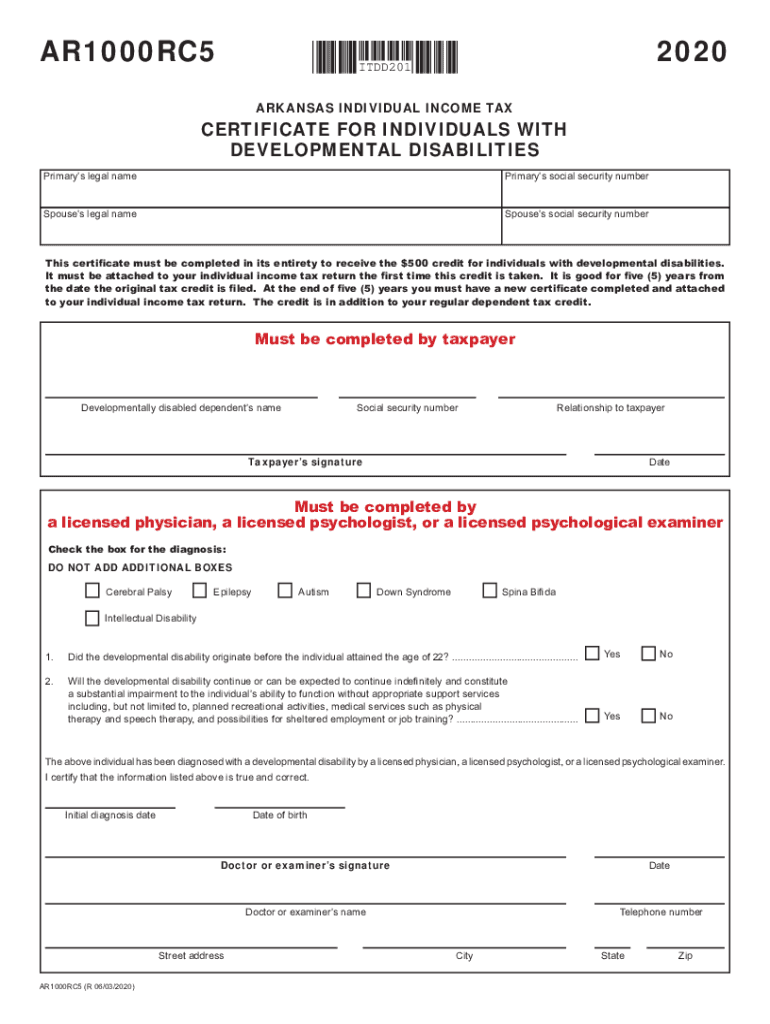

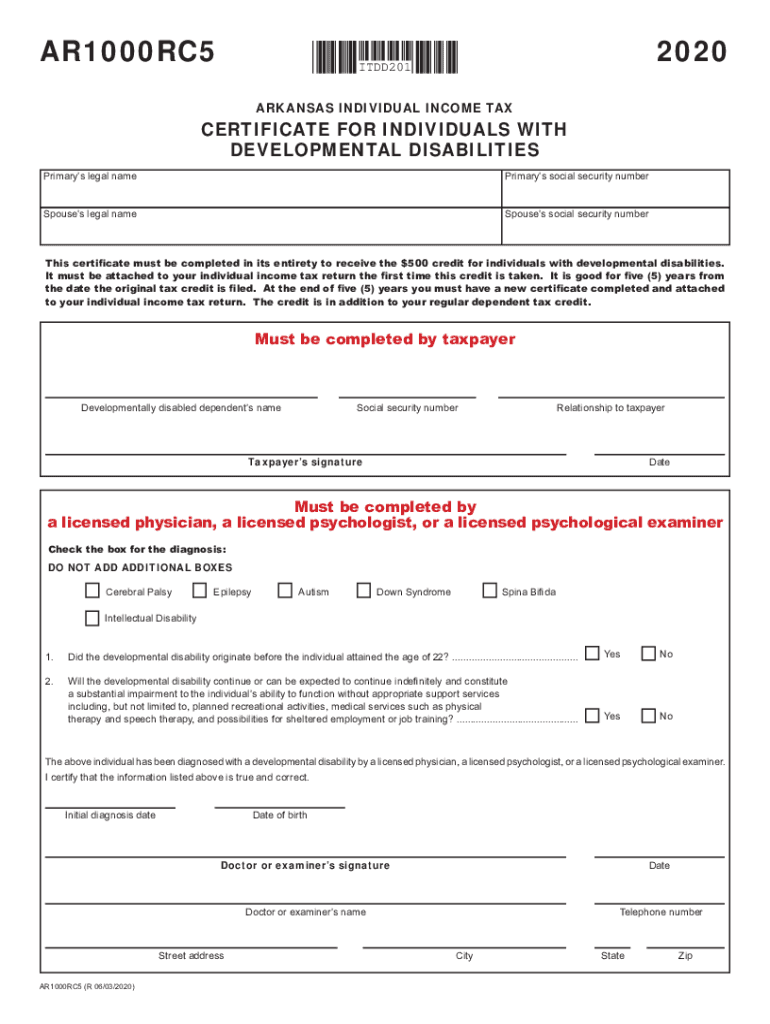

AR AR1000-DD (Formerly AR1000RC5) 2020 free printable template

Show details

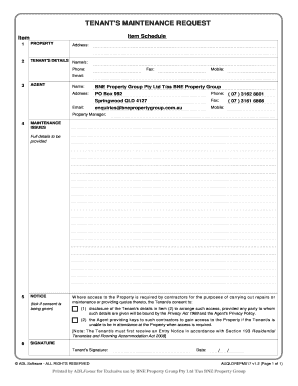

AR1000RC5PRINT FORMER FORM2020ITDD201 ARKANSAS INDIVIDUAL INCOME CERTIFICATE FOR INDIVIDUALS WITH DEVELOPMENTAL DISABILITIES Primaries legal namePrimarys social security numberSpouses legal espouses

