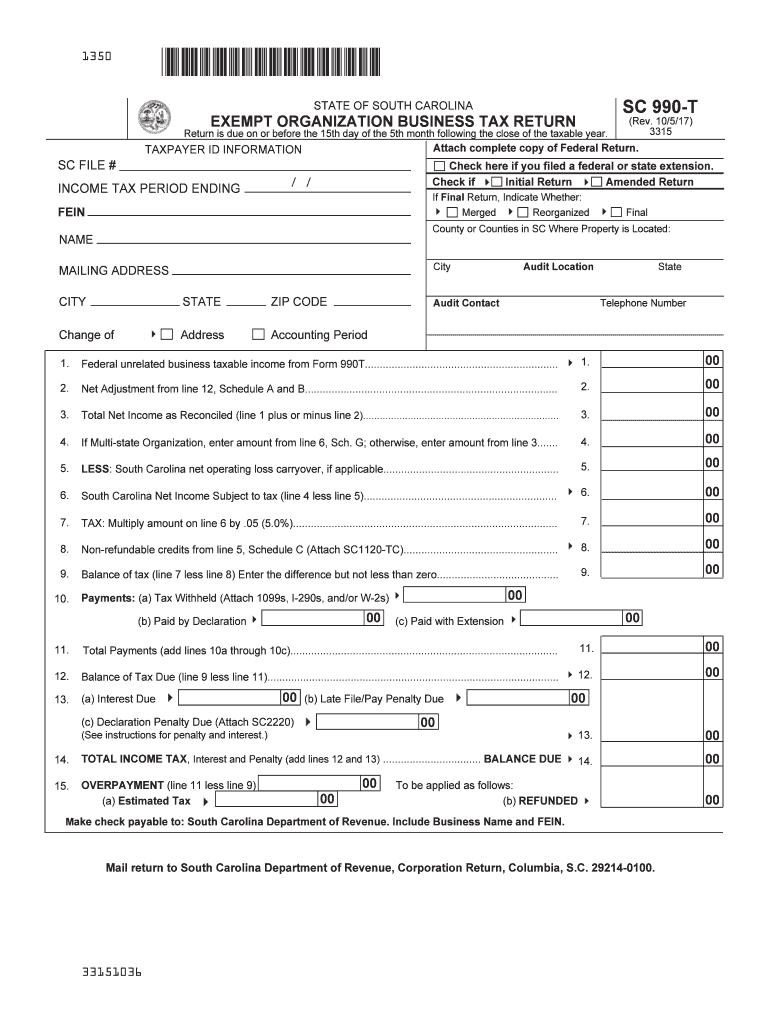

SC DoR SC 990-T 2017 free printable template

Get, Create, Make and Sign sc 990

Editing sc 990 online

Uncompromising security for your PDF editing and eSignature needs

SC DoR SC 990-T Form Versions

How to fill out sc 990

How to fill out SC DoR SC 990-T

Who needs SC DoR SC 990-T?

Instructions and Help about sc 990

Hello everyone this is quoted giving you game 3 in a series between TO versus trickster game 3 taking place on metal Polish and this series has been great so far polo spotting as the red Terran player here at the three o'clock location tricks responding at the twelve o clock location as the blue protons Terran vs protons once more this time on metal Polish, and we'll see how these players will play out this map now this is going to be relatively close air spawns or the closest a response that you can get here on metal Polish Oh Banshee harassment may become a factor now based upon the openings here and the chance for Bennie harassment I expect to trick Strop to open up with a one gate into a robotics facility for that really observer and a couple stalkers now we'll see what To try to do in this matchup he can either go down that Banshee route or you could try to change it up and go into the barracks with stem and put a lot of early pressure down with one to two medieval and if tricksters does not respond correctly, and he doesn't have enough units to really fight back if he gets too many observers or doesn't have enough gateways he's not going to be able to macro up a large enough army, and we'll see what will be going in here TO now chasing away a probe we are getting that all importing gas in play TO most likely knows exactly where trickster has spawn SCV and probe of battling and output the probe smart enough to say hey you know what I'm going to take some real damage let me back out a here man I do not want to take any real damage as the SCV now comes in a fresh SCV now comes over to try to handle this pro, but the probe shields have already fully regenerated and now just continuing to wander around once more now we are going to see a marine adding to this group are ready the Marine going to be fighting against this one particular a probe the probe realizes this realizes that realizes this and decides the back out we are getting that cybernetics core the second pylon already up so a very standard build order pile on gateway a simulator pylon cybernetics core from trickster, and then it will be important to see whether he gets that second a simulator and when he does have that second a simulator what he uses and what his next building will in fact be we can see that tricks are now saving up a lot of energy on this nexus so he may be dumping this straight into the gateway and this is going to be very interesting to see if the or sorry into the cybernetics core for warp gate check as soon as it's ready so there you go he is now I'm dumping that out, and he is also throne boosting out of stalker now Corona blue see now the stalker is one of those things where I'm let part of me is kind of split 50-50 on whether you want a throne boost out that initial stalker but because trickster is going to be opening up with that zealot stalker pressure it does make a lot of sense as that stalker arrives to the party 10 seconds earlier act off of one throne...

People Also Ask about

Do you have to pay state taxes in South Carolina?

Do I need to file a return Social Security?

Does South Carolina allow consolidated returns?

Who can file a South Carolina composite return?

Do you have to file a state tax return in South Carolina?

Does South Carolina have state income tax form?

Do seniors have to file taxes in South Carolina?

Who must file a SC return?

Do you have to file taxes on Social Security?

Is there a South Carolina state tax form?

Where do I file SC 990 T?

Who is required to file SC tax return?

Do I need to file a SC return?

Who is not required to file a return?

Does South Carolina have a state tax withholding form?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my sc 990 directly from Gmail?

How can I send sc 990 to be eSigned by others?

Can I edit sc 990 on an Android device?

What is SC DoR SC 990-T?

Who is required to file SC DoR SC 990-T?

How to fill out SC DoR SC 990-T?

What is the purpose of SC DoR SC 990-T?

What information must be reported on SC DoR SC 990-T?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.