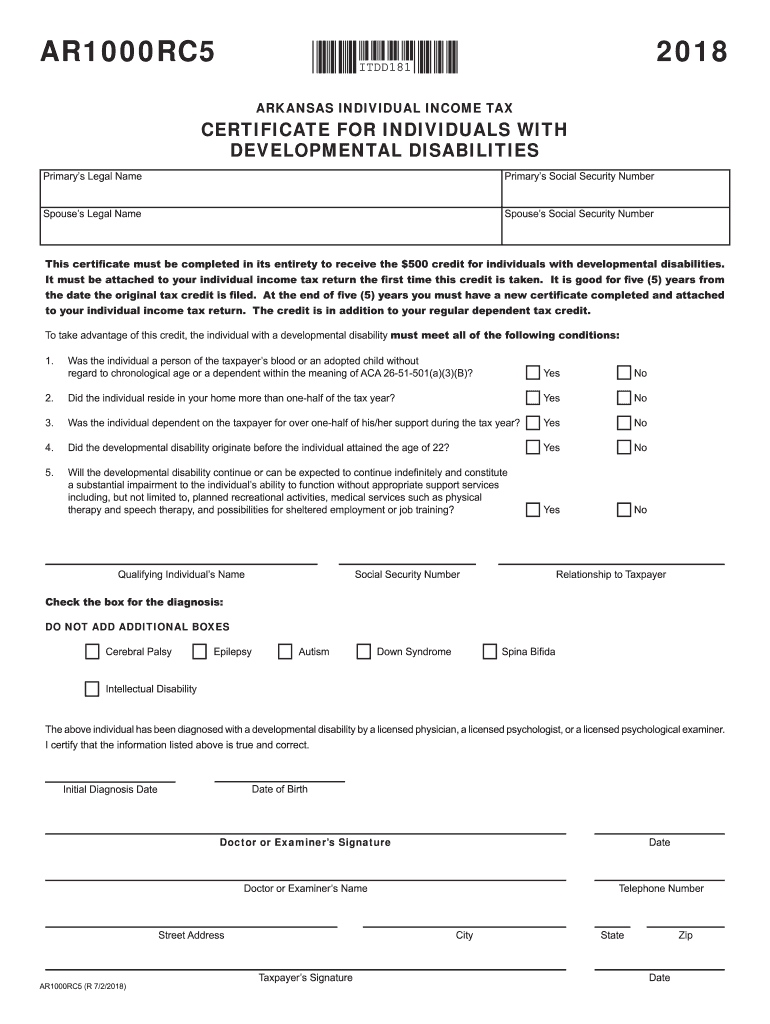

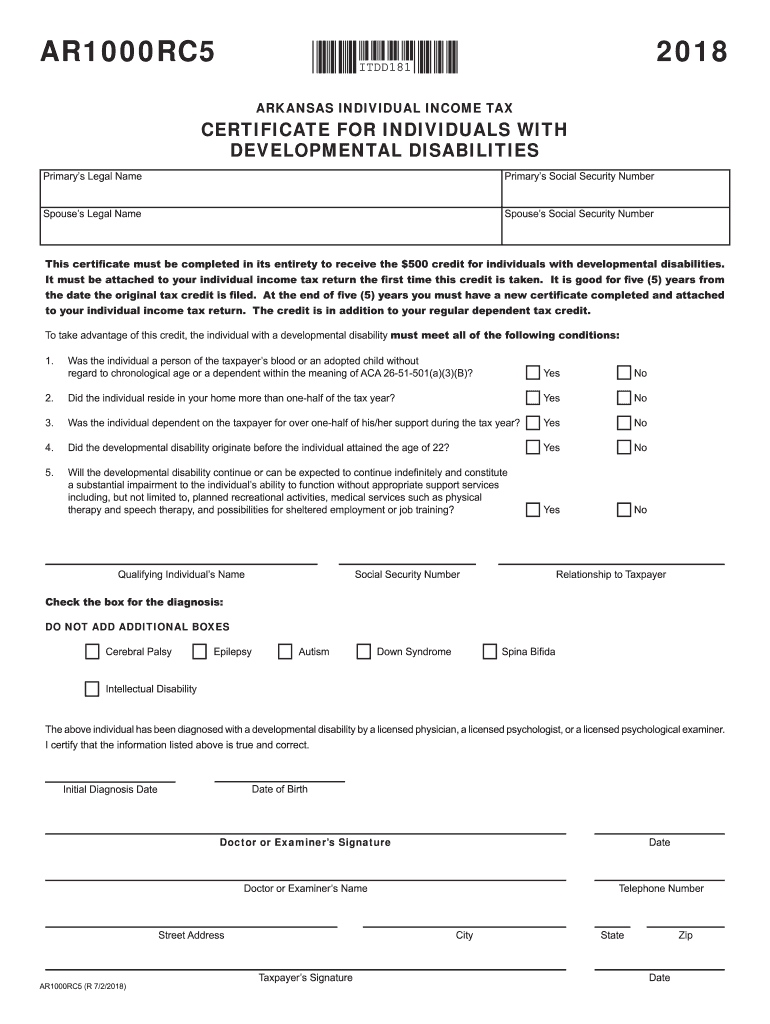

AR AR1000-DD (Formerly AR1000RC5) 2018 free printable template

Get, Create, Make and Sign arkansas tax form ar1000rc5

Editing arkansas tax form ar1000rc5 online

Uncompromising security for your PDF editing and eSignature needs

AR AR1000-DD (Formerly AR1000RC5) Form Versions

How to fill out arkansas tax form ar1000rc5

How to fill out AR AR1000-DD (Formerly AR1000RC5)

Who needs AR AR1000-DD (Formerly AR1000RC5)?

Instructions and Help about arkansas tax form ar1000rc5

Hi this is Missy and Lance with autism playbook and Arkansas friends we have something pretty special for you today, and we were meeting with some Isis and parents this morning and the subject of tax preparation and tax filing came up today, and we were talking about the season hopefully you haven't filed your taxes before you see this video, so we were talking about how we know of tax credit for families of kids with autism and other disabilities and people are pretty interested in that not everyone knew about it, so we thought we would make a video explaining it, so that is what Lance is going to do this video is specifically for families in Arkansas and Lance is going to do some digging and see if you can find out stuff from other states yes you can try to search through Arkansas so go ahead laughs all right so lets just dive right into this is a 500 a year credit for individuals with developmental disabilities including autism and I just want to show you how to claim it I mean we just we want to claim that credit right so um first you're going to file your taxes however you normally would so if you do it by yourself with tax software or use a CPA or tax repair file them how you normally would but when you're in the Arkansas area of the questionnaire go into the Arkansas credits section and look for a credit for individuals with developmental disabilities, so that is this credit check whatever box you need to claim the 500 credit then you're going to need to Google and your tax software you may provide it, but you're going to need a physical copy of form AR 1000 rc5 I'm just going to go out and show