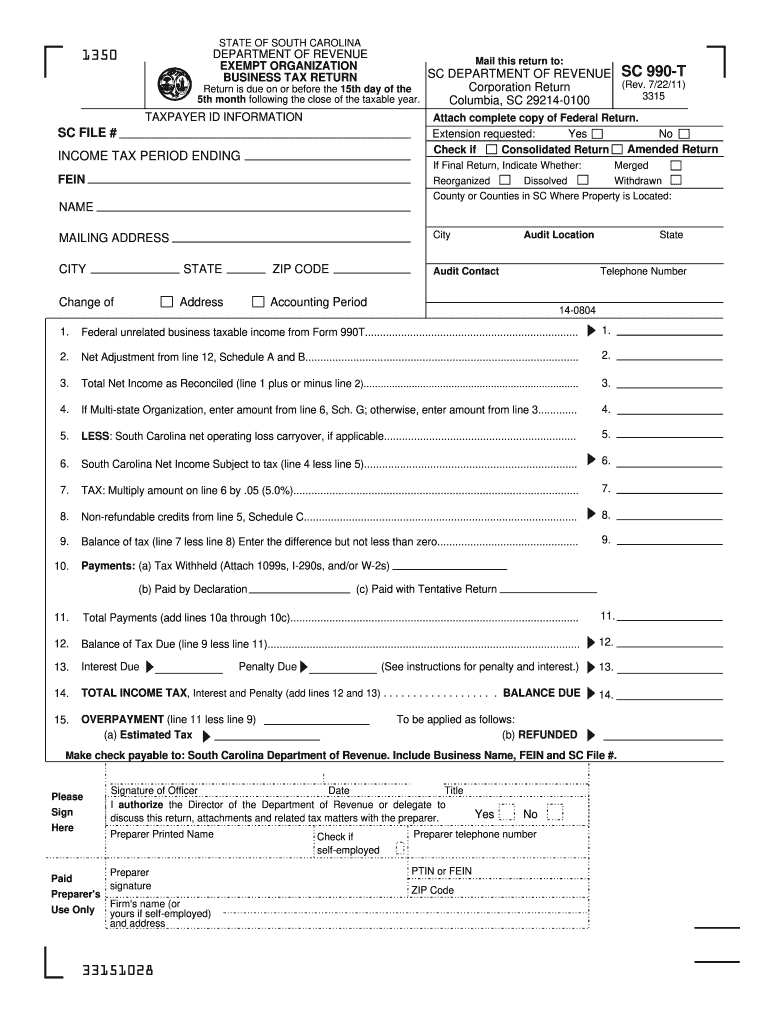

SC DoR SC 990-T 2011 free printable template

Show details

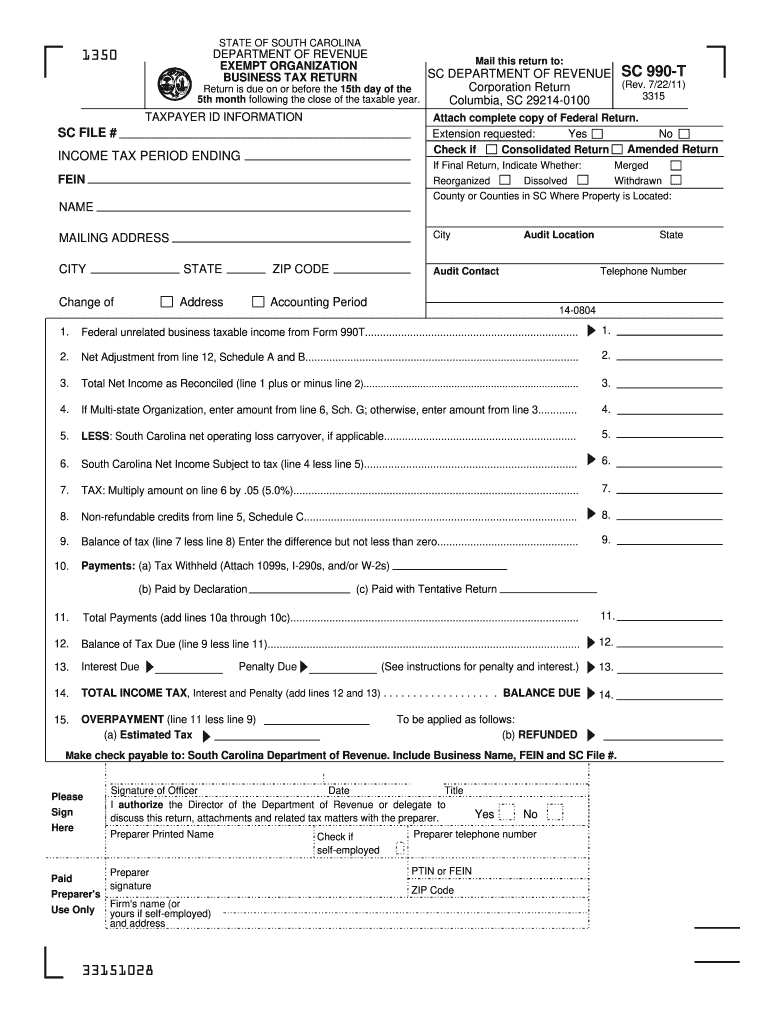

22 Jul 2011 ... 33151028. Federal unrelated business taxable income from Form 990T. .... Carolina taxable income plus or minus the modifications required by state law. For information on these state.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign sc990 t 2011 form

Edit your sc990 t 2011 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sc990 t 2011 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit sc990 t 2011 form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit sc990 t 2011 form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SC DoR SC 990-T Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out sc990 t 2011 form

How to fill out SC DoR SC 990-T

01

Obtain the SC DoR SC 990-T form from the South Carolina Department of Revenue website.

