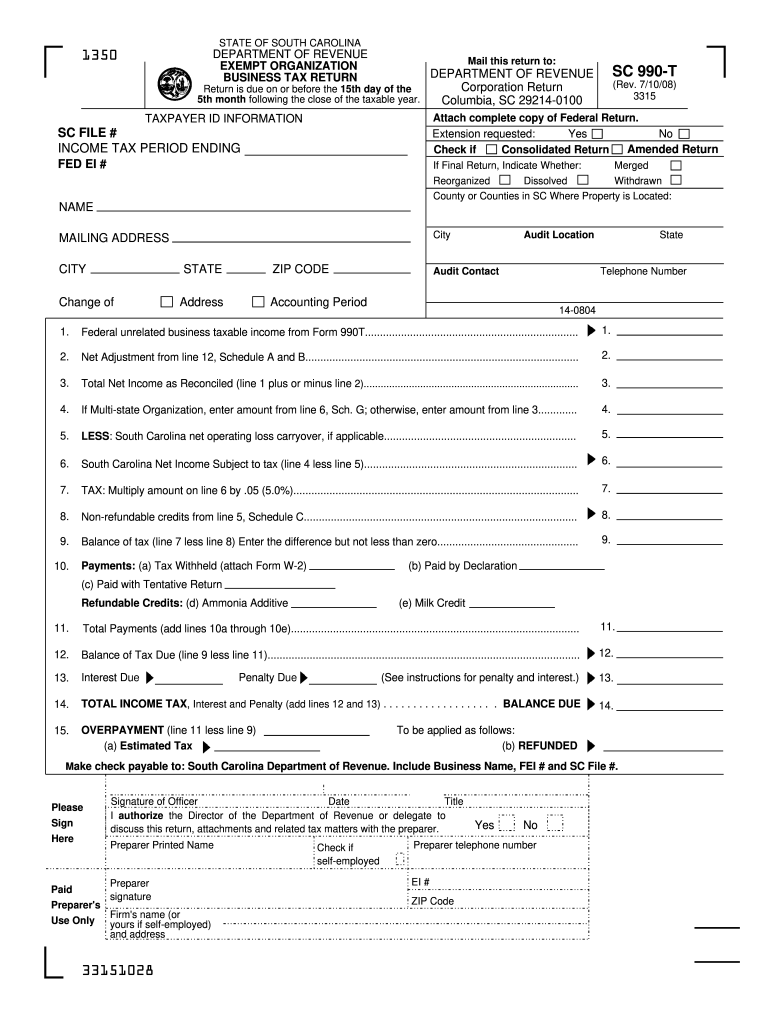

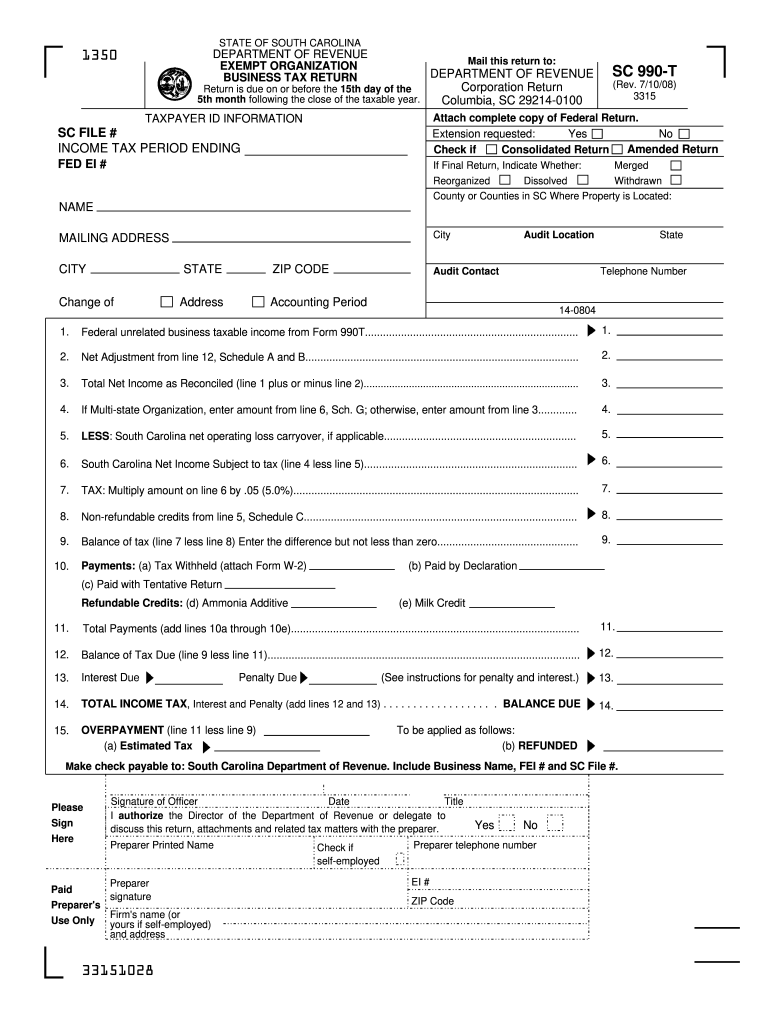

SC DoR SC 990-T 2008 free printable template

Show details

Tax line 7 SC990-T. Lesser of line 3 or 4 enter on line 8 SC990-T NOTE Should agree to SC1120-TC Column C line 16. Starting with year 1992 unrelated business income will be reported on SC990-T. 33153024 INSTRUCTIONS - EXEMPT ORGANIZATIONS Filing Requirements - In general every corporation or unincorporated entity operating in South Carolina that is required to file federal Form 990-T to report unrelated business income must file SC990-T with the South Carolina Department of Revenue. For...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign 47110 form 990-t processinginternal

Edit your 47110 form 990-t processinginternal form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 47110 form 990-t processinginternal form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 47110 form 990-t processinginternal online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit 47110 form 990-t processinginternal. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SC DoR SC 990-T Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out 47110 form 990-t processinginternal

How to fill out SC DoR SC 990-T

01

Obtain the SC DoR SC 990-T form from the South Carolina Department of Revenue website or local office.

02

Review the instructions provided with the form carefully.

03

Fill out your organization's information at the top of the form, including the name, address, and tax identification number.

04

Complete the income section by reporting all unrelated business taxable income, if applicable.

05

Deduct any allowable expenses related to the unrelated business income.

06

Calculate the tax owed based on the net income reported.

07

Sign and date the form at the bottom.

08

Submit the completed form to the South Carolina Department of Revenue by the due date, along with any required payment.

Who needs SC DoR SC 990-T?

01

Non-profit organizations that have unrelated business income exceeding a certain threshold need to file SC DoR SC 990-T.

02

Any organization operating in South Carolina that earns income from activities not substantially related to their exempt purpose may need to file this form.

Fill

form

: Try Risk Free

People Also Ask about

Who is responsible for filing Form 990-T?

The custodian, FMTC, is responsible for filing a Form 990-T on behalf of each retirement account.

Does my IRA need to file 990-T?

Tax considerations UBTI is subject to taxation in all varieties of retirement accounts, such as IRAs, retirement plans like Keoghs, and health savings accounts (HSA). When total positive UBTI across all applicable investments held in a retirement account equals $1,000 or more, then Form 990-T must be filed.