that to you Music okay so here is that RC five into your what you'll do is fill this out with the fields electronically that allow you to as much as you can to put in all this information you're going to have to answer these five questions these are what qualify you for the credit if you have a child living in your house your child living in your house that you provide support for that has autism in the state of Arkansas its highly likely that you answer yes to all these and qualify for the credit fill out the children name all that information and then there's actually a box to check for autism then print this form you sign it and take it into your children pediatrician who should have your children autism diagnosis on file they will put in the diagnosis state and sign the form and then and then you're done so its quite simple then, so you'll file your return if this is the first year you're claiming that credit you'll actually have to physically mail that form into the state of Arkansas now you can go ahead and file and do everything like you normally do so our first year claiming this credit I just thought we had to have it on file, and so I II filed claiming the credit and Arkansas sent me a note that said hey you actually if its in not form it, so I did, and we got our 500 um and you, but you only have to actually do that piece every five...

People Also Ask about

How much does a tax ID number cost in Arkansas?

What is the form for Arkansas state tax extension?

How do I get an Arkansas tax ID number?

Does Arkansas have state tax ID?

What is the Arkansas credit for developmentally disabled people?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit arkansas tax form ar1000rc5 online?

How can I fill out arkansas tax form ar1000rc5 on an iOS device?

Can I edit arkansas tax form ar1000rc5 on an Android device?

What is AR AR1000-DD (Formerly AR1000RC5)?

Who is required to file AR AR1000-DD (Formerly AR1000RC5)?

How to fill out AR AR1000-DD (Formerly AR1000RC5)?

What is the purpose of AR AR1000-DD (Formerly AR1000RC5)?

What information must be reported on AR AR1000-DD (Formerly AR1000RC5)?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.