SC DoR SC 990-T 2014 free printable template

Show details

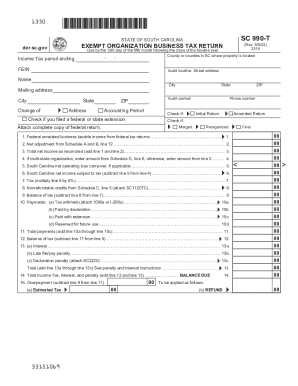

STATE OF SOUTH CAROLINA DEPARTMENT OF REVENUE EXEMPT ORGANIZATION BUSINESS TAX RETURN 1350 Mail this return to: SC DEPARTMENT OF REVENUE SC 990-T (Rev. 6/12/14) Corporation Return is due on or before

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign form sc 990 t

Edit your form sc 990 t form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form sc 990 t form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form sc 990 t online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form sc 990 t. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SC DoR SC 990-T Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out form sc 990 t

How to fill out SC DoR SC 990-T

01

Begin by gathering all necessary financial information for the tax year.

02

Fill out the identifying information at the top of the form, including your name and address.

03

Calculate the unrelated business taxable income (UBTI) and enter it in the appropriate section.

04

Complete any applicable deductions and adjustments to UBTI.

05

Determine the final tax liability based on UBTI.

06

Fill out any additional schedules or forms required for your specific situation.

07

Review the completed form for accuracy and completeness.

08

Sign and date the form before submitting it to the appropriate state department.

Who needs SC DoR SC 990-T?

01

Non-profit organizations that engage in unrelated business activities and have generated income that is subject to taxation.

02

Any organization required to report and pay tax on unrelated business income in South Carolina.

Fill

form

: Try Risk Free

People Also Ask about

Do you have to pay state taxes in South Carolina?

South Carolina's general state Sales and Use Tax rate is 6%. In certain counties, local Sales and Use Taxes are imposed in addition to the 6% state rate. The general local Sales and Use Tax collected on behalf of local jurisdictions is for school projects, road improvements, capital projects, and other purposes.

Do I need to file a return Social Security?

However, if Social Security is your sole source of income, then you don't need to file a tax return. If the only income you receive is your Social Security benefits, then you typically don't have to file a federal income tax return.

Does South Carolina allow consolidated returns?

A consolidated return must include the income allocated to South Carolina and the calculation of a separate License Fee for the parent and each subsidiary. A separate annual report and profit-and-loss statement are also required using each member's own apportionment ratio.

Who can file a South Carolina composite return?

A composite return is a single return filed by a partnership, S corporation, or Limited Liability Company (LLC) taxed as a partnership or S corporation on behalf of two or more nonresident participants.

Do you have to file a state tax return in South Carolina?

Do I need to file a South Carolina return? If you are a South Carolina resident, you are generally required to file a South Carolina Income Tax return if you are required to file a federal return.

Does South Carolina have state income tax form?

South Carolina Income Taxes and SC State Tax Forms. South Carolina State Income Taxes for Tax Year 2022 (January 1 - Dec. 31, 2022) can be completed and e-Filed now along with a Federal or IRS Income Tax Return (or you can learn how to only prepare and file a SC state return).

Do seniors have to file taxes in South Carolina?

South Carolina taxpayers ages 65 and older do not need to file a state income tax return. In addition, Social Security benefits are not taxed by the state of South Carolina. Overall, Kiplinger rates South Carolina as a tax-friendly state for retirees.

Who must file a SC return?

ing to South Carolina Instructions for Form SC 1040, you must file a South Carolina income tax return if: You are a RESIDENT and: You filed a federal return with income that was taxable by South Carolina.

Do you have to file taxes on Social Security?

You must pay taxes on up to 85% of your Social Security benefits if you file a: Federal tax return as an “individual” and your “combined income” exceeds $25,000. Joint return, and you and your spouse have “combined income” of more than $32,000.

Is there a South Carolina state tax form?

These 2021 forms and more are available: South Carolina Form 1040 – Personal Income Tax Return for Residents. South Carolina Schedule NR – Nonresident Schedule. South Carolina Form 1040/Schedule NR – Additions and Subtractions.

Where do I file SC 990 T?

Mail return to South Carolina Department of Revenue, Corporation Return, Columbia, S.C. 29214-0100.

Who is required to file SC tax return?

ing to South Carolina Instructions for Form SC 1040, you must file a South Carolina income tax return if: You are a RESIDENT and: You filed a federal return with income that was taxable by South Carolina. You had South Carolina income taxes withheld from your wages.

Do I need to file a SC return?

Do I need to file a South Carolina return? If you are a South Carolina resident, you are generally required to file a South Carolina Income Tax return if you are required to file a federal return.

Who is not required to file a return?

Under age 65. Single. Don't have any special circumstances that require you to file (like self-employment income) Earn less than $12,950 (which is the 2022 standard deduction for a single taxpayer)

Does South Carolina have a state tax withholding form?

Complete the SC W-4 so your employer can withhold the correct South Carolina Income Tax from your pay. If you have too much tax withheld, you will receive a refund when you file your tax return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit form sc 990 t from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your form sc 990 t into a fillable form that you can manage and sign from any internet-connected device with this add-on.

Can I create an electronic signature for signing my form sc 990 t in Gmail?

Create your eSignature using pdfFiller and then eSign your form sc 990 t immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I complete form sc 990 t on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your form sc 990 t from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is SC DoR SC 990-T?

SC DoR SC 990-T is a tax form used by certain organizations in South Carolina to report unrelated business income and calculate the tax owed on that income.

Who is required to file SC DoR SC 990-T?

Organizations that are exempt from federal income tax but have unrelated business income of $1,000 or more during the tax year are required to file SC DoR SC 990-T.

How to fill out SC DoR SC 990-T?

To fill out SC DoR SC 990-T, organizations must provide information about their unrelated business income, expenses associated with that income, and the total taxable income, along with the necessary schedules and supporting documentation.

What is the purpose of SC DoR SC 990-T?

The purpose of SC DoR SC 990-T is to ensure that tax-exempt organizations report and pay taxes on their unrelated business income, thus complying with state tax laws.

What information must be reported on SC DoR SC 990-T?

SC DoR SC 990-T requires organizations to report details such as the type of unrelated business activities, the gross income from those activities, expenses incurred, and the resulting net income or loss.

Fill out your form sc 990 t online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form Sc 990 T is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.