Is 990-T required to be filed?

15th day of 4th month or 15th day of 5th month. An employees' trust defined in section 401(a), an IRA (including SEPs and SIMPLEs), a Roth IRA, a Coverdell ESA, or an Archer MSA must file Form 990-T by the 15th day of the 4th month after the end of its tax year.

Where do I send my 990-T?

Mail your IRS Form 990 to the below address: Department of the Treasury, Internal Revenue Service Center, Ogden, UT 84201-0027.

Who files 990-T for an IRA?

If you hold assets in a self-directed IRA or HSA account and you haven't done so already, you'll soon be grappling with a Form 990T (Form 990-T) for this tax season. A 990T is the form IRA holders must use to report their retirement account assets.

How do I fill out a 990-T?

990-T filing Instructions Line 1 - Total of Unrelated Business Taxable Income computed from all Unrelated Trades or Businesses. Line 2 - Reserved for future use. Line 4 - Charitable Contributions. Line 5 - Total of Unrelated Business Taxable Income before Net operating Losses. Line 6 - Deduction for Net Operating Loss.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 47110 form 990-t processinginternal for eSignature?

Once your 47110 form 990-t processinginternal is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I make changes in 47110 form 990-t processinginternal?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your 47110 form 990-t processinginternal to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I fill out 47110 form 990-t processinginternal using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign 47110 form 990-t processinginternal and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is SC DoR SC 990-T?

SC DoR SC 990-T is a South Carolina tax form used to report unrelated business income for tax-exempt organizations.

Who is required to file SC DoR SC 990-T?

Tax-exempt organizations that generate unrelated business income are required to file SC DoR SC 990-T.

How to fill out SC DoR SC 990-T?

To fill out SC DoR SC 990-T, organizations must provide their identification details, report their unrelated business income, calculate the tax owed, and supply any necessary supporting documentation.

What is the purpose of SC DoR SC 990-T?

The purpose of SC DoR SC 990-T is to ensure that tax-exempt organizations pay tax on income that is not related to their tax-exempt purpose.

What information must be reported on SC DoR SC 990-T?

Information that must be reported includes the organization's name and EIN, total unrelated business income, deductions, tax computation, and any credits being claimed.

Fill out your 47110 form 990-t processinginternal online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

47110 Form 990-T Processinginternal is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.