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign AR AR1000-DD Formerly AR1000RC5

Edit your AR AR1000-DD Formerly AR1000RC5 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AR AR1000-DD Formerly AR1000RC5 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing AR AR1000-DD Formerly AR1000RC5 online

Follow the guidelines below to use a professional PDF editor:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit AR AR1000-DD Formerly AR1000RC5. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AR AR1000-DD (Formerly AR1000RC5) Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AR AR1000-DD Formerly AR1000RC5

How to fill out AR AR1000-DD (Formerly AR1000RC5)

01

Gather all necessary documents and information related to your tax situation.

02

Start filling out the identification section at the top of the form, including your name, address, and social security number.

03

Complete the income section by listing all sources of income for the relevant tax year.

04

Move on to the deductions section and enter any eligible deductions you plan to claim.

05

Review the tax credits applicable to your situation and fill those out in the appropriate section.

06

Double-check all entered information for accuracy and completeness.

07

Sign and date the form before submission.

Who needs AR AR1000-DD (Formerly AR1000RC5)?

01

Individuals or businesses filing for tax assessments in Arkansas.

02

Tax professionals assisting clients with Arkansas state tax filings.

03

Entities that have had tax assessments or wish to appeal an assessment.

Fill

form

: Try Risk Free

People Also Ask about

What is AR1000TC?

AR1000TC (R 10/25/2021) ARKANSAS INDIVIDUAL INCOME TAX. TAX CREDITS.

What happens if you don't pay Arkansas State taxes?

If you do not pay the entire amount of tax you owe by the due date, you will be assessed penalties and interest from the original due date of the tax. Interest is charged at a rate of 10% per year.

What is form AR1000RC5?

The AR1000RC5 form is used by families to receive a $500 tax credit for individuals with developmental disabilities. It is submitted with your state income taxes.

Where to get Arkansas State Income Tax forms?

State Tax Forms The Arkansas Department of Finance and Administration distributes Arkansas tax forms and instructions in the following ways: In Person: Arkansas Revenue Office, 206 Southwest Drive, Jonesboro, AR. Phone: Arkansas Revenue Office, 870-932-2716 (Jonesboro) 1-800-882-9275 (Little Rock)

Where to get Arkansas State Tax forms?

State Tax Forms The Arkansas Department of Finance and Administration distributes Arkansas tax forms and instructions in the following ways: In Person: Arkansas Revenue Office, 206 Southwest Drive, Jonesboro, AR. Phone: Arkansas Revenue Office, 870-932-2716 (Jonesboro) 1-800-882-9275 (Little Rock)

Who is required to file Arkansas state tax return?

to return to it after leaving or if a person spends more than six months of the taxable year in Arkansas, they are considered an Arkansas resident for state tax purposes. All non-residents must file a state tax return if they receive any in- come from an Arkansas source.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my AR AR1000-DD Formerly AR1000RC5 in Gmail?

AR AR1000-DD Formerly AR1000RC5 and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

Can I create an electronic signature for the AR AR1000-DD Formerly AR1000RC5 in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your AR AR1000-DD Formerly AR1000RC5 in seconds.

How do I fill out AR AR1000-DD Formerly AR1000RC5 using my mobile device?

On your mobile device, use the pdfFiller mobile app to complete and sign AR AR1000-DD Formerly AR1000RC5. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

What is AR AR1000-DD (Formerly AR1000RC5)?

AR AR1000-DD (Formerly AR1000RC5) is a tax form used in Arkansas for reporting various types of income, particularly for individuals and businesses in the state.

Who is required to file AR AR1000-DD (Formerly AR1000RC5)?

Individuals and businesses who have taxable income in Arkansas, as well as those who meet certain threshold criteria, are required to file AR AR1000-DD.

How to fill out AR AR1000-DD (Formerly AR1000RC5)?

To fill out AR AR1000-DD, you need to provide personal information, details about income earned, any applicable deductions, and necessary tax calculations as per the instructions provided with the form.

What is the purpose of AR AR1000-DD (Formerly AR1000RC5)?

The purpose of AR AR1000-DD is to report taxable income and determine tax liability, ensuring compliance with Arkansas state tax laws.

What information must be reported on AR AR1000-DD (Formerly AR1000RC5)?

The form requires reporting of total income, deductions, tax credits, and any other relevant financial information that affects tax liability.

Fill out your AR AR1000-DD Formerly AR1000RC5 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AR ar1000-DD Formerly AR1000RC5 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.