02

Fill in your organization's name, address, and federal employer identification number (EIN) at the top of the form.

03

Complete the income section by listing all unrelated business taxable income your organization has earned.

04

Deduct any allowable expenses directly related to the income reported in the previous step.

05

Calculate the net unrelated business taxable income by subtracting the expenses from the income.

06

Determine the tax liability using the rates provided in the instructions for the form.

07

Fill out any additional schedules or attachments necessary for reporting specific types of income or deductions.

08

Review your completed form for accuracy and ensure all required signatures are included.

09

Submit the form to the South Carolina Department of Revenue by the deadline, either electronically or via mail.

Who needs SC DoR SC 990-T?

01

Organizations that have gross unrelated business taxable income of $1,000 or more during the tax year.

02

Non-profit entities that operate income-generating activities that are not substantially related to their exempt purpose.

03

Charitable organizations, educational institutions, and other exempt entities that must report and pay taxes on their unrelated business income.

Fill

form

: Try Risk Free

People Also Ask about

Do you have to pay state taxes in South Carolina?

South Carolina's general state Sales and Use Tax rate is 6%. In certain counties, local Sales and Use Taxes are imposed in addition to the 6% state rate. The general local Sales and Use Tax collected on behalf of local jurisdictions is for school projects, road improvements, capital projects, and other purposes.

Do I need to file a return Social Security?

However, if Social Security is your sole source of income, then you don't need to file a tax return. If the only income you receive is your Social Security benefits, then you typically don't have to file a federal income tax return.

Does South Carolina allow consolidated returns?

A consolidated return must include the income allocated to South Carolina and the calculation of a separate License Fee for the parent and each subsidiary. A separate annual report and profit-and-loss statement are also required using each member's own apportionment ratio.

Who can file a South Carolina composite return?

A composite return is a single return filed by a partnership, S corporation, or Limited Liability Company (LLC) taxed as a partnership or S corporation on behalf of two or more nonresident participants.

Do you have to file a state tax return in South Carolina?

Do I need to file a South Carolina return? If you are a South Carolina resident, you are generally required to file a South Carolina Income Tax return if you are required to file a federal return.

Does South Carolina have state income tax form?

South Carolina Income Taxes and SC State Tax Forms. South Carolina State Income Taxes for Tax Year 2022 (January 1 - Dec. 31, 2022) can be completed and e-Filed now along with a Federal or IRS Income Tax Return (or you can learn how to only prepare and file a SC state return).

Do seniors have to file taxes in South Carolina?

South Carolina taxpayers ages 65 and older do not need to file a state income tax return. In addition, Social Security benefits are not taxed by the state of South Carolina. Overall, Kiplinger rates South Carolina as a tax-friendly state for retirees.

Who must file a SC return?

ing to South Carolina Instructions for Form SC 1040, you must file a South Carolina income tax return if: You are a RESIDENT and: You filed a federal return with income that was taxable by South Carolina.

Do you have to file taxes on Social Security?

You must pay taxes on up to 85% of your Social Security benefits if you file a: Federal tax return as an “individual” and your “combined income” exceeds $25,000. Joint return, and you and your spouse have “combined income” of more than $32,000.

Is there a South Carolina state tax form?

These 2021 forms and more are available: South Carolina Form 1040 – Personal Income Tax Return for Residents. South Carolina Schedule NR – Nonresident Schedule. South Carolina Form 1040/Schedule NR – Additions and Subtractions.

Where do I file SC 990 T?

Mail return to South Carolina Department of Revenue, Corporation Return, Columbia, S.C. 29214-0100.

Who is required to file SC tax return?

ing to South Carolina Instructions for Form SC 1040, you must file a South Carolina income tax return if: You are a RESIDENT and: You filed a federal return with income that was taxable by South Carolina. You had South Carolina income taxes withheld from your wages.

Do I need to file a SC return?

Do I need to file a South Carolina return? If you are a South Carolina resident, you are generally required to file a South Carolina Income Tax return if you are required to file a federal return.

Who is not required to file a return?

Under age 65. Single. Don't have any special circumstances that require you to file (like self-employment income) Earn less than $12,950 (which is the 2022 standard deduction for a single taxpayer)

Does South Carolina have a state tax withholding form?

Complete the SC W-4 so your employer can withhold the correct South Carolina Income Tax from your pay. If you have too much tax withheld, you will receive a refund when you file your tax return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my sc990 t 2011 form directly from Gmail?

sc990 t 2011 form and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How do I complete sc990 t 2011 form online?

Easy online sc990 t 2011 form completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

Can I sign the sc990 t 2011 form electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your sc990 t 2011 form.

What is SC DoR SC 990-T?

SC DoR SC 990-T is a tax form used by organizations in South Carolina to report unrelated business income and calculate the tax owed on that income.

Who is required to file SC DoR SC 990-T?

Organizations that have gross income from unrelated business activities exceeding $1,000 are required to file SC DoR SC 990-T.

How to fill out SC DoR SC 990-T?

To fill out SC DoR SC 990-T, organizations must provide information about their unrelated business income, deductions, and other relevant financial details as required by the form.

What is the purpose of SC DoR SC 990-T?

The purpose of SC DoR SC 990-T is to ensure that organizations pay taxes on income generated from activities not directly related to their exempt purposes.

What information must be reported on SC DoR SC 990-T?

The information required on SC DoR SC 990-T includes details of unrelated business income, expenses, and the resulting taxable income along with identification of the organization.

Fill out your sc990 t 2011 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

sc990 T 2011 